We’ve saved the Medicare trust fund by doing the right things with Medicare Advantage, and we’ve set up far better and more affordable care in the process.

The 2023 Medicare trustee report and basic data set shows that to be true.

We have excellent, relevant, timely, and credible sources of information from the Medicare trustee annual report and from multiple sources to confirm for both critics and supporters that we’re on the right path for the country for benefits, service levels, and costs for the people who’ve chosen to enroll in Medicare Advantage plans and the amount we’re paying now, and will pay in the future, are saving Medicare.

The new Medicare Commission 2023 trustee fund report and information set tells us that Medicare Advantage has hit the cost and the performance levels that will save Medicare. The total cost for the Medicare Advantage program for all expenses last year hit $403.3 billion.

That amount covered almost exactly half of our total Medicare members for their care, and it paid for all of the additional benefits that have been created and used by the plans for their members as part of the Medicare Advantage program in place for 2022.

About 48 percent of the Medicare members were covered by that 2022 expense.

Our most current enrollment information tells us that the growth for the program has continued, and now more than half of Medicare members are directly enrolled in plans for 2023.

That amount meets our need and defines the cost for an expense level for those members — and we know from the way we buy care for those members with surpluses every month over fee-for-service Medicare, and from the control that the capitation payment model gives us over future costs each year, that it will continue to be financially positive and beneficial for Medicare to buy that coverage for our Medicare Advantage members using that approach and those payment level determination formulations and approaches.

The trustee report tells us that Medicare had a slight and unexpected gain in their reserve levels for the year based on some Covid-related lower hospital use situational realities, and that piece of Covid-related good news about expenses isn’t expected to continue for the immediate future.

The good news that will continue in full force into future years, is that the report tells us that we now have half of the members enrolled in capitated Medicare Advantage plans at an affordable price, and the functional reality that we need everyone to understand and appreciate is that we have almost total control over the future payment levels for those patients, because we pay capitation for their care — and we don’t pay fees for each piece of service for any of those members.

The most important piece of information for Medicare from that trustee report is that we know that we have the costs for those members who cost us $403.3 billion as the total expense for their care this year, under the control of a capitation payment system, and we know that payment model lets us functionally decide how much to spend on their care going forward for the next years of the program.

When we look at the total costs of care outlined in this years’ Medicare trustee report, we know that Medicare received a total of slightly more than $968 billion in total revenue for the year. We also know from the trustee report that Medicare has an annual projected income and revenue increase of roughly 6.2 percent and that increase will happen each year for the overall program for the next several years.

An important conclusion from those numbers is that a 6.2 percent increase in total revenue means that if the Medicare Advantage piece of the expenses goes up at 6.2 percent, the overall program will break even on Medicare Advantage members from the current status for those members. That break-even outcome is true if Medicare Advantage costs also go up by 6.2 percent at the same rate as the overall income.

But if the Medicare Advantage expense number for the year goes up at a lower number than the income increase — that lower number in the expenses creates a surplus payment to the trust fund for Medicare for those members, and that surplus increases the trust fund for the program, because that money will go into Medicare reserve funds and that payment will strengthen those reserves for the program.

The trustee report looked at the likely future cost issue for Medicare Advantage based on current data, and the report predicts that the Medicare Advantage numbers this year will increase by 4.2 percent for 2023.

The trustee report says that the predicted 4.2 percent increase number in Medicare Advantage costs is based on prior costs, on the risk levels of the plan members, and on the plan’s estimates of how much they’ll need to provide and pay for the core care they’re obligated by contract to deliver to members who enroll in Medicare Advantage.

If the payment increase for the plans is, in fact, 4.2 percent for the year — that expected performance level by Medicare Advantage will increase the Medicare trust fund, and it will be enough to save and slightly rebuild and support the Medicare trust fund for the next decade, because that surplus for half of the Medicare members will directly offset expected losses and deficits for Medicare Part A and Medicare Part B that are also included, described, predicted and anticipated by the 2023 Medicare trustee report.

That support for the trust fund reserves from Medicare Advantage members should be very good for all Medicare Members at several levels. We know that Medicare Advantage has much better benefits, much better care, and slightly lower costs, and that package of benefits and costs has been good for enrollment and for patient satisfaction levels in the quality and service results.

Having growing enrollment for Medicare Advantage is clearly a good thing for Medicare when we look at the context set up by the Medicare trust fund report and see that those Medicare Advantage members will add to the reserves.

Those are important numbers for both short- and long-term operations. Medicare has a couple of basic revenue sources, and we know from the 2023 trustee report that the total increase in revenue for Medicare that we expect each year for the next decade will run 6.2 percent a year.

That is very important information from that report. That income projection creates an important financial context for Medicare.

The trustee report tells us that we should plan around that annual 6.2 percent income growth number for our Medicare approach as a country for the next decade.

To plan for the future and look at the total costs, it’s important to recognize that Medicare has four key parts — conveniently labeled Medicare Part A, Medicare Part B, Medicare Part C, and Medicare Part D — and they each have streams of revenue and expense. Three of the parts for Medicare deal directly with the foundational coverage for all of the members.

Medicare Part A deals with hospital care.

Medicare Part B deals with medical care.

Medicare Part C creates the Medicare Advantage plans as a melded coverage for both hospital and medical care. It also deals with and allows a much broader set of benefits for the delivery of care.

Medicare Part D deals with prescription drugs,

That extremely important set of benefits that now exists for prescription drugs has its own revenue stream, and it is basically financially self-containing each year. Almost all of the Part D members have relationships with health plans covered by Part C of Medicare, but it’s a separate funding and alignment stream for both programs, and members choose which path they’re on.

Some of the Medicare Advantage plans now use part of their surpluses and some of their profits to buy Part D coverage for their members as part of their extended benefit offerings, but those are separate streams of cash, and each serve their own purpose and cash utility and benefit design components for the plans, and they continue as separate programs.

The plan payments for Part D benefits that exist for some members of some plans are included in the $403 billion spent on the plans, because the plans do it from their cashflow and internal profits, and it doesn’t create any new expenses for Medicare itself when the plans do that premium support for Part D coverage for their members.

Projected Part A Increases now more than Double Predicted Part C Increases

The Medicare trustees have been cautious in their approaches, and they continue to have an official prediction in their annual report that the Medicare trust fund will become insolvent in the path it’s on. The trustees officially continue to predict that the overall program for Medicare will have expenses that will exceed income each year, and the trustees now predict that the trust funds will go insolvent within the decade, because they expect to continue with those current cost and revenue trends that have been in place for basic Medicare programs for the past several years.

The trustees expect definite increases in some of their basic costs for the next several years, and they described those increases in the report. The Medicare Commission trustees predict in their current report that the costs for Part A and Part B of Medicare will increase between 7 percent and 9 percent each year. They also predicted in the current report that 8 percent cost increases would happen for the next several years for Part A and Part B programs.

That same trustee report does also look at Medicare Advantage and at the private plan expenses and the 2022 report now predicts a 4.2 percent increase for those plan costs and for those payments for next year. They don’t describe how the two expense streams and sets of programs are expected to interact in the future, but they default to the Medicare Part A and Part B numbers for some future Part C trends, and they have expenses that are echoing and expecting parallel numbers with Medicare A and Medicare B.

The trust fund basically broke even overall on the reserve levels for the past couple of years — and Covid costs were part of that lower expense picture for Part A programs. People were hospitalized a bit less with Covid.

The trustee report also said that a growing number of people who were eligible for enrollment in both Medicaid and Medicare have enrolled in Medicare Advantage special-needs plans. Those members brought down the cost of Medicare Part A hospital expenses directly by not being enrolled there, so Part A costs were slightly lower than expected for those years because of that enrollment.

We should ask the trustees in future reports to tie those numbers together into a package for their next report and then make a prediction for what the impact of all the current and relevant factors will be on the Medicare trust fund.

When we pull the key pieces out of that current report, it says that we’re moving in a very good direction with over half of the membership now in Medicare Advantage plans, and with the plans having a defined and controllable expense level for the program.

If we have the population split evenly between the traditional Medicare enrollees and the Medicare Advantage enrollees, and if we already know from the monthly cost tracking that we do on the cost of care that the Medicare Advantage enrollees in every county have a lower average cost than traditional Medicare, then we need to recognize that lower cost creates surpluses for the Medicare Advantage plans that are definitely better for the members, because the surpluses create better benefit packages for the plans.

That set of data and those results tell us that we’re on the right track financially, structurally and even politically to have Medicare Advantage enrollment continuing to grow.

There’s a political benefit to growth because that set of information about voluntary growth of the program should be good for public morale, for creating a sense of confidence in our leadership and their intentions and skill sets, and for our planning approaches for care delivery with that approach because we’re seeing 95 percent satisfaction levels with the lowest-income and highest-cost members of the plans in the surveys done of those members.

That high level of satisfaction with those programs and those care sites isn’t what is happening for those members in far too many other areas of their lives today.

The members of the plans appreciate the much richer benefits and lower costs in their reactions to the surveys they receive on those issues.

We need to share that sense of appreciation more broadly in policy circles, political settings, and media contexts to give people a sense of how well the program is going and how much is it appreciated.

Those costs to Medicare for all of those benefits are included in that $403.3 billion, and they are an extremely good and safe use of the Medicare dollar for the country that we should expect will continue into the future.

The Medicare trustee report information about the relative costs and relative cost increases for the plans can now give us a sense of security and confidence that we’re on the right track for saving the Medicare trust fund by having the Medicare Advantage approach grow in enrollment.

We need the plans to continue to maintain the relative positive cost position they have today in each county as part of the total Medicare program. And growth should be encouraged to make those results and expanded benefits continue to happen.

Medicare Advantage has some critics who very much want to cut the benefits given to members. The critics are very clear that they want to reduce the use of plan surpluses to make benefits better for members — and the most energized critics attack Medicare Advantage continuously in multiple academic, policy, public, and even media settings with extreme and misleading misinformation about what plans do and how they do it.

They attack the payment approach that uses the average cost of fee-for-service Medicare in every county as the baseline payment level for the plans — even though the plans always spend less than that average baseline costs for fee-for-service Medicare to deliver care.

The current funding approach that some critics hate and attack with consistency, and with almost no actual data that is relevant to the delivery of care, and the approach they attack has actually been very successful as a funding mechanism in allowing the plans to spend less than Medicare, and to create surpluses and then use those surpluses to expand their benefits for their members.

People who want to attack the plans have been trying hard to change things in the funding processes that allow those bonuses, and that allow those better benefits to happen.

The Medicare Trustee Commission itself has completely avoided that entire set of topics and issues in their report. Rather than discuss the issues of richer benefits and better care for any of their members, they have focused as trustees on a number of real internal issues that exist for Medicare Part A and Part B, and they only did a brief description of the private plan program that creates and funds Part C in their current 2023 report.

The confusing and sometimes persuasive energy of the Medicare Advantage critics in a number of settings has been wrapped around the argument and the claim that, even though the plans might look like they’re doing great work at many levels, there’s actually a deeply negative other side to the plan performance — and the critics say that negative aspect should give everyone a high level of caution, because they say the plans are overpaid, and they actually say explicitly and directly in multiple settings that the overpayment to plans based on over coding will bankrupt Medicare.

They have some credible people making those non-credible claims. If you don’t actually have any data or information other than the attacks made in those thought pieces and articles by those critics, then the impact of that misinformation is that those concerns from those critics can trigger caution, and even some alarms, and those very explicit alarms keep too many important people who should be helping people from supporting, endorsing, or understanding Medicare Advantage and understanding the need to get high need people to enroll in plans because they don’t trust the plans.

That set of attacks and those clear warnings from those critics about bankrupting Medicare should finally completely end now, because the Medicare trustees 2023 report does not show that the plans have bankrupted Medicare and it has given us rock-solid bottom-line data that shows and proves that particular accusation is both not true and impossible.

That Medicare trustee report says that the total costs for the plans — including all of the possible up codes that might arise from any of the risk level enhancements, distortions, or data manipulations — actually would have to be embedded and included in that $403.3 billion expense if they exist, and that $4.2 billion is actually an extremely good and affordable number for us all to have as the actual amount we now spend on the plans with every aspect of those processes fully and already embedded in that number if they exist at any level.

The people who continue to say that the plans are bankrupting Medicare should’ have been put to bed by having the actual number of plan costs that cover every accusation that they have made in that trustee report and embed it in that payment to the plans.

Upcoding did not bankrupt Medicare.

Those critics were wrong.

Medicare Advantage accurate information about patient care is, however, creating a path to survival and success for the Medicare trust fund itself, at a basic level, and those outcomes should improve over time, because care should be continuously improving if we do this right.

The Medicare trustees did not speculate in their report about any outcomes, strategies, processes, or concerns they might have for the plans, but they did tell us clearly how much the plans cost Medicare. That report tells us that the entire Medicare Advantage program for last year cost $403 billion as a part of the total $905.1 billion Medicare cost level that existed for the entire program.

The trustees should be celebrating that number, and they should be celebrating the plans for what they have accomplished and can do now to improve the program going forward from here.

The plans have set the foundation for future Medicare success with that number and with the payment process we use to pay the plans.

Medicare trustees should become very clear and very positive and even celebratory at this point in time about how much real control they now have over those plan-related dollars. They should make it clear to everyone in their next trustee report that they now understand that with the high rate of growth for the Medicare Advantage plans, the trustees can save Medicare simply by having those costs increase for Medicare Advantage plans at a lower rate than the overall 6.2 percent income level that will happen for Medicare.

Until this year, the Medicare trustees have avoided any speculation about that entire set of issues for that part of the Medicare program, and they should now expand their thinking as trustees into that space.

They’ve said in fairly general terms each year in their report that they expect the Medicare Part C total costs each year to run in parallel with Medicare Part A and Part B total costs, and expected the plans to echo their results. They had no sense of what possibilities existed for another look at those issues by the trustees. They knew the cost data for the plans each looking backward at that category of expense, but they did not look at Part C going forward at any level in any of their thinking.

It’s not entirely clear why the trustees chose that approach in the past.

They might just have wanted more data. People were very inaccurate in their projections of future growth most years, and their reports each year express surprise at how much Medicare Advantage has grown.

They might’ve had some political, or even ideological reasons to avoid looking at the Medicare Advantage information up to this point in time. The traditional policy journals have an extremely hard time writing things about some aspects of plan performance, because the economists all take more than a year to write each piece. And the work done by the plans on reengineering care uses current data and changes regularly to reflect today’s data.

The most recent Health Affairs article on plan quality showed that the plans were slightly better in a couple of areas for that report, and the researchers literally cited 10-year-old data to make their points.

Absolutely nothing in quality engineering in any industry looks at or uses 10-year-old data.

They had a wealth of current data.

The quality programs for Medicare Advantage have gone from having only 10 percent of the plans at four or five stars in the first years of measurement, to having 90 percent of the plans at four or five stars today. That has happened because the plans all take those goals and processes seriously, and change both culture and process to make improvements happen. And the major critics of plans called that very positive and reinforcing result “The Lake Wobegone Effect,” and told Health Affairs and MedPac teams that they could safely ignore those extremely positive results, because they were impossible to achieve if they represented real data.

They do represent real data and we’re very fortunate as a nation to have those care improvements happening.

It’s an honor and a celebration event in care sites across the country to be a five-star plan, and the critics sneer at that program because they clearly don’t understand what it does or why it matters.

We need the Medicare trustees to be looking at those results as part of their measurement process for Medicare plans.

The trustees have been consistently wrong every year on their prediction of what Medicare Part C will have as a cost trend for the next years, and they tend to significantly understate what the plan enrollment will be in their predictions for future years.

It’s time for the Medicare trustees to realize how good the Medicare Advantage program actually is, and to also recognize and understand their high level of both influence and power over those costs for the plans.

They now should deal with the fact that they can actually control that number, because it’s capitation based — not an insurance underwriting prediction or process or circumstantial outcome of any kind. They get to decide what the capitation is every year, and they should make that process a central piece of the overall planning for the program.

For the current report, the trustees are continuing to predict and project at a base planning level that the Medicare trust fund itself will deteriorate to very poor levels over the next decade, and they say that’s because of some of the expenses they project in the report for Medicare A and B that will exceed expected income for the program. They predict and anticipate that the trust fund will seriously erode if we stay on the path we have been on for basic Medicare and simply continue those trajectories into the future.

We need the trustees to include Medicare Advantage members out of their planning for the future.

They’ve been badly deceived by MedPac, who continues to strongly favor fee-for-service Medicare and to say that we should be sure never to give Medicare Advantage an unfair advantage over basic Medicare.

They say that Medicare Advantage somehow costs more than Medicare, while at the same time they acknowledge record numbers of plan benefits from the surpluses, and say very clearly in their current report that Medicare Advantage provides the basic benefits for 17 percent less than Medicare spends on those same benefits.

Trustees Need to Succeed with Med C Solutions

At the most senior level, we need the current trustees — Janet Yellen, Xavier Becerra, Julie Su, Kikolo Kijakazi, and Chaquita Brooks-LaSure — to recognize that they can make decisions now that will give the Medicare trust fund itself additional decades of life, and they can do it simply using extremely popular tools for high-need and low-income people that we now have in place to deliver better care for our people.

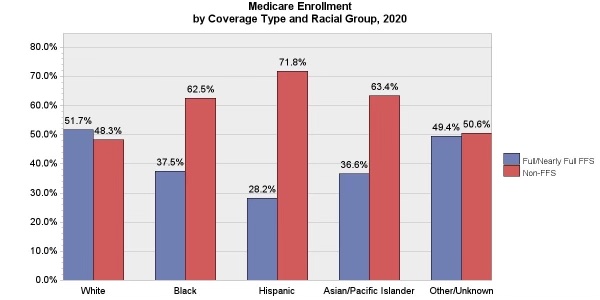

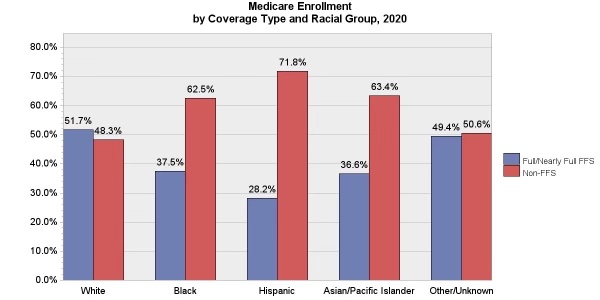

The enrollment chart that leads this piece makes that point.

We now have 71 percent of the Hispanic members of Medicare enrolled in plans who have an average net worth of about $14,000. The average income of the White traditional Medicare enrollees who buy private health plans, rather than enroll in Medicare Advantage, is over $200,000.

It’s absolutely clear why hearing, vision, and dental benefits make great sense to people who only have $14,000 in total assets. The MedPac people who so strongly oppose increasing benefits for anyone clearly aren’t thinking about real people with real needs in their ideological focal points and benefit opposition strategies.

The Medicare trustees for the overall fund have the power to support those processes that create all of those benefits and they should be able to celebrate moving Medicare in those directions and endorse doing things to make it happen.

The Medicare trustees also said in their report that Medicare itself might possibly do some things that could improve care for their traditional fee-for-service members, and they also said in that report that they doubted that those efforts and attempts to make care better for those members would succeed at any significant level.

That conclusion about failing in those efforts with the traditional members is actually a major mistake for the trustees, because there are a number of very good programs happening for Accountable Care Organizations (ACOs) in multiple settings, and even if those ACO programs haven’t saved very much money, they have done some wonderful work on making care in some settings more patient-focused and effective, and that’s very much the right thing to do. It enhances people’s lives in important ways.

We don’t need the ACOs to succeed to save the trust fund, but they’re very good to have, and we should help them in every way possible because they do so much good for real people. People enrolled in ACOs have better lives in those settings and they should be encouraged everywhere.

What we do need to save the Medicare trust fund, is to have a growing number of people enrolled in the plans. We can save people’s eyesight and avoid most amputations if we get more members into both health plans and accountable care organizations for their care. We have more than one out of five traditional Medicare patients getting some support from the ACOs, and we have all of the Medicare Advantage patients getting better and more team-focused care that can make care better in those areas.

Medicare Part A and Medicare Part B are both going to see some increases in their costs. We’ll see 7 and 8 percent cost increases for many people, according to the trustee report. Those costs will put direct pressure on the Medicare trust fund.

Those cost increase numbers can’t happen in Medicare Advantage because of the nature of the way the plans are paid and the basic nature of how care is delivered for the members.

We need the Medicare Advantage programs to be going down their natural paths for both surpluses and care, and we need more people enrolled.

It’s extremely important for everyone thinking about Medicare as a program, and as a commitment that we make to all Americans, to recognize how good it is that we pay for that care using capitation and not fees for their care.

The worst Medicare Advantage critics continue to say in multiple public and credible settings that the plans are somehow doing distortions in their coding approaches. And some key critics still say that the cost impact to us all of having those distortions happen in all of those settings is actually 9 percent for the payment model.

There continue to be people at MedPac who very much want to cut and shrink the benefits for the members and who want to reduce the cashflow to plans, and those people still predict that the damage and distortions to the coding process from the plans organizing their data bases will somehow create a 9 percent level of damage to the program and to Medicare.

Nine percent has been a magical and often repeated number to some of the critics for over a decade.

Even in the last annual MedPac report, where they had to deal with the fact that the plans lost the old coding systems entirely and can’t actually code anything today, those critics at MedPac said that they will magically still create 9 percent levels of damage to the process by influencing care pattern data set up in Medical offices at the encouragement of the plans.

None of those things can actually happen in the real world that we live in now.

Be a Buyer; Not a Payer for Care

The Medicare Advantage payment for the year for each patient is capitated and capitation is always fixed by the buyer. The functional truth is that the capitation level absolutely will not increase by the 9 percent number that the critics still predict because there’s no way that CMS as the buyer would allow that 9 percent increase to happen to Medicare systems.

The goal and strategy and approach that we need to follow is to be a buyer — not a payer — for care.

It’s possible to be either a payer for care or a buyer for care — and each of the Medicare payment approaches is either one or the other of those approaches today.

The Affordable Care Act very intentionally, directly, and explicitly set up Medicare Advantage to be a buyer for the care delivered to our seniors.

President Obama and President Biden should both get credit for putting those tools that enable purchasing in place and then using them very well.

Being a buyer gives Medicare control over the specification’s ties to quality and service for care, and allows Medicare Advantage to be steered down paths that continuously improve care with complete control over the amount to be paid because it’s fixed annually on a per member basis.

Fee-for-service caregivers profit more when care deteriorates or fails — because they get paid by the piece and there are more care pieces when patients have heart attacks or asthma attacks or strokes. And for a capitated care system, every heart attack or congestive heart failure crisis is a major cost item that reduced profitability for the plan and program, and the plans have as many people being hospitalized for those conditions.

Fee-for-service medicine payment approaches are somewhat like buying a car and having to pay twice as much if the car crashes and having to pay three times as much if the driver dies.

We do more amputations in this country for our low-income people than any country in the world — and they cost Medicare billions of dollars each year. They cost over $100,000 per amputation

The capitated Medicare Advantage plans all know that 90 percent of the amputations are caused by foot ulcers. They also know that you can reduce over 40 percent of the foot ulcers with dry feet and clean socks. So, all of the plans work on dry feet and clean socks for those patients, and our low-income care sites don’t do that work for even one in four patients according to recent studies done in some key inner cities.

The only medical condition that had a surge when Covid hit was amputations for our low-income patients. One-hundred-thousand dollars per patient was tempting when Covid was changing patterns of care.

Low-Income and High-Need Patients

Medicare Advantage plans enroll more than 5 million low-income people who are eligible for both Medicaid and Medicare — and some of those patients have been badly damaged by various social determinants of health issues and are getting team care for the first time in their lives.

Part A of Medicare reported in this year’s Medicare trustees report that they had a reduction in costs that came from some of those dual eligible high-need people leaving Medicare A and enrolling in Medicare Advantage plans.

The plans have over a 95 percent satisfaction level with those high-need patients.

So, when we know that Medicare spend $403 billion on the Medicare Advantage patients through the plans — and when we know that we can absolutely control future costs for all of those people because they’re now in capitated payment as their only way of getting Medicare money, that says we need to appreciate and support those processes and enrollment growth, then the enrollment growth is real and a good thing for everyone.

Plans do a number of things to get the care right for those people, and that lower care costs created much better benefits for Medicare Advantage patients.

Medicare Advantage has much better benefits than fee-for-service Medicare and they’re funded by the surpluses that are created by better care and by having costs lower than Medicare in every county.

We know absolutely that Medicare Advantage costs less because it’s obvious and visible and highly clear in all of those settings where the plans have lower costs than fee-for-service Medicare. The health plans all bid less than the average cost of fee-for-service Medicare in every county for their capitation bids and the plans both improve care and enhance benefits with the surpluses and the profits they make from that discounted and reduced cashflow.

The Medicare Advantage critics do say in multiple settings that the plans actually have surpluses in every county but the critics say the surpluses exist because the plans have intentionally distorted the risk levels of their members and they say repeatedly that they’re overpaid because of those distortions. The truth is, the plans build and create their profits and their surpluses in every county from better care. That’s a key part of the program design, the quality improvement processes, and the agendas — and it’s been very successful in all of those settings.

Medicare Advantage has a five-star quality program in place that focuses the plans on 40 quality and service goals. The people who built that quality program knew that you can reduce blindness in diabetics by over 60 percent if you simply manage the blood sugar of the patients.

Fee-for-service traditional Medicare for low-income people has some of the highest blindness rates in the world — and every case of blindness creates major expenses that end up expanding the average cost of fee-for-service Medicare in every county. The Medicare Advantage plans save both eyes and money with better care — and almost every Medicare Advantage plan now has a direct vision benefit that’s funded with those savings.

The plans know that people with congestive heart failure need various kinds of interventions to keep their situation from turning into painful and life-threatening crisis, and every plan does enough patient targeted direct interventions to reduce those crisis events and expensive hospital days for those heart failure patients by over 40 percent.

The low-income diabetics for Medicare have some of the highest levels of amputation in the world, and the medical science reality that everyone knows is that 90 percent of the amputations are caused by foot ulcers and it’s clear to all of the Medicare Advantage plan care teams that you can reduce foot ulcers by more than 40 percent with dry feet and clean socks.

The amputations cost billions of dollars in total and the plans now save more than $100,000 for each amputation — and the plans have far fewer people with their feet removed because of those programs and much lower costs of care.

The plans spend far less than fee-for-service Medicare for those procedures and the pattern is clear that the plans spend 15–20 percent less on the care for those patients and for almost all of the other patients with chronic care situations why make up 70 percent of care costs in America.

Medicare Part D is a self-sustaining cashflow and gets funded every year at the amount needed to pay for the program. As the trust fund report says: “Income from premiums and governmental contributions are reset each year to cover expected costs.” The costs for Part D for 2022 ran $125 billion for the year and that program funds itself every year.

The plans are all tightly linked to the Medicare Advantage care teams, and some Medicare Advantage plans are so supportive of Part D benefits that they pay the Part D premiums for their member from their Part C surpluses.

Medicare A, 8 Percent and Medicare C, 4 Percent: That Difference Rocks the Trust Fund Boat

The trust fund report said that the expenses for Medicare Part A and Medicare Part B would probably increase by 8.9 percent for next year and that report also said that total expenses for those enrollees would exceed that revenue for those Medicare beneficiaries.

The people who write that report and who continue each year to basically ignore and not even mention the Medicare Advantage half of the enrollment and who predict in that trustee report that the Medicare trust fund will deteriorate and will go insolvent over a relatively short time use those 7 percent and 8 percent expense numbers against the 6.2 percent Medicare income number to reach their conclusions. They say as trustees that the that long-standing difference between Medicare income and Medicare revenue continues to be our future, and they continue to believe and predict that the trust fund will be significantly eroded and impaired over the next decade or so based on those numbers.

That difference between 6.2 percent revenue in the basic Medicare income level and the 8 percent increase in cost for major parts of the program causes a financial loss and will cause the trust fund reserves to diminish and shrink to an unacceptable size over that time, and it’s clear that insolvency will happen if we don’t do anything about it to change that outcome.

The trustee report is flawed in regard to those issues, and the people who serve as trustees must not have any sense right now what those issues or opportunities are.

The current anticipation in that official trusteed report is that we won’t do anything as a country or a program to change any of those numbers and they report that they’re unhappy, as a trustee commission, about that result but they have no plans to change that trajectory that’s included in their plan on any of those issues.

The trust fund reserve fund for the Medicare Program that we’re concerned about is currently at $409.1 billion at the end of 2022, and that number is projected to shrink slightly for 2023 based on the current trajectory described in the report.

We should make them wrong in that approach and we should take this opportunity to change that trajectory and to change those projections for the next version of their report that they write for next year.

The numbers they need, to come up with a different trajectory, are already in their current report if they choose to use them, and if they understand the power they have over future payments with capitation as a tool.

We clearly should do everything we can to get people to enroll in Medicare Advantage plans. We already have over 60 percent of our African American Medicare members and over 71 percent of the Hispanic members in the plans.

Those enrollment numbers are shown in the chart that heads this piece.

We also have two out of three of our lowest-income members in the plans — and we see nearly a 95 percent satisfaction level with those members.

From a purely political perspective, we don’t have many downsides to having more high-need people getting much better care in the plans, and there should be a major political gain as a country when that is done.

We have some highly ideological people who think that any approach that isn’t entirely government-run is politically wrong. We need those people to realize that it’s also politically and ethically, and even morally wrong, to have nine times more amputations for our lowest-income Americans, because that part of the government-run system badly underperforms for those members.

It’s unfortunate, sadly accurate, and true that the highest political purity approach for covering people that has some very strong ideological advocates has almost twice as many people losing limbs, and three times as many people going blind, but that’s what we’re seeing today for too many people who are using that model for care.

We have an immediate savings for each person who actually joins a plan, and that should be understood and supported by the academics who continue to distrust the plans, because of the upcoding flat-earth people.

We should be celebrating the successes and using them to get more people enrolled in the plans.

A significantly increased enrollment by all of the middle-income and low-income people in Medicare Advantage could be an extremely popular thing to do from a political perspective.

The people who have been damaged the worst by various social determinants of health issues have Medicare Advantage as the single most relevant, immediate, effective, and real program for dealing with those care site inadequacies and inequities and doing it in ways that directly help individual people one at a time in the place where they live.

The more progressive political people who care about actual people being helped in actual and direct ways will love that program when they realize what it does and how well it does it. Many of those very low-income patients are getting the best care of their lives — and they tend to share that information with their political allies.

The people who believe that we should have market forces that reward achievement should be very happy with the fact that this is the only government program in the world that pays more for higher quality care. None of the European systems pay more now when care is better. Canada clearly does not pay more for better care.

Only Medicare Advantage actually pays more for quality and the buyers are CMS today are becoming increasingly sophisticated about their definitions of quality in very successful and effective ways.

We can make that progress without having to change a single law — and elected officials from each of the major parties are finding that their voters would be very unhappy if anyone cut their benefits or impaired their care for ideological reasons.

Some of the Medicare Advantage critics are ideologically misled and even impaired people who very much oppose low-income people having better benefits than high-income people, and those ideologically rigid people attack the benefits every year and want them reduced.

The chair of MedPac is clearly anti-benefit in his research and his discussions, and he just said in a public interview that he thought that it wasn’t fair for high-income people to have to use their own money to buy supplemental plans to get care-related things that Medicare Advantage members get for free.

He argued that it was an intellectual fairness and equity position for him and he has said it more than once, with support from the head of Health Affairs in their most recent interview who seemed to agree with his fairness point.

That’s sad — and we need to make very sure that cold-hearted and short-sighted perspective isn’t influential in any way that reduces benefits that people should obviously have.

That’s an important point for CMS to understand. We need all of the academics and the media people and the political people to know that Medicare Advantage is not only popular enough to get a 95 percent satisfaction rating from its highest need members, it’s also now getting direct support from elected officials, and that support from those people will continue, because it’s fed by happy voters and makes structural sense.

We need everyone to understand and know that we need to protect Medicare Advantage. We have already done enough good things to make the Medicare Advantage program financially beneficial to both members and the trust fund so that we should ride the horse we’re on and we can end up with a solvent Medicare trust fund if we don’t listen to the critics and allow them to screw up the current version and cashflow for Medicare Advantage in any key way.

We have been doing some very effective things in putting together Medicare Advantage bid processes — and we now have some spectacular benefits for the members and the care sites because that has been done.

The plans have created their profits and their surpluses in every county every month and have added vision benefits, dental benefits, hearing benefits, and various levels of in-home support benefits, and the plans have funded them all with the same Medicare dollar that fee-for-service Medicare uses so poorly and so ineptly every day.

The fee-for-service Medicare patients have personal expenses each year that exceed $5000 because that program is so badly designed and actually not run for most issues. Medicare Advantage members save more than $2000 each in out of pocket expenses in addition to the better benefits just by enrolling in the plans, and fee-for-service Medicare patients do not get any of those benefits because the people who run that part of the program have decided to not offer them.

Why Not Enroll Everyone?

So that raises the obvious question that if Medicare Advantage is that much better than fee-for-service Medicare; and if two out of three of the lowest-income people; and if over 5 million of the dual eligible people need it so badly: Then why don’t we expand it to everyone now as the new normal, and make that an easy next step in the process for Medicare?

We won’t do that and we should not do that forced expansion to everyone because we need Medicare to be a choice and not an imposition and we don’t want to take any prisoners with any part of our Medicare enrollment.

Also, we now know that many people with higher income levels do prefer not to enroll in plans. Seventy percent of the higher income people buy supplemental coverage from private insurance companies so they can make more of their own care team decisions and, for a number of well-to-do people who’ve been happy with their earlier and historical levels of care, it’s okay to have them maintain their own trajectories for care. Some are willing to spend a few hundred dollars to maintain that status and that opportunity, and that’s not a bad use of money for those people.

That’s not a problem and it should be enabled and supported. As long as we don’t have the damaging anti-health plan people, who are so fanatical and so insistent about defending the cashflow that exists in some settings for higher income doctors in their circle of influence and some of their medical-related friends using their political clout and leverage to reduce benefits for low-income people. We do not want those adversaries to screw up the care and the benefit packages for our members by attacking the cashflow of the Medicare Advantage plans under the pretense that the savings and bonuses that actually result from plans having one-third as many amputations, and half as many lost eyes, are caused by “upcoding” of some kind rather than better care.

Those people are too often shameless. They write attacks on plans that are meanspirited and wrong. One set of critics takes the care patterns of Medicare Advantage patients with much better care every year, and actually prices those better pieces of care against the Medicare Fee Schedule, and then compares those costs to the capitation payment and calls much better care overpayment.

The anti-health plan critics come up with that same often quoted phony report every year that says the plans are overpaid by 104 percent, and the absolute truth is that that number and cost is created entirely by pricing and misreporting better patterns of care for patients with a fake news label added to politicize the process. That 104 percent overpayment number needs to be exposed as the clear sham that it is in the face of the deep discounts happening in every county for all of the members and in the fact of the current MedPac report that reluctantly but accurately acknowledges that the plans spend an average of 17 percent less to buy that care.

We do need better care. Let’s make it happen at this important point in the history of care.

We Should Detect most Cancers Earlier in Continuously Improving Models of Care

We’ve reached the point in the delivery of care in the country that we have a whole new array of diagnostic tools, connectivity tools, care enhancement tools, and treatment tools — and we should be on a pathway to much better and more effective care for less with those tools available to us all.

Medicare Part A should be looking at the fact that the best hospital systems in America now have completely moved full-service and extremely effective care into people’s homes — and that should make care more effective and higher quality at the same time, and give Medicare Part A a new lease on life that they haven’t had in the past two decades.

We’re also very near the point where we’ll be able to diagnose 24 cancers from blood and fluid samples before Stage 1 — and that will save lives and money because Stage 4 cancer is one of the most expensive care episodes, and Stage 1 cancer can cost pennies in a high percentage of settings.

We can also already predict both strokes and heart events over half the time more than six months earlier than we see them now in almost every setting.

Capitated Medicare Advantage plans will use those tools and compete with each other to have the best set of available processes and approaches. Fee-for-service Medicare has always been the last to try the new things, and they won’t even be relevant to this generation of care.

We need Medicare Advantage to help create the context for using those tools and approaches.

So, let’s have Medicare Advantage survive rather than be starved, isolated, and intentionally damaged by cold-hearted and rigid people who very openly and very strangely hate it when people have good benefits and enroll in the plans.

Those people who hate Medicare Advantage and continue to attack plans are absolutely distorting the truth of the Medicare Advantage situation and process. They seem to have renewed energy in those efforts for no discernable reason and even Health Affairs runs pieces that say the Medicare Advantage nurses are in homes to distort and upcode diagnosis, rather than deliver care.

Keep in mind the absolute reality and unquestioned number that we can have as our future level of Medicare costs if we do this right.

We know the real numbers.

Medicare Advantage actually cost Medicare $403.3 billion this year — including every single penny that was created by any kind of upcoding issues, coding intensity or risk level delineation determinations or distortions and actual health status alignment and focus that uncovered every diagnosis and added them to the data mix.

That’s a very real number and we can’t screw that number up because it grounds our costs for the program going forward and it’s what those costs actually are.

The extremely competent people who now run CMS brilliantly eliminated the old coding system that the plans previously used to send their risk information to Medicare Advantage. They ended and eliminated the old plan-based coding system completely for 2020 and the CMS team replaced it with encounter data for each patient that gets the patient diagnosis information from actual patient encounters at the time of care.

That information is now both timely and protected from upcoding at any level, because they literally eliminated plan coding and that entire report. The CMS data for 2021 was based on that solid and accurate flow of data. We can trust those numbers.

But even if there is any inaccurate data now, the CMS team can and does now make their decision about the capitation levels used to pay plans, and that number saves the Medicare program according to this year’s report by the trustees.

It’s basic arithmetic.

If we use the extremely powerful and absolute level of control that we have today over that cost because this is a capitation system and if we only increase the new capitation impact cost by 4 percent for Medicare Advantage members for next year, that saves Medicare Advantage as a thriving program and it does amazingly good things for millions of people because we get to keep all of those benefits that people love, and we can absolutely afford the number it creates.

All of the retirement plans for the 5 million union and work site retirees will continue to be protected and the enhanced benefit set for over 5 million people with dual eligibility for Medicaid and Medicare will continue to be protected, and we will be able to afford everything that the plans are now doing with benefit design and care programs because that’s the level of spending that was actually needed to achieve all of those goals and that’s what we’re spending now.

The arithmetic is bulletproof.

The benefits are huge.

We have full control over the process.

We know all of the relevant numbers.

We would have to be stupid or ethically, morally, and even intellectually challenged and functionally inept not to make that decision, and to do it well and to enjoy the ride.