The Medicare trustees just published their 2023 annual report. It shows and proves that Medicare Advantage is saving Medicare.

Medicare Advantage costs less, delivers much better care, and is now using the financial savings that are created each month from better care in the plans to save the Medicare trust fund and to provide much richer benefits to Medicare members.

The current benefits are a major improvement over the weak, incomplete, and inadequate benefits of the traditional fee-for-service Medicare programs that have financially damaged so many people over time and that have been a problem and a challenge for members since Medicare was created.

The plan has been to sustain those enhancements as a permanent set of benefit improvements for the country and as a permanent asset for the people who choose the plans and to do it in a way that has the overall Medicare trust fund grow instead of deteriorate financially each year.

It was a total success.

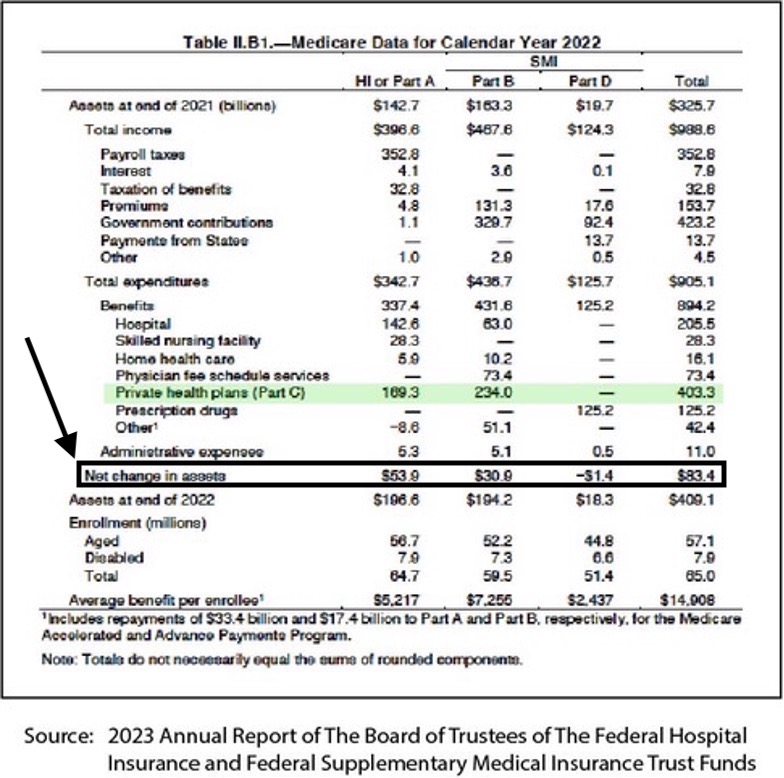

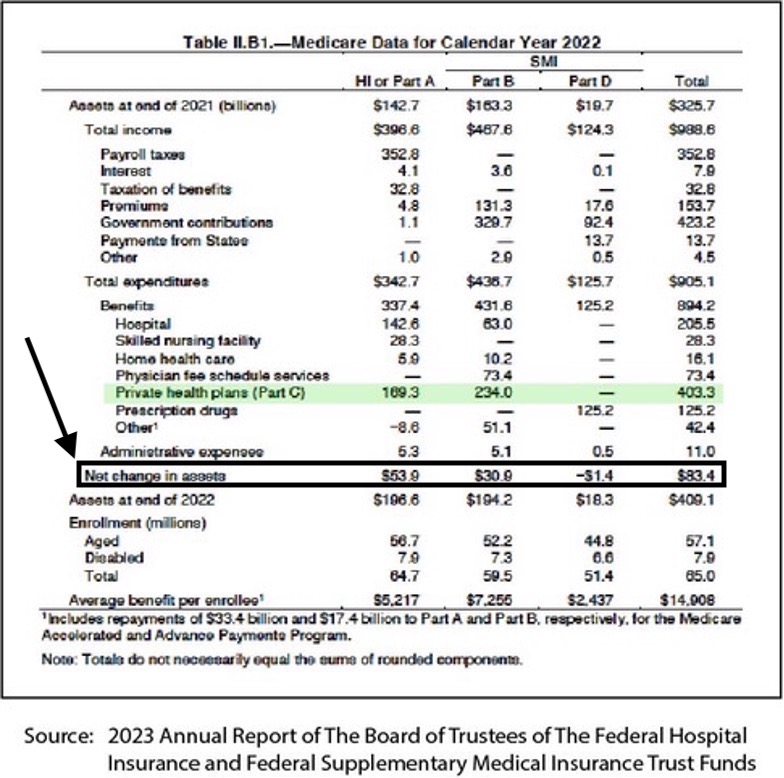

The trust fund just grew by $83.4 billion in 2022.

That was a major accomplishment and a significant achievement for the Medicare program, which wasn’t predicted or anticipated by the people who’ve been critics of the Medicare Advantage program and who’ve been saying clearly and often that Medicare Advantage is the wrong path for Medicare.

We’re achieving those financial and performance goals with the current cash flow, the current payment system, and the current approach that’s built into the Medicare Advantage program to create the payments. The better benefits and the lower costs are a key part of the overall Medicare approach and strategy that is now doing exactly what the Obamacare planners intended it to do when they designed and implemented that program for the country and built it into the federal law over a decade ago.

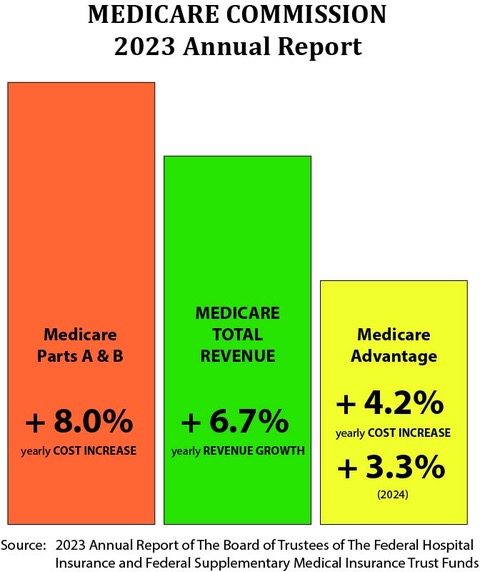

We know and should understand from that Medicare trust fund report that “from 2023 through 2032, total Medicare income will increase at an average annual rate of 6.7 percent.”

That 6.7 percent number is very important to the Medicare program. It creates the annual context for both revenue and costs for the country for the Medicare members.

We know from that report that elements of Medicare Part A and Part B will have expense increases that run at 8 percent or higher. We know that the trustees predicted that the Medicare Advantage rate increase would run at 4.2 percent.

That means that Medicare loses money on the fee-for-service members, but it also means that Medicare generates a profit for the program if the costs for members fall below that 6.7 percent.

That makes Medicare Advantage a profitable program for 2022 and for the foreseeable future.

They predicted in that report that Medicare Advantage costs would go up by 4.2 percent for the next year, and that Medicare would make a profit on every enrollee in that program for that year.

That’s exactly what Medicare Advantage was created and designed to do.

The goal of Medicare Advantage as a key component part of the Affordable Care Act package was to bring much better benefits and measurably better care to Medicare members, and to spend less than traditional Medicare in the process in every county so that the Medicare program could be financially self-sustaining and could use the revenue stream of Medicare to create assets and financial security rather than being a perpetual loss factor and a permanent financial deficit for the country.

That goal from the Affordable Care Act of having the program succeed on those levels and strengthen Medicare financially and operationally at the same time has been achieved for the 2022 calendar year report. It parallels and reflects the Medicare Advantage enrollment growth to the level that it’s now the majority of Medicare members and it’s now the new normal for the Medicare program by enrollee choice.

The 2023 Medicare trust fund report shows the basic payment numbers and their impact on the Medicare financial reality now.

After more than two decades of trust fund losses — and after continued, steady, and perpetual financial deterioration of the Medicare assets for all the years that Medicare A and Medicare B have been the majority of the enrollees — the current Medicare trustee annual report shows that the Medicare trust fund actually grew by $83.4 billion in 2022 and that Medicare Advantage, as Medicare Part C, now enrolls more than half of the Medicare beneficiaries. And that enrollment is growing.

Eighty billion dollars is a significant, important, and game-changing amount for the Medicare program, but the majority of people in our media and policy circles don’t seem to know that it happened.

We know it’s real and we know it happened because it’s reported in the current trustee report as the current financial status of the program.

That’s a significant change of direction for the trust fund financial reality. We need to build on that new strength and make it foundational for a new level of public benefit from the program.

Medicare has been a financially troubled program, and one that’s been destined and projected by experts and policy authorities to financially erode to the point of insolvency and possible crisis-level weakness within the decade that lies just before us.

The long-standing and completely legitimate and reality reinforced concerns that have existed for the country and for the Medicare trustees about the trust fund becoming insolvent over time with a majority of members enrolled in money losing Medicare Part A and Medicare Part B programs have now been permanently altered and effectively eliminated as a projection, a concern, a threat, and even as a possibility by the current package of payments for Medicare, and by the Medicare Advantage enrollment growth that’s combined with the financial success and performance of the plans to save the program and to build surpluses (instead of deficits) for that program.

Plan enrollment growth has had a major positive and reinforcing impact on that financial situation.

Over half of the members are now in Medicare Advantage plans.

It’s important to now have over half of the Medicare beneficiaries in Medicare Advantage plans. That membership status creates both stability and momentum for the program. It also creates the context for future success and achievement because the Medicare Advantage members create surpluses for Medicare; not deficits.

It’s game changing for Medicare and for the country to have that level of financial growth and success for the program. We should have public policy people and our leaders working on the next steps that should build on that success. This $83.4 billion increase for 2022 during a time of enrollment growth for the program is reinforcing and affirming at multiple levels. It creates a future trajectory that can (and should) have us, as a country, think very differently about that particular entitlement program and its future.

We should be able to sustain the much better benefits forever. The critics of Medicare Advantage who try so hard every year to reduce the benefits for the members should now be rendered harmless by the permanent surplus levels.

This financial status is not theory or speculation.

It’s a real outcome.

No one in the country can deny that that financial gain and success happened. The actual numbers are now in the annual report from the Medicare trustees about the Medicare program. The Medicare Advantage critics who say and write all of the attacks that say the plans are overpaid are obviously and completely wrong.

Those numbers in this overall report summary document show us exactly what happened to the expenses and the reserve levels for the Medicare program in 2022.

These results and this flow of cash points us to the future set of numbers that will have a major impact on our future at multiple levels and our response to those numbers will determine whether we maintain those trust fund gains for future years or manage to have people with ideological and political opposition to Medicare Advantage allowed to damage the program in the various ways they seek to do that damage, and reduce the benefits to the narrow and inadequate fee-for-service Medicare program that many of those people explicitly and clearly prefer as the Medicare approach for future years.

The current financial situation has key elements that we need to understand to know if that set of gains is somehow at risk and could disappear with various financial circumstances that might emerge for the program in the immediate or the long-term future.

We need to understand a couple of key and very foundational points to make that determination and to have peace of mind that these successes will continue.

The first point we all need to understand and appreciate is the lower average cost for the members that we have now. Does the current cost for the plans achieve the basic program goal of costing less per member than the average expenses of fee-for-service Medicare enrollees?

Yes.

Current data shows that, when the plans bid their capitation levels and base them on the average cost of fee-for-service Medicare in every county, the current discounts from that cost level are 17 percent, on average.

So, the plans are paid 17 percent less than the average cost of Medicare in every county, which creates the cash flow for those members. That is, in fact, exactly what the bids are now for the plans.

If you take the full cost of the Plans shown in the trustee report, and if you inflate it by that 17 percent, then that’s how much those members would have cost if they had not enrolled in the plans.

Medicare Advantage clearly costs less than fee-for-service Medicare currently. That’s very intentional. The truth is, achieving that explicit status of costing less than fee-for-service Medicare was the goal and the reason for the plans all bidding below what we know to be the average monthly cost of fee-for-service Medicare in every county.

When the plans bid for their monthly capitation numbers, they tend to bid at numbers that run significantly lower than the average cost of fee-for-service Medicare in every county. The plans all know they can provide better care and that better care costs less than wrong and expensive care.

The most recent MedPac report says that the plans bid an average of 17 percent below fee-for-service Medicare for their monthly payment. That’s an accurate number for the current bids.

If you look at the total cost of the Medicare Advantage plans in the current trustee report, the trustees reported that the plans cost Medicare $403.3 billion in 2022.

If you take that $403.3 billion cost and multiply it by the 17 percent discount that the plans bid every month, the amount that was saved for the trust fund by those very real and very current plan bids was roughly $68.5 billion for that year.

That creates most of the surplus and profit in 2022 for Medicare.

Medicare Advantage isn’t the only good program being run by CMS to make care better and less expensive as a country. Accountable Care Organizations (ACOs) were also built into the Affordable Care Act as ways of making care better.

We’re nearing the point where half of the people who aren’t enrolled in health plans are in the ACOs. The people who run the plans also run a high percentage of the ACOs. So, there is significant overlap between the programs, and some overlap with the care sites.

The ACOs are also costing less than fee-for-service Medicare. They create a significant portion of the overall profit created by that 6.7 percent annual increase in Medicare revenue and the costs of their care.

If you also take the number of people who enrolled in the various ACOs run by Medicare, and if you assume that they’re now about half of the remaining members who haven’t joined plans, and if you assume that the reports that show those ACO members cost about 5 percent less per member than the average Medicare member, that generates another $16.2 billion in savings for Medicare that helps create the rest of that $83.4 billion surplus for 2022, which has changed the direction and the future of the Medicare program.

Those savings numbers are approximations, but they add up to $84.4 billion. They let us understand how Medicare reversed decades of losses as a program and became a profit center for the US government for the year 2022.

The Medicare Advantage critics who write convoluted, distorted, often ignorant, misleading, and sometimes angry and hostile attack pieces about Medicare Advantage upcoding and overpayments were wrong on multiple levels. Those critics owe us all a fairly big apology based on the actual results for Medicare.

They also owe an apology to the people who they unintentionally, but functionally, steered away from better lives and better care with their inaccurate information about Medicare Advantage plans.

Those wrong attacks have kept people from enrolling in Medicare Advantage plans by weakening government and public support for the plans. That negative impact is particularly relevant to the people with dual eligibility for Medicare and Medicaid, and who have major and significant medical needs that haven’t been met by their traditional Medicare care sites.

Many of those people who haven’t enrolled in those programs have had amputations and have gone blind. We need the people who persist with the upcoding attack pieces to back off and to encourage everyone to get as many high-need people as we can into those programs as quickly as we can get them there.

The costs are clearly lower, and they will stay lower because of the payment model used for the plans.

We don’t need to worry about somehow losing ground on these processes for future costs. Medicare Advantage is a capitation payment system. Capitation is a very powerful and very controllable system. It’s often the best way to buy care when you want caregivers to work together to make care better for people and are willing to create the resources for that to happen.

Those lower costs are protected and assured to infinity if CMS decides to have that be the financial outcome for the program. They seem to have that goal clearly in hand with their future payment decisions.

There’s no way for Medicare to lose on that issue going forward if the capitation payer uses the ability to set those numbers where they should be (and need to be) for that outcome to happen.

We have a guaranteed slam dunk win for the financial future of the program. We should be able to maintain a permanent solvency level for the program by making the right decisions on the capitation levels for Medicare Advantage going forward from here. The arithmetic is simple and basic and clear. Lower costs now that are tied to lower capitation increases guarantee a win for the program for as long as we want that win to happen.

We should have achieved that financial win from the trajectory we’re now on today.

CMS has now set the capitation and payment increase levels for 2024.

Those numbers will continue to make the payment level and reserve impact from this annual report successful for the indefinite future for the Medicare program.

The extremely competent staff at CMS is now carefully managing the model and all of its component parts very well. The team at CMS has become a very competent, skillful, adept, and explicitly intentional buyer instead of just being a payer in their decisions related to the five-star program performance expectations and to all of the cash flow decisions that steer the program.

They created a new and improved reporting system with the encounter process they now use that gives us very accurate and current data on the diagnosis and risk levels of the patients. We should be able to trust that system and its data indefinitely. They put it in place in 2020 as the only approach that they now use. It works very well.

It’s functionally very well done and it’s completely and safely in place now.

The team at CMS understands capitation as a tool, and they’re using it well.

They set numbers for next year that will keep this success happening for the Medicare program into the indefinite future.

They’re also steering people and care sites into the ACO approach, which makes lives significantly better for those patients as well.

MAJOR ENROLLMENT GROWTH IN MEDICARE ADVANTAGE WAS PART OF THE SOLUTION FOR THE PROGRAM

Enrollment growth for Medicare Advantage has been, and is and should be, a major part of that success and achievement for the Medicare program.

This is an historic moment for membership levels. It’s a key time for the program because 2023 is the first year where more than half of all the members of Medicare are now enrollees in the plans, and that means that it now creates the underlying enrollment status for Medicare.

That enrollment success inherently and functionally makes Medicare Advantage the new normal for Medicare. It’s now the anchor tenant and the core plan for most of the members and almost all of the care sites. People planning for the future of the overall Medicare program should do their planning in that context from this point on.

Medicare Advantage has been a popular and growing program. It wasn’t forced or imposed on the country or the members in any way. It’s made steady progress each year in its enrollment growth and that pace of growth continues today. The plans are responding well to the opportunity that the program creates.

The planners for the Affordable Care Act explicitly and intentionally wanted the enrollment in the program to be completely voluntary, and to be based only on members who were wanting to enroll because the plans managed to entice them and persuade each of them to make that decision — with no involuntary and directed and forced and mandated enrollment for any of the Medicare Members.

The theory for that approach was that plans in this country who had to compete for their members were more likely to be more customer-focused, creative, and more member-friendly than the kind of government programs where the membership alignment is assigned to some organization or process. The decision made for Medicare Advantage wasn’t to have any people being assigned and mandated as customers and somehow ordered to be members of the plans by the government or by any other structure, process, or entity.

That completely voluntary enrollment approach was a good and now very popular strategy. It forced the plans to come up with better benefits and higher levels of service. It encouraged the plans to offer better levels of team care and patient-focused care culture and process successes in order to gain and retain customers.

The plan satisfaction levels are measured in a number of ways and the results are made visible to the members and the care sites. The plans have competed with each other well enough over the past decade of growing marketing efforts that some measures and some plans now have 90 percent satisfaction levels and approval ratings from their members.

That high satisfaction level wouldn’t have happened if the members were simply assigned to plans.

Medicare Advantage enrollment has now grown to more than half of the total Medicare enrollees for 2022. The plans that are best meeting their members needs and achieving higher levels of member satisfaction will probably continue to grow because it will continue to be a voluntary process.

The prediction and expectation is for those numbers to continue to grow at their current rate, or even a slightly higher rate, for a number of years if we continue using these approaches. The plans have competed with each other well enough over the past decade, that some plans now have 90 percent satisfaction and approval ratings from their members, and they take pride in those results.

Those high satisfaction levels have made it more difficult for enemies and critics of the plans to get members of Congress to write legislation that’s damaging to plans, because the backlash from members who believe that their care teams are being damaged could be significant in some political settings.

Most members of Congress don’t have many programs where their voters are extremely satisfied with the program results. Most members of Congress who’ve seen people financially damaged by the weak benefits of fee-for-service Medicare also strongly support having better benefit levels in the Medicare Advantage plans so that their voters have better lives when that happens.

Having vision, dental, and hearing benefits — along with various levels of in-home team care benefits — are all extremely popular with the people who have them. Telling people with poor vision that they should pay for their own eyeglasses isn’t a politically wise decision when the health aides for the senators and members of Congress know that benefit actually costs Medicare less than poor vision care and blindness costs in fee-for-service care.

Plans can reduce blindness levels for diabetics by more than 60 percent with better blood sugar control. The very first Medicare Advantage quality measurement and goal is to help patients manage their blood sugar.

So, the enrollment of a majority of Medicare members into more affordable care as plan members has been extremely beneficial at basic political and economic levels as well. It’s now saved Medicare financially in ways that had less impact when most Medicare members were on the old fee-for-service plans and when those plans and traditional programs were all losing money.

The reality is that adding $84.3 billion to the Medicare reserves and trust fund for 2022 is obviously beneficial at every level. It also gives us the right anchor for continuously improving care with adequate funding now assured for future years for care sites who want to invest in improving, and using that dependable capitation cash flow to fund and afford those improvements in those sites.

That gain is actually a significant change in direction for the country. Adding $80 billion to the trust fund is a major success for the country that lets us think differently about Medicare for the future. It takes one of the major future financial and political issues off the table for the country. It’s not the path Medicare has been on with the old enrollment levels and patterns.

That’s why the 2023 trustee report is so important and why we need to think about what happens now with that result as a very real part of the Medicare experience and how we can do optimal things for the future of members and the program.

At the most basic level, we know from that report that the Medicare trust fund reserve didn’t shrink in 2022, after more than two decades of weak performance in that area for the country. We know that there were almost universal expectations from health economists, health policy makers, and even health journalists — that Medicare would be a permanent loss leader for the country and doomed to put us at a future moment of truth when we would have to makes some level of painful decisions as a country about Medicare eligibility and future Medicare programing to return a financially damaged Medicare to solvency.

We know that all of the old projections by the economists, the policy thinkers, and even by the Medicare trustees themselves, was that Medicare would continue to lose money forever. That prediction and expectation of perpetual losses would be true if a majority and growing number of members were still enrolled in fee-for-service Medicare.

But that isn’t the future we face. That future issue that we actually face now for funding Medicare is no longer going to force us into future painful decisions that create adverse outcomes at multiple levels because we are under funding care.

The trustees in the current report significantly missed the point of what was happening with the Medicare Advantage members and lumped them in with the Medicare Parts A and B future trajectories.

The Medicare trustees actually haven’t understood what Medicare Advantage was trying to do. They’ve avoided that entire set of issues relating to Medicare Advantage every year.

They’ve written their annual report every year showing current numbers for Medicare Parts A and B — accurately projecting future losses for each of those programs — and then writing a summary statement for the entire report each year with the generic expectation that any losses that happened for Medicare Parts A and B would simply be echoed, repeated, and paralleled for future years in the same losses from Medicare Advantage as Part C of Medicare.

They didn’t do a separate Part C projection or a separate Part C thought process in the trustee report in any year.

That projection and the slim and almost vague set of observations that was written each year about Medicare Advantage has been wrong every year in the Medicare trustee report. They didn’t project or report anything that was actually happening for those members in any of their reports. They consistently underestimated the future growth levels for the plan and program.

They clearly didn’t know, as trustees for the overall program, what the plans were trying to do with their money.

They actually heard the Medicare upcoding alarmists and program critics say — with no actual evidence in any report and with no measured cash flow information or data from those harsh and constant and consistent critics at any point in time — that what appeared to be surpluses for Medicare Advantage in every single county every month were not real surpluses. Some of the critics even said and wrote that no one should believe that the surpluses for the Medicare Advantage plans that seem to happen every month, and that now create record surpluses for the plans, were either legitimate, accurate, actual, or real outcomes and results for the plans.

That information confused the trustees and the people writing their report.

The trust fund report authors thinking about Medicare Advantage as a piece of the package and report, probably believed the worst critics of the Medicare Advantage program even with no data in their pieces to support that belief, and what should’ve been widespread and enthusiastic support for the plans. That attack flew in the face of obvious surpluses for the plans in every country. It was just taken at face value and then rejected as somehow now being real money by the critics and the community.

Those surpluses helped create and enable the $83.4 billion surplus for the program. The critics said not to trust those surpluses because some combination of upcoding mechanisms by the plans made them illusions and not credible or real.

The critics directly and explicitly said the underlying upcoding process done by the plans was actually creating a 12 percent deficit in the payment process. The critics said that their invented, unsubstantiated, and highly political and strangely partisan expense increase number should be the number used by everyone to measure the plans and to evaluate and predict and understand their performance as plans, rather than the obvious surpluses that do exist, and that have enriched Medicare at multiple levels in every county.

The trustees and their analysts at least partially seem to have believed those fairly visible critics to be making a credible point. So, even though the trustees had significant data showing what Medicare Advantage actually costs in every county, the hardline critics said that the current set of good outcomes with lower costs than fee-for-service Medicare can’t be trusted because the functional and financial impact of the upcoding process will make it all somehow disappear in future years and change in the immediate future into overpayments of 12 percent for the overall program and for the plans.

The trustees didn’t use that 12 percent number in writing the Medicare Advantage part of their report, but they heard it, and the people who used it seemed to have a data-free conviction that it was a real number.

They actually were partially saved on that issue of future plan costs for next year. They used real information about some of the actual current costs in writing their report. They said in the current report that they would only project that the Medicare Advantage cost will increase by 4 percent in 2024 based on the current year’s actual data and current expense level.

Four percent was a real number and they used it.

But they then predicted with absolutely no data, but with a politically correct thought process that they thought the actual cost increase number for the plans will double in 2024 and in following years, because of the possibility of upcoding by the plans.

We need the trustees to use real numbers for future reports.

They now are learning to understand and know that the Medicare Advantage cost levels stem from a different set of issues and processes than Medicare Parts A and B programs. They now know and can see that Medicare actually has two lines of business, and that one is profitable.

The $83.4 billion surplus is very real. It needs to be addressed in much more detail in the report they write for 2024.

In 2023, as a partial explanation for that number, they only said that the significant increase in assets for the trust fund for 2022 was due to “lower actual expenditures than estimated” in last year’s report.

It’s obviously a permanent increase in the reserve levels. That increase happened based on the cash flow to the plans that has $403.3 billion (in actual dollars) spent on Medicare Advantage plans as a base expense for the year. That number is at least 17 percent, and $68 billion lower as a cost than it would’ve been if all of those members were currently enrolled in fee-for-service Medicare and incurring that level of expense.

There are no comparison numbers for prior years for those particular pieces of data in that trustee report. They missed every year on the future costs for that line of the report and they significantly underestimated the enrollment growth each year.

The health plan piece of the projection for each program each year for the past decade wasn’t particularly important, relevant, viable, or even very visible when Medicare Advantage only had 10 or 15 percent of the total enrollees. They very consistently did inaccurate predictions annually and they had only a footnote that updated the inaccurate projection for each year as part of the official report at the end of the year.

That level of importance for those particular projections has obviously increased significantly with over half of the membership now in Medicare Advantage plans and we should expect this year’s report to be more robust on that area.

This report did predict that Medicare Advantage would continue to grow and that it would now be a majority of the members.

The current plan predicts with what are probably good numbers that the Medicare Advantage costs might increase by 4 percent in 2024 based on the most recent and current data, but the report then said that they believed that the 4 percent cost increase was a short-term number.

They again predicted that the cost increase for Medicare Part C would go back to the 6 and 7 percent that we see for Medicare Parts A and B for 2026 and beyond. That prediction will be wrong again as it has been every year. They will probably stop using that approach for estimating those numbers.

They did make an important point and they said on page 4 of the current report that the biggest savings for the Medicare Part A numbers and program in 2022 came from some very high-expense patients with high health care needs who were eligible for both Medicare and Medicaid, and who enrolled in the Medicare Advantage special needs plans for high-cost people and who were much less expensive as Medicare Advantage members.

They said those numbers were important to point out because the people with dual eligibility for Medicaid and Medicare are currently the fastest growing part of the Medicare program. That trajectory for those people was useful to Medicare costs in 2022 because the Medicare Advantage cost for those patients was so much lower when they converted to Medicare Advantage.

That somewhat unfocused and incomplete thinking about the role of Medicare Advantage for the next trustee report will be massively reinforced and explicated when we see an estimated, but inevitable and probably irrevocable, extension of some portion of the $83.4 billion surplus for the trust fund that was created for 2022 by those costs, extending into 2023 and then into 2024 and giving us the new future for Medicare.

We should have much better information on those issues in the 2024 report.

We know that the program is financially safe because these savings and lower costs are very real.

The basic mathematics points us in a fairly clear direction on those issues. Medicare Advantage costs run several points below the average cost of fee-for-service Medicare in every county now to create those surpluses each month.

CMS has already decided to keep the Medicare Advantage cost increases at a low level for 2024.

We now know that the trust fund will now increase (instead of decrease) with Medicare Advantage as the primary payment model for Medicare, and we can plan to build on that better performance as a country and as a program for care at multiple levels.

We should be looking at the total Medicare package and recognizing that, when Medicare becomes a kind of profit center for the government, we can put more money into better benefits for older Americans. We can take full advantage of the other opportunities that were also created by the Affordable Care Act with those parts of our Medicare enrollment who get care from those sites and who will benefit from that improved care created by the Medicare Advantage template, incentives, structures, alignments, and tool kits.

That is much better care than traditional Medicare.

We need to help as many people as we can to leave the very weak care created by far too many fee-for-service Medicare Care sites. We also need community leaders who understand how important better care is to steer people who need that care into joining plans.

The Medicare Advantage plans in the aggregate have created an industry, a culture, and a growing infrastructure of better care. Anyone interested in looking at those achievements and those accomplishments can go to any of the various Medicare Advantage summits currently being held in various places and can see that a growing number of settings have people sharing and celebrating those tool kits and those levels of achievement, and creating a very directionally correct set of realities and expectations for American care that people very much appreciate and use to deliver and receive care.

The total amount spent on the plans has created an industry, a set of expectations, and a very complex and energized set of caregivers on multiple issues that involve making care better for people enrolled in Medicare Advantage plans. In a health care industry that has no functional leadership, no macro strategies, and no missions or collective visions for delivering care, the rule set and cash flow that springs from the Medicare Advantage processes and cash flow are probably the most influential programs that exist today for the infrastructure of American health care.

The $403.3 billion cost for Medicare Advantage for the year is a very good price for Medicare as a program as well as a motivator for care delivery processes for the country.

That expense was based on the payments for 2022 actually being less than the average cost of Medicare in every county. The basic truth is that those discounts in every county are actual and real. They give us a very good value for the money we spend on the plans and they’re very focusing for the care systems.

There is nothing that the plans can do to distort those basic numbers that create the payment approach each month, even if the worst critic accusations about coding issues were true. The plans paid in dollars — not codes — and it’s less than we would spend on those patients if they were still getting fee-for-service care.

We know from the financial results of having the trust fund increase in size for 2022 that the $400 billion is a very good number for Medicare to have spent in 2022 on the health plans who participate in the program.

We also know from the trustee report that they now expect the 2023 spending for Medicare Advantage to increase at a slightly better and lower level than other parts of the program and that will continue that benefit level for the country.

The actual result is game changing for Medicare and the country.

The actual result saves the trust fund and creates highly valuable cash flow stability and positive outcomes for the future of our health care system. It makes investments possible in many care settings, which couldn’t happen with a pure fee-for-service payment model.

That success level actually gives the plans a cash flow that they can rely on as they do their financial planning and make their care re-engineering decisions and investments for the future for their care systems and infrastructure.

Cutting a number of costs in a capital-intensive industry is much more likely to happen and succeed if the organization making the investments today has a good sense of what the cash flow will be for next couple of years — and can use that cash flow in informed and effective ways as an investment strategy and agenda.

Hospitals build for decades, not quarters. When hospitals know what their cash flow for a site will be for multiple years — which is an outcome based on capitation-related contracts — the hospitals can then make much more effective decisions about site design and current process funding and enhancements.

We now have Medicare Advantage as a solidly funded multiyear program. That longer term stability can allow plans and care sites to plan much more effectively on the various tools in the health care tool kit that can give us future care.

MEDICARE ADVANTAGE IS NOW A LEGITIMATE PROFIT CENTER FOR MEDICARE

That’s now possible, with Medicare Advantage being a profit center for Medicare rather than an expense for the program.

We know from that 2023 Medicare trustee report that Medicare as a program grows in total and relevant revenue each year by 6.7 percent. And we know that the expenses charged against that growth and income number by the key component parts of the current Medicare program shape and create the Medicare trust fund and its reserve levels each year and allow for long-term planning by the care sites and their financial realities.

We need to understand that entire package at several levels to realize where the Medicare program is today and where it’s going.

We know from the 2023 trustee report that Medicare Part A and Medicare Part B have current expense increases that exceed 7 and 8 percent of the cost for those programs. We know that Medicare currently loses money on both Part A and Part B Medicare members, because those numbers exceed the 6.7 percent overall program revenue increase number.

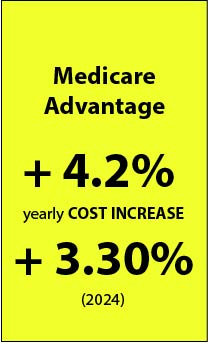

We know that Medicare Advantage has much lower cost increase numbers than Medicare A and Medicare B. We know from the report that the cost increases per person that the trustees predict in that report for Medicare Advantage will be 4.2 percent of prior expenses for the year. We know from more recent data from CMS shown in that capitation level decision that the cost increase for 2024 will actually be 3.3 percent.

We know that Medicare Advantage builds reserves and creates Medicare assets from the surpluses and deficits created by the difference between those revenue increases and those expenses for plan members.

Almost no one in policy circles expected this outcome to happen.

The people who’ve hated, opposed, criticized, and attacked Medicare Advantage with a high level of consistency and persistency for multiple years have been predicting the exact opposite future and opposite impact for the entire process.

They’ve been very visible and often seemed credible in their attacks. Those persistent and hardcore critics say Medicare Advantage financially damages Medicare and will destroy the Medicare trust fund with extensive expenses and with high levels of plan profits that they exaggerate shamelessly knowing that the law limits the plan profits and that law is enforced.

They couldn’t be more wrong on all of those accounts, but they’ve been fairly visible in their attacks, to the point that even the Medicare trustees thought they might be right on those points.

They were completely wrong on the key points of attack, but they were credible in their point of view for many people. That kept the trust fund from recommending the plans to the extent that the actual performance levels would seem to merit.

THE WIN WAS INEVITABLE FOR HOLDING THE COURSE

The people who designed the Affordable Care Act Medicare program actually expected and intended for this outcome of Medicare Advantage saving Medicare to happen.

Saving Medicare is inevitable as a consequence and outcome if you do the key parts of the Medicare Advantage approach right and then succeed in enrolling a majority of members in the plans to create the critical mass of enrollment needed to sustain the success levels and achieve the cost-saving goals.

The people who designed Medicare Advantage didn’t announce, proclaim, predict, or even brag about that particular consequence and outcome, but they expected it.

The supporters of the approach didn’t need to debate, describe, or even discuss that trajectory for those outcomes with all of the people who hate Medicare Advantage plans and who aren’t open to any positive information about the program of plans.

However, if we do everything right, this is the only possible outcome for the program. You don’t need to debate or postulate something that you can simply show as the current reality when it actually happens.

The current reality is that Medicare Advantage is now over half of the enrollment for Medicare. Medicare just increased the underlying trust fund by $80 billion with that program in place. There’s no way to have that win turn into a future loss with all of these pieces in place if we make the right decisions from this point on.

We do need people to understand what just happened and where it will go from here.

We now have Medicare on the path to be solvent in a comfortable and dependable way for the foreseeable future. That should be an easy win going forward.

We will now have much better benefits for our members as a permanent component and outcome of spending the Medicare dollar more effectively. Those better benefits are extremely important for growing numbers of our members. They should continue and survive as long as we stay on this trajectory for the plans.

Two out of three low-income members have joined plans now because of the lower costs and better benefits. Their benefits will be protected and even enhanced if we continue to use the funding approaches that we’re using now, and if we continue to encourage the plans to compete for their customers with better benefits and higher service levels.

The best parts of our overall economy across the board for all industries can produce high value to customers for the product they sell when competition is part of the sales and purchasing package. That result is being achieved with the Medicare Advantage program now, and that product for the plans continues to improve. The plans benefit when that happens.

This is groundbreaking and important information.

It’s a far better use of the Medicare dollar.

The new normal for Medicare, with Medicare Advantage being over half of the enrollment, can now be projected as having Medicare increase the size of the trust fund reserves every year and not being in perpetual danger of the financial inadequacy levels and the insolvency levels that have been projected as the future of the program by the Medicare trustees in their annual report every year for almost two decades.

The trustee report on page 4 goes a step in that direction and explains that the Medicare Part A cost levels and reserves were enhanced in 2022 by having some of the highest cost and highest need members who have dual eligibility for both Medicare and Medicaid enrolling in the Medicare Advantage Special Needs Plans — thereby removing their high expenses from Medicare A costs for lower plan expenses for that program.

The trustees noted that the fastest growing segment of Medicare Advantage today is the special needs plans — with over 20 percent growth for those members for each of the past two years. The trustees are now keeping track of that program for those members as a separate cost category, because it has such a high impact on Medicare Part A direct expenses.

The Medicare Advantage critics who write consistently inaccurate and distorted thought pieces and attacks on Medicare Advantage plans in various technical and academic settings for upcoding their risk pools have been wrong in their description of the impact of those plan coding approaches.

The critics of the plans’ current reporting systems and operations, who claim the plans succeed by avoiding risk and manipulating data, never mention and carefully avoid discussing or even describing the 5 million extremely low-income and high medical-need members of that program for the people with eligibility for both Medicaid and Medicare, because of their high health needs and the extensive care that exists and happens for those Medicare Advantage members.

Some policy journals have allowed the upcoding attacks on the Medicare Advantage plans to be made by those critics without explaining that there’s no possible relevance for those attacks for that entire set of very visible members who have multiple co morbidities, serious diseases, and major health issues that clearly make upcoding issues functionally irrelevant if anyone tried to do them.

The critics and the thought pieces who attack the plans also don’t describe or discuss the fact that those upcoding and cash flow enhancement accusations have no role in the actual cash flow for the Medicare program as it exists today, because the data set for the payment model and process is now based on encounter reporting, rather than on plan coding processes that used to be the core of that program.

CMS ELIMINATED THE CODING PROCESS AND SYSTEM IN 2020 AND ONLY PAYS MEDICAL RECORD GROUNDED CAPITATION NOW

Everyone looking at Medicare Advantage should know and understand that CMS completely eliminated the old plan risk coding reporting process in 2020. They replaced that old coding system for risk levels, which had triggered so many concerns from a number of people for a number of years, with a new and better system that uses encounter reports from every patient encounter as the source of data for the plan risk levels, and as the source of care delivery practices that trigger the payment system for the plans.

It's now an extremely accurate and timely reporting approach.

The plans provide the diagnostic information of each patient through that direct encounter reporting process where each report ties back to the medical records of the patients in each site — and that encourages the plans to have the most accurate diagnosis in their Medical record, but it doesn’t allow the plans to generate those sets of reports that used to cause so much concern for the Medicare Advantage critics.

The new approach is a very accurate and safe and effective system. We can trust that easily available and current flow of data to determine what the risk information is about each patient.

The diagnosis from the medical records for each patient feeds the data base for the capitation system for the plans that triggers the actuarial levels for the capitation payments being made today for Medicare Advantage.

Capitation as a system, a process, and as a flow of cash is the key to Medicare solvency and success today, because it gives the plans the money they need to deliver care, enhance benefits, and create the cashflow that is allowing the Medicare trust fund cash reserve to grow, instead of shrinking each year.

Capitation is probably the most effective and best way of buying care. It pays a fixed amount each month for each patient, which is the only payment that the plan will ever get from Medicare for that patient. There are no fees or payments for pieces of care — as the traditional system works. The capitation pays a fixed amount for each person, which is the amount that the care sites and plans need to use to pay for their care.

Capitation creates a cash flow for care teams that’s completely free from all of the perverse consequences that functionally and inherently result from piecework purchasing and payment models. Plans can use the capitation as a cashflow to provide needed care, with no restrictions on the cash flow based on any patient-related pieces of care. It’s a flexible and highly useful way of getting cash for care.

It allows for care improvement processes to happen and be used in care settings where the entire care tool kit is available to the capitated care team as a package that they can choose to use for their members in whatever ways make sense to the team delivering care.

Capitation is definitely the most powerful and high-impact purchasing tool that exists for care because it is both flexible and absolutely finite and fixed in its payment amount to the care team.

It gives complete, absolute, direct, immediate, full, and total control over the amount paid by the payer for the process to the seller of the capitated services purchased by the process. Complete control is what happens for CMS on Medicare costs and cost trends when they decide on the capitation amount and use it with the plans.

Many health care economists, academics, and even many health policy people (who should all be capitation experts) too often don’t have a clue that it even exists, or what it does. Too many experts, and far too many policy people, don’t have any sense of what that payment approach does for care and for care engineering processes. They don’t know how important that cash flow is to making care better.

That’s a little like laser design experts who don’t understand quantum physics. You can function as an engineer with that deficit, but you often don’t get a lot of key things right or functioning at optimal levels with that knowledge gap.

Capitation is now how we actually buy care for the Medicare Advantage approach. The decisions made about capitation should be part of the national discussion and debate about care. They set up the financial reality for the process at important levels and create the context for many decisions about care.

It isn’t just Medicare that has a capitation link, cash flow, and tool kit.

Most Medicaid sites across the country today also have some level of capitated payments upstream in their payment processes and cash flow — and that cash flow has also been transformational, enabling, and often even culture-changing for those Medicaid care sites. That Medicaid use of prepaid and packaged care also been invisible to far too many care experts on policy and economic issues for those programs and patients. Most health care policy makers don’t understand how extremely important and useful that process is.

The people who run the Medicaid programs in every state have an extensive and growing understanding of that set of tools. There’s a growing culture in America of continuous improvement for many of those programs, which is also very good for millions of patients with Medicaid coverage.

CMS is completely in charge of that process for Medicare Advantage and steers it heavily for Medicaid at several levels. The numbers they just set and announced for 2024 for the Medicare Advantage plans guarantee that the cost trend will be below the annual revenue increase levels for the Medicare program. We should see another surplus for that program in 2024 because they start with Medicare Advantage costs that are less than traditional Medicare, and then they build on that lower base to create their total cost for those members for the year and determine the capitation levels for the plans.

We know that Medicare Advantage costs less than fee-for-service Medicare in every county, because we know what the average costs are in each county, and we know what the plans bid to provide that care. Lower bids from the plans are savings for Medicare and they create the surpluses in each county each month by delivering better care.

PLANS BID BELOW THE AVERAGE COST OF MEDICARE IN EVERY COUNTY

The average cost of fee-for-service Medicare in every county is calculated as a starting point for the capitation building process each year.

We know each year before the year begins if the plan expenses will be higher or lower than the average cost of Medicare in every county, because that average cost of fee-for-service Medicare in every county is the number that functionally starts the process, and it’s easy to see and measure when the plans are paid less than that actual average cost of fee-for-service Medicare, because it’s a very visual and open process and it happens every year.

The plans learn the average cost of fee-for-service Medicare in every county each year from CMS and Medicare and that number for the counties is calculated with data processes and cost totals that have been time tested for accuracy, consistency, and legitimacy over time, because they do it each year.

The plans all know what the history is for that Medicare cost number in each setting. The plans get to use that county specific benchmark number to bid their own capitation level for each year, and they directly use that benchmark data as the anchor and starting point for the process for each county.

The plans actually are paid the capitation levels they bid in that process by the Medicare program. It’s important for the plans to rely on that number as their probable revenue stream for multiple years. That number is guaranteed and reliable. It gives the plans the money they need to deliver and redesign care on a monthly basis to fund their current and future investments in care.

The plans very consistently bid lower costs than the average cost of Medicare in each county to set their capitation levels. Those lower payments of capitation that are created for each member add up as a package to the $403.3 billion total expense for 2022 that the trustees noted in their 2023 report, and that total capitation payment is the only money the plans ever receive from Medicare.

That number includes the impact of any and all of the upcoding processes that the critics complain about the plans using, because it’s the actual payment to the plans and it creates a real payment in cash. It’s not an approximation or an estimate based on some risk-level manipulations or numerical speculations done by the plans.

It's actual dollars paid to the plans and it’s all of the dollars paid to the plans by Medicare. That $403.3 billion is what Medicare Advantage cost for 2022 and the discounted payments created that number.

The trustee report for 2024 will have another number in that line for the 2023 costs — and that will be one of the most important lines in that report for 2024, because it will include all of the impacts of everything being done in the cashflow for Medicare Advantage plans in 2023. We’ll see how well the CMS pricing approach worked for the year when we add up the total of those payments to the plans.

That report and number will summarize the amount that the plans get in capitation for 2023. The plans looked at that average cost of care in every county for fee-for-service Medicare and they set their bids for 2023 based on that number. They discount that benchmark number in every county significantly — and pay less than fee-for-service Medicare in every county as a result.

That’s why and how we know that the $403.3 billion cost for the program for 2022 is less than Medicare would have spent on those same enrollees if those enrollees had not enrolled in plans and it’s how we will know that the 2024 number will be less than fee-for-service Medicare would have cost for the year for those members if they had continued as fee-for-service enrollees.

We know that the cost estimate number for the other members that they calculate each year to be true and credible. When the people didn’t enroll in any plans, and when they added up the cost of fee-for-service Medicare in each county a year later for all of the people who did not join plans, those numbers and the actual expenses for those members were always very close to the prior year costs for those settings every year.

It’s a legitimate number to use to set the capitation level each year. Basic insurance underwriting practices for an outside carrier would use that number to estimate and measure the current costs for those members. A premium based on those averages would be a credible number to use as their premium for the year.

PLANS SPEND 17 PERCENT LESS TO BUY THE SAME BENEFITS

When we look at the actual cost for the enrolled members, we know that their world changes when they join plans. When the traditional Medicare enrollees join plans, we see the cost numbers and the actual expenses for those members change significantly and fairly quickly.

The expenses drop to lower levels for those members.

MedPac agrees in their current report that the Plans spend 17 percent less for those same benefits for those same people than fee-for-service Medicare spends. That payment level creates a lower total cost for Medicare Advantage that equaled that $403.3 billion for 2022 when we lump those expenses together for the members.

The plans bid on each county, and they can accept the average cost of fee-for-service Medicare in each county, or they can apply some discounts to that average number to create their capitation bid. They’re completely locked in to whatever number they bid.

Most plans discount their bid from that average fee-for-service cost.

The plan average bid discount in 2023 from the average benchmark fee-for-service costs in every county was 18 percent. That was slightly higher than the bids for 2022.

The plans bid those discounts and accept a lower cash flow from Medicare because care is much better and much less expensive in the plans.

That lower bid by the plans isn’t a marketing approach or a sales technique, or a financial manipulation of some kind. It’s based on the actual lower costs created by better care in each of the plans. The plans know how much less they’re likely to spend than the average cost of Medicare because of that better care.

THE BETTER CARE DIFFERENCES ARE EASY TO SEE

Those better care differences for the plans are easy to see when you look for them.

We have some of the highest rates of diabetic blindness in the world for our low-income populations — and the people who designed the Medicare Advantage quality programs knew that you could reduce diabetic blindness by more than 60 percent by managing the blood sugar of those patients.

The first Medicare Advantage quality target in the five-star quality program is to manage the blood sugar level for the patients.

Almost 90 percent of the plans now achieve the five-star plan higher ratings and goals, and the blood sugar management goals and performance levels for the plans with those patients even improved during Covid.

Those numbers are all very visible to everyone, because the goals of the Medicare Advantage quality and service goals are all part of a very visible process for everyone to see.

Diabetic blindness is very expensive for Medicare — and the high cost of that failed care for so many people increases the average cost of fee-for-service care in each county — and that cost sets the benchmark for the plans to bid against.

It isn’t upcoding that creates those plan bids. It’s much better care.

We have some of the highest amputation rates in the industrialized world and the impact of that procedure is particularly high for our low-income people. Medicare spends billions of dollars on amputations each year and they now cost over $100,000 per patient as fee-for-service caregivers to remove a leg.

The plans know that 90 percent of the amputations are caused by foot ulcers on diabetic patients. That is basic medical science. The plans also know that you can reduce foot ulcers by over 40 percent with just dry feet and clean socks. The plans are all capitated, so they have a strong financial incentive not to have those amputations happen for their members and they can use their capitation money based on those higher costs to pay people to help people with that basic care.

Fee-for-service Medicare doesn’t pay caregivers for some of those basic intervention and in home support services. They call it billing fraud if a fee-for-service caregiver bills Medicare for those services.

Over 90 percent of the Special Needs Plans manage that situation for those patients and less than 30 percent of the fee-for-service Medicare patients in low-income settings have that same approach for their patients.

The people who designed the Medicare Advantage program set up a process that keeps track of whether the plans make a profit or a surplus in costs when they provide care. Plans generally make surpluses because the care is so much better. The law was set up to have the surpluses created by better care used by plans to increase the benefits offered by each plan to their members.

It's a much better use of the Medicare dollar. Plans do an extremely good job of using what is in effect free money to Medicare to make benefits far better for their members.

The plans offer dental benefits, vision benefits, hearing benefits, and a variety of social and service benefits that fee-for-service Medicare does not provide.

The plans pay for those benefits entirely with the surplus they create from the discounted bids. There’s no additional cost to Medicare from those additional benefits and there’s no expense charged against the trust fund for those services.

Fee-for-service Medicare is an inept, incompetent, vastly inferior, and extremely inadequate user of the health care dollar that Medicare Advantage plans need to make care and benefits better for their members. The MedPac people who criticize that use of the Medicare dollar should have their own health plans stripped down to the bare bones benefits that they advocate and encourage for Medicare beneficiaries that they are supposed to be somehow helping.

SOME PLANS USE THEIR PROFITS TO BUY PART D COVERAGE FOR THEIR MEMBERS

One of the more significant additional benefits that some plans pay for is to buy Medicare Part D drug coverage for their members. That surprised a lot of people when it started. Some people didn’t believe it was possible, but it’s very true and very real. Many Medicare Advantage members get their personal Part D Medicare coverage for free because they’re in plans that pay and buy that premium for them.

Some plans even go one step further in that direction and pay the actual Part B basic enrollment premium for their members from their profits and discount-based surpluses. That purchase actually appears as a revenue line against the Part B trust fund report and it also isn’t an additional cost for Medicare.

It’s a hugely and massively beneficial benefit and a far better use of the Medicare dollar.

It’s extremely difficult to understand why MedPac never mentions, or celebrates, or discusses that far better use of the Medicare dollar in their reports and meetings.

Traditional Medicare has been obviously and clearly an inept, ineffective, ineffectual, marginally incompetent, and very weak user of the Medicare dollar in too many ways.

The traditional Medicare program needs to be improved for the benefit of the members and that should be part of the Medicare strategy at a macro level. Traditional Medicare is far better for people than not having any coverage at all, but the basic benefit package is clearly suboptimal and inferior in a couple of areas that create financial damage for too many people.

We know what those numbers are. We can’t deny that they are what they are.

The fee-for-service Medicare members each now have an average out of pocket personal cost of care each year of more than $5000.

Five-thousand dollars per person on average is a lot of money for low-income people.

The Medicare Advantage critics who clearly favor traditional Medicare don’t mention those dollars from traditional fee-for-service Medicare in their attack pieces on the plans and on Medicare Advantage as a program.

Wealthier fee-for-service Medicare members who don’t want to join plans often buy supplemental coverage from insurance companies to make up that basic benefit weakness and deficiency for fee-for-service Medicare coverage. Lower income people tend to join plans because the benefits are so much better, more complete, and usually free. However, many low-income people have no coverage other than fee-for-service Medicare, and care costs far too often bankrupt and destroy them financially.

The Medicare Advantage critics who say the plans are ruining Medicare never mention those enrollment patterns or those huge care deficiencies for low-income people in their attacks on the plans. They pretend that the people who remain with traditional Medicare get the right care when they so vigorously and negatively attack plans. They’re very careful to never discuss care differences in their attacks.

They do sometimes say that Medicare Advantage has an unfair advantage over fee-for-service Medicare. They say the benefits of the plans are better and they propose that the government somehow reduce the benefit levels for the plans.

That is extremely cold-hearted and narrow-minded thinking. It’s part of the attack package for that set of critics and they continue on that path with some vigor and persistency.

TWO OUT OF THREE LOWEST INCOME MEMBERS ARE IN PLANS

That would be a huge mistake.

We all need to take a good look at who’s joined the plans.

Two out of three of the lowest income Medicare members have now joined plans.

African American members also now have two-thirds of the members in plans and the Hispanic population with Medicare coverage currently have over 71 percent of the members in plans on the day that the trustees released their report.

.jpeg)

The average net worth of the people who buy supplemental insurance coverage to fill in the gaps in their Medicare coverage is over $200,000. The average net worth of the Hispanic members who have joined the plans is $14,000 — and that average asset level might have gone down during Covid.

Being able to get eyeglasses as a benefit from your care site is extremely useful for the people who only have $14,000 in assets to spend.

The Medicare Advantage plans are clearly a much better use of the Medicare dollar for everyone with low levels of financial assets who wouldn’t be able to purchase many of those dental, vision, and hearing services if they weren’t in the plans.

We will need the annual report from the Medicare trustee commission for 2024 to more accurately reflect what is actually happening and to offer some thoughts about what should be happening for Medicare as a program. They should be forced down that path and to that thought process by the 2023 results.

The $80 billion surplus expansion is very real. It’s too big to ignore.

We need the people doing the projections for the trustees to look at the real numbers that we’re seeing today and use them to plot out the future for the program.

So, what’s true? And what can we count on now?

MEDICARE ADVANTAGE COSTS ARE INCREASING BY 4 PERCENT; NOT 8 PERCENT

What’s true is that we’ll keep Medicare Advantage cost increases per member at 4 percent or less every year, and we’ll base the Medicare trust fund reserve contribution numbers on the current actual dollars being spent on those members by Medicare. That will make care better and it will save the trust fund.

The arithmetic works.

We can simply have the Medicare Advantage costs increase at less than 4 percent each year and that will offset the losses from Medicare Parts A and B, with 7 and 8 percent total cost increases for those programs.

We’ll make that reserve solvency goal happen for the entire program as a blend of the two financial trajectories and we can achieve it from the cost realities that exist from that approach today as a completely legitimate plan for Medicare.

It actually doesn’t matter for the success of that approach if we miss on our cost projections for Medicare A and Medicare B from the trustee report for those next couple of years, because the Medicare Part C system is a rock-solid capitation payment level, and we have huge control over that number because it is capitation.

The right number for the program is to do what we’re now doing and have a number each year from Medicare Advantage that is guaranteed, appropriate, safe, and a very good use of the Medicare dollar, and doing that intentionally and well makes us an extremely competent buyer, rather than a payer for that care.

We’ve decided that our capitation number as a system for 2024 will be 3.3 percent, and because we’ve decided that will be the number, it is in fact the number for that year. The numbers at the top of this page have that number in them for 2024, and we know it will happen, because CMS has the authority to make that decision and made it.

The Medicare Advantage program was built into the Affordable Care Act in very intentional, deliberate, strategic, tactical, and intentional ways to give us a template for care improvement processes. It was meant to be the capitated portion of the American health care economy that was created to set up, fund, support, and reward continuous improvement in care delivery. It was meant to create a template for all other care with the momentum built by all of those settings doing that process improvement for plans and members in ways that can be extended to everyone receiving care in this country at this point in time.

Both President Obama and President Biden should be celebrating now how well that strategy and agenda has worked. Their teams built the original Affordable Care Act model and strategy when the bill was designed and passed. The Biden team is now running the overall programs well enough to make them financial winners for the long term and to have much better and more affordable care now for many care sites and care teams across the country.

The timing is very right to do that work.

CARE IS CHANGING RAPIDLY — AND WE NEED TO OPTIMIZE THAT PROCESS AND TOOLS IN INTENTIONAL WAYS

Care is changing rapidly. We should use those changes for optimal effect on Medicare and the nation, and we should use our Medicare Advantage program expectations and successes to facilitate, support, and guide those enhancements as part of the capitation funding for care that anchors the process and gives us tools we can use for everything that’s insured in health care for the next several years.

We should make care improvement a national goal and we should use the capitated plans and the Medicare Advantage plans to make that happen as a new set of expectations for the country.

The science of care is transforming itself daily. We should build on that transformation.

We should be able to make care much better.

We should have major portions of care actually cost less because we have better care connections, better care information, better care linkages, much better science on a couple of key areas of care, and better care teams.

We can set them up in the Medicare Advantage template and then extend them to all patients.

When we look at the care coverage system that we have, we can see a number of plans that run and own Medicare Advantage plans that are now fully in the loop for this care — with 10 percent of the diabetic amputations and less than 30 percent of the congestive heart failure crises happening for our people.

Ninety percent of the Medicare Advantage plans have achieved four- and five-star status on the quality programs. That’s a huge improvement for care quality. It sets up an infrastructure of plans that do continuous improvement work together with their care systems.

Medicare is now largely run and managed by health plans with much better care, much better processes, much better connectivity, much better service levels, and much better care delivery.

We have 90 percent of the Medicaid plans run by the organizations that also run and own Medicare Advantage plans.

The majority of insured Americans have self-insured employers offering and administering the coverage to their employees. Ninety percent of the self -insured employers hire third-party administrator companies to run their insurance plans. And 90 percent of those third-party administrators also own Medicare Advantage or Medicaid programs and plans.

The Medicare Advantage care protocols for diabetic patients that are the core and anchor measure of the Medicare Advantage five-star plans — that have achieved 90 percent compliance for their Medicare patients — look a lot like the care protocols that are being measured in the self-insured plans, and a lot like the care protocols that are now being used by the Medicaid plans with many of the same caregivers in that loop.

Medicare has a major opportunity to do major steerage for the entire country.

We could and should be on the cusp of a golden age for care improvement for the entire country.

We should be using better connectivity, better diagnosis, better care information, better care support, and continuously better use of the most effective artificial intelligence tools and algorithms for making care better in ways that will also make care less expensive and more affordable if we do it well in all of those sites.

Preventing foot ulcers and having support staff with basic direct patient focus has cut amputations by more than half for the plans now. The Medicare Advantage critics write in Health Affairs — and Health Affairs publishes their pieces — to directly and shamelessly say in several settings and publications that the only reason that health plans have nurses going into homes is to harvest diagnosis so they can up code those patients and increase the cash flow to plans because of those coding changes.

Those critics and the publications that ran their pieces should apologize to those care sites and to the nurses who they insulted with that accusation. We should change their practices, messages, and data flows to have their readers do what they can to get more people into plans, rather than trying to take away the benefits from plans and reduce the number of people enrolled in places and care settings that transform their lives.

Some of the MedPac people oppose the enriched benefits created by the Medicare Advantage surpluses. The chair of MedPac even published a piece in Health Affairs wondering how much those benefits could be cut and who would even miss them if they were gone. He also thought it wasn’t fair for wealthy people to have to join plans to get those benefits for free, and he suggested in a podcast interview with a senior editor of Health Affairs last month that particular equity issue for wealthy people should be on the agenda for us to discuss and resolve as a nation.

There isn’t one line in hundreds of pages of MedPac discussions about Medicare Advantage that deals with continuously improving care or care enhancements at any level. They don’t think that the fact we have gone from only 10 percent of plans achieving the top-quality ratings to a much higher number performing at that level is worth both mentioning and celebrating because of what it means for both the process of care and the culture of care in our country.

They don’t see the obvious success that we’ve now reached (with 90 percent of the plans performing at that level after years of hard work) as a legitimate topic for either discussion or celebration by anyone at MedPac.

MedPac continues to write its own very strange overpayment report every year that gets quoted often.

That report looks at the data that comes from the plans having 35 percent lower emergency room visits, half as many people with congestive heart failure patients, and half as many people going blind — and they literally say the plans are overpaid because the capitation benchmark average cost data for each county has those patterns of inferior care that don’t exist today for those people.

They say every year that the plans are overpaid because they don’t have those patterns of care when they draw up a fee schedule and a list of procedures showing the care that is there now for the patients who have enrolled in the plans.

They also intentionally and completely ignore the care being received by the 5 million special needs plan patients in their over payment accusation that has many care elements that aren’t on the Medicare fee schedule.

People who read or hear it should say to whoever is using that overpayment report:

“Show me the actual data that you used for those people.

“Add to their costs, the 35 percent lower use of emergency room care that wasn’t on the expense list.

“Add to their costs 40 percent higher use of congestive heart failure admissions. Add to their costs the 50 percent lower asthma attack admissions. Add to their costs the significantly lower rate of blindness interventions.”

Sharing that accusation and using that report about overpayment without adding back in the actual and clear differences in the patterns of care is a sham, a fraud, a deception, and an intentional misrepresentation of the actual costs of care for those people.

We need people to stop using that report and that declaration of relative cost without adding those actual expenses for those groups of people back into the report.

We know the $403.3 billion is less than we would have paid for those same members without the plans, because that expense and payment had 30 percent fewer hospital days for chronic conditions and 40 percent lower hospital days than we would’ve had as congestive heart failure crises. We know that the resultant underlying expense was an extremely good use of the Medicare dollar.