We live longer with Medicare Advantage

This important final official report from The U.S. Department of Health and Human Services “Comparing Outcomes for Dual Eligible Beneficiaries in Integrated Care” shows that the mortality rate for each version of Medicare Advantage is both lower and better than the mortality rate that we currently have for standard fee-for-service Medicare in this country and the study shows that the Medicare Advantage mortality results have been improving over time and will probably continue to improve because that is the trajectory they are on.

When we are trying to figure out ways of measuring the value of the care we are receiving in any setting, one of the most effective measures of value for us both individually and collectively for each category of care should now be whether the care allows us and enables us to survive.

This new study of the Medicare Dual eligible care results breaks important and credible ground on that issue. Survival rates can be a useful and legitimate way of determining whether or not we are receiving good care, and this study shows us those rates for our most important Medicare Advantage members.

We know that fee-for-service Medicare far too often delivers bad care. We know that fee-for-service Medicare has the highest rates of blindness for our older population in the world and we know that fee-for-service Medicare has the highest rates of amputations for our older population — with $6 billion worth of amputations being done each year for our older Americans.

We know that diabetic blindness can be massively reduced and prevented for most people with the right treatment — and we know that adequate, appropriate and timely treatment is much more likely to happen in our Medicare Advantage settings and it is extremely rare in far too many of our fee-for-service Medicare settings.

We also know that poor people with diabetes are much more likely to lose limbs in this country because fee-for-service Medicare has no programs to change that terrible pattern of care and only Medicare Advantage patients get the right care in large numbers of their settings.

Medicare Advantage plans are paid by the month for each patient and they are not paid by the piece for each piece of care, so Medicare Advantage plans do the basic work to keep people from going blind and to keep people from losing limbs to amputation and the plans can do that because capitation both gives plans the resources they use to do that work and then rewards them financially when the care is successful.

The fee-for-service Medicare care sites make $100,000 on each amputation and they bill for $8 billion in amputations each year. The care provided in the amputation situations can be extremely difficult and it is inherently dangerous and it should not be happening for most of those people.

High mortality rates happen for that surgery

That is clearly very wrong in terms of patterns of care in too many settings. The Medicare Advantage plans have strong incentives to improve care and they respond directly and intentionally to those incentives at multiple levels. The Medicare Advantage caregivers know that 90 percent of those amputations literally started with ulcers on the feet of the patients. They know that 90 percent of the ulcers on patients’ feet could have been either prevented or cured.

Simply having patients wearing clean socks and having dry feet can stop over 40 percent of those ulcers. Medicare Advantage plans all have care teams helping patients to have dry feet and fee-for-service Medicare care sites for low-income people usually have no one doing that work and they just let those ulcers turn into amputations and too often into deaths.

There is a huge differences in care for many of our lowest income Medicare members when they join Medicare Advantage plans. Patients with chronic conditions do particularly well when they are in Plans because each member has their own link to the care delivery network of each plan and their Medicare Advantage care teams are delivering patient specific care for their conditions.

The basic care delivery model for Medicare Advantage is based on doing the right things to improve care. The major epidemic of blindness going on for far too many of our senior Americans today can be dealt with just by managing the blood sugar for each of the diabetic patients.

The capitation payment to the Medicare Advantage plans creates the resources needed to do that work and then the capitation payment approach rewards plans when patients do not have expensive vision loss and blindness remediation expenses. It’s much less expensive to save vision than to lose it.

Far too many health care economists and too many health care journalists and media outlets do not understand the massive impact that capitation payment model has on everyday care. They think of it as just being an alternative cash flow device. It actually restructures care by putting the financial rewards into better care outcomes and then provides the resources needed to reengineer care and deliver the better model.

Some examples of those differences are relatively easy to see. The plans prevent $100,000 amputations by intervening with the foot ulcer development and they also prevent a very high percentage of congestive heart failure crisis events by intervening as quickly as a patient with that disease starts to show sudden weight gains in their home.

Medicare Advantage plans have a long history of successes on preventing bad outcomes and crisis events with congestive heart failure as a disease. The plans know that you can avoid hospital admissions for that disease by identifying all of the people at risk for a congestive heart failure crisis and by interacting directly with each patient to keep those future crises from happening.

The CHF crisis events cost $20,000 to $40,000 each. They are a favorite care event for many fee-for-service Medicare care sites because they are so profitable and functionally easy to treat. They are part of the $4 trillion in billable events that make up the American health care economy.

Medicare Advantage plans do some basic things to keep those costs and those care events out of the system. The functional reality is that when the care team from the Medicare Advantage plan intervenes very early in each crisis, almost half of them simply don’t happen. More than 40 percent of those crises are avoided with proactive care by the Medicare Advantage plans.

Plans often assign nurses directly to each patient and some plans even put easy to use scales in the home because the easiest detection tool is often significant and rapid weight gain by the patient. Some plans even put scales in people’s homes that have direct telephone links on the scale to alert the care team as soon as possible when the weight gain happens.

Congestive heart failure crises can be very painful and sometimes frightening and they can be both damaging and fatal. So cutting them by over 40 percent is good for the patients and their families and it saves significant money for the plans because those unnecessary admissions don’t happen.

When you look at the massive reduction in patient mortality rates that the Health and Human Services study of people in the Medicare Advantage plans for dual eligible showed to everyone in America who looks at that data, those kinds of programs that reengineer care to change the level of care crisis for their members clearly added up to important gains in people’s life expectancy and lives.

Similar programs have a similar and obvious positive impact on reducing asthma attacks for a significant number of patients. Those attacks can also be painful and frightening and life threatening — and a high percentage of those attacks can be avoided with patient focused team care from the plans.

Those normal care improvement programs for standard Medicare Advantage patients work extremely well and they are far overshadowed daily on a patient focused basis by the full array of support needs that happen for the Medicare Advantage special needs patients and particularly for the low-income and high medical need patients who are enrolled in the Medicare Advantage special needs plans and in Medicaid simultaneously.

Those programs and their impacts were all included in the new government report that looked at all four approaches to funding care.

The JAMA data showed that the plans had 18 percent lower hospital admissions overall and had a 44 percent lower hospitalization rate for asthma and chronic obstructive pulmonary disease patients compared to fee-for-service Medicare patients. They also ended up with significantly lower costs for those patients.

The JAMA quality piece ended with a description of the fact that the plans “align their capitation payments to the health care burden of both the individual beneficiary and the aggregate population served.”

JAMA policy description said that this capitation model allows “revenue to be deployed to develop the infrastructure that improves the quality and efficiency of care for the patients enrolled in Medicare Advantage.

Some of the Best Care in America is in Medicare Advantage Special Needs Plans

That is particularly true for the Medicare advantage enrollees who are extremely low income and who are eligible for both Medicare and Medicaid as their health care payment models.

The people who continue to accuse Medicare Advantage in public settings and even in some policy settings of skimming risk and somehow exaggerating the health care needs of their patients in order to intentionally distort plan diagnosis codes should be ashamed of themselves for distorting the truth so significantly at so many levels.

People with some of the highest health care needs in America are in those plans and they are getting great care and giving those programs extremely high levels of satisfaction as members.

Our biggest policy and one of our top functional concerns as a nation today should be that only half of the people who could qualify for those programs are currently enrolled in the plans, and that is very bad for the country and those patients because the people who are not in the plans are much more likely to have their leg amputated and much more likely to go blind.

We have good and credible context information about the overall managed care programs from multiple sources, and we should be using that information to understand what the plans are doing.

We do have some very good context information to help us understand what the plans are going.

In addition to that set of data from multiple sources, we need to understand the importance of the work done by the Health and Human Services team who carefully took a clear and systematic look at all of the variation of managed care purchased today as a package by the government — and that data gives us solid grounding to look at all of the other data from a highly credible perspective that underscores the importance and credibility of that work.

We are extremely fortunate that we have that great new report from the government that we can use to putting those important issues into perspective at a time when there continues to be debate from some critics on some extremely inaccurate issues relative to the performance of the plans.

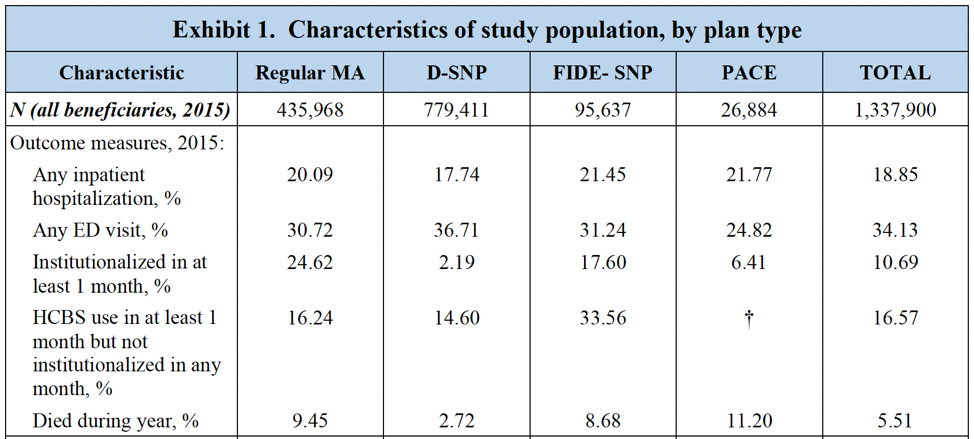

A lead chart from that important and grounding new report is at the very top of this discussion piece.

Health and Human Services just did an excellent overview of the four Medicare Advantage types of plans and they achieved some important new data point about the current performance of the plans that included, for the first time ever, showing us the mortality rates from each of the programs.

The study actually counted the number of people who died in each program.

This official “final” outcomes report from The U.S. Department of Health and Human Services is actually called “Comparing Outcomes for Dual Eligible Beneficiaries in Integrated Care,” and it does exactly that.

That report gives us an extremely robust, well researched, extensive, inclusive, and solid look at the actual performance of the four managed care plans used now by the federal government and that study is worth reading by anyone who wants to get a sense of what those programs are, what they do, and how well they do it.

That report shows that the mortality rate for the two most tightly managed Medicare Advantage programs that reach out to people with special needs is extremely low and that information about the low mortality of those members ought to be extremely encouraging and informative for anyone looking at the future of Medicare funding and at the trajectory and the performance of the Medicare Advantage plans.

The Medicare Advantage plans have had some open, consistent and extremely persistent critics who have made disparaging and too often inaccurate statements and who have created some very wrong and misleading reports about plan performance, and so it was a very good thing to have the new federal Office of Behavioral Health, Disability, and Aging Policy doing this study and then releasing the data to everyone with interest in those issues who wants to have a sense of what is true for the performance of the plans.

We should definitely have the people who did this particular study do follow-up studies to take advantage of the expanded data flow from the encounter reporting for the Medicare Advantage plans and this should not be a final report — but this information in this report is extremely well done and well timed as we look at the future of Medicare financing and the report gives us a sense of security that the four basic programs are on some good trajectories.

Survival rates were an unexpected new addition to the reporting agenda and to the reporting data flow, and we now know that they make extremely good sense as an addition factor for our data flow about care and they tell us some important information about the plans at an important time to have that information.

Survival rates are a useful way of determining at a very basic level whether or not we are receiving good care because surviving is a good outcome for care and it turns out that they can have some variations that can guide us in good directions.

They are particularly relevant here because we know from multiple sources and data flows that fee-for-service Medicare far too often delivers bad care and sometimes clearly dangerous care. We know that fee-for-service Medicare has the highest rates of blindness for our older population in the world and we know that fee-for-service Medicare has the highest rates of amputations for our older population — with $6 billion worth of amputations being done each year for our older Americans — and we haven’t had a good mechanism for creating a context around those issues that explains how Medicare Advantage has very different approaches to those areas of care and to measure the final impact of that care.

We also need everyone in America to realize that those bad outcomes for fee-for-service Medicare beneficiaries do not need to happen. The policy people too often look at those bad outcomes and regard them as being somehow inevitable and a normal consequence of care for Medicare patients and then completely leave those bad and damaging outcomes out of too many high-level policy discussions about the traditional Medicare program.

That is shortsighted and almost unethical thinking for us to not focus attention on those failures in a clear, direct, visible, and constructive way because they damage so many Americans every day and the damage has a permanent and unnecessary impact on too many lives. We know from extensive science and extensive care experience that diabetic blindness can be massively reduced and prevented for most people with the right treatment.

We know now beyond any doubt that the right treatment is much more likely to happen in our Medicare Advantage settings and it is extremely rare in far too many of our fee-for-service Medicare settings.

We also know that poor people with diabetes are much more likely to lose limbs in this country because fee-for-service Medicare has no programs to change that terrible pattern of care and we know that only Medicare Advantage patients regularly get the right treatments and prevention services in large numbers of settings.

We need people to understand that the payment model has a major impact on whether or not our patients get the right care. Medicare Advantage plans are paid by the month for each patient and not paid by the piece for each piece of care, so Medicare Advantage plans do the basic work to keep people from going blind and to keep people from losing limbs to amputation and the plans can do that as a regular outcome because the capitation payment gives plans the resources to do that work and then the capitation cash flow rewards them financially when the care is successful and the amputation isn’t needed.

The fee-for-service Medicare care sites currently make $100,000 on each amputation and the fee-for-service Medicare sites in total bill for $8 billion in amputations each year. The care provided in the amputation situations can be extremely difficult and it is inherently dangerous and it should not happen if we are giving Medicare patients the right care.

High mortality rates happen for that surgery.

That is very wrong in almost all of those care sites in terms of patterns of care before the amputation happen. Medicare Advantage goes down a very different path for patients and members. The Medicare Advantage plans all know that 90 percent of those amputations started with ulcers on the feet of the patients. They all know that 90 percent of the ulcers on patients’ feet could have been either prevented or cured.

Simply having patients wearing clean socks and having dry feet can stop over 40 percent of those ulcers

Those processes are why the mortality rate is so high in fee-for-service Medicare, with upwards of 40 percent of those patients dying and it’s why the Medicare Advantage special needs plans who take care of those low-income people who have personal eligibility for Medicaid as well as for Medicare, were shown on the new dual process report to only have a total death rate as a program of 2.72 percent.

Doing the right thing actually isn’t hard a very large percentage of the time, but there needs to be someone in the care loop actually doing the right thing or it will not happen and that right person and that care loop does not exist for most low-income people in fee-for-service Medicare.

The differences are painfully obvious to anyone who just looks at those programs. We need the hardcore Medicare Advantage critics to take that look and to explain to us all why so many of them continue to inexplicably be hardcore critics of Medicare Advantage plans who continue to urge hurting that care process and program in multiple ways.

MedPac continues to ignore all of the differences in outcomes and in care processes and managed to do another report where they said their key concern about Medicare Advantage dealt with the accuracy of the diagnosis codes for some of plans.

They should be using their great influence to get more people into Medicare Advantage special needs plans to keep them from going blind and dying.

We need everyone looking at the Medicare program and agenda for America to appreciate that there is a huge differences in care that happens immediately for many of our lowest income Medicare members when they join Medicare Advantage plans. Patients with chronic conditions do particularly well when they are in Plans because each member has their own link to the care delivery network of each plan.

The basic care delivery model for Medicare Advantage is based on doing the right things to improve care. The major epidemic of blindness going on for our senior Americans in too many sites today can be dealt with by managing the blood sugar for diabetic patients.

The capitation payment creates the resources needed to do that work and then the capitation cash flow rewards plans when patients do not have expensive vision loss.

Just like the amputation intervention process, the Medicare Advantage plans all know that you can avoid hospital admissions for congestive health failure patients by identifying all of the people at risk for a congestive heart failure crisis and then interacting directly with each patient to keep those crisis from happening.

The admissions for CHF cost $20,000 to $40,000 each, and when the care team intervenes very early in each crisis, usually almost half of them don’t happen.

Plans often assign nurses directly to each patient and some even put easy to use scales in the home because the easiest detection tool for a crisis is often significant and rapid weight gain by the patient. Some plans even put scales in people’s homes that have telephone links to alert the care team when the weight gain for a patient happens.

Congestive heart failure crises are painful and often frightening and they can be both damaging and fatal. So cutting them by over 40 percent is good for the patients and their families and it saves significant money for the plans not to put those people into expensive hospital beds for the crisis.

Similar programs have similar positive impact on reducing asthma attacks for a number of patients. Those attacks can also be painful and frightening and the right set of training and tools in place can keep most of them from happening.

Medicare Advantage plans tend to have about 35 percent lower use of emergency rooms as the result of all of those care improvement approaches.

Some of the MedPac people actually say that the 35 percent lower emergency room use by Medicare Advantage patients is an actuarial risk selection phenomena that has happened each year for more than a decade because, they say, people who are less likely to use emergency rooms also tend to enroll in Medicare Advantage plans. That isn’t a good or legitimate way of understanding that number, but the MedPac explainers use it every year to show that the differences in care patterns for each patient mean that the plans are overpaid.

That’s the basis for one of the urban myths about Medicare Advantage payment rates that we need to stop using, because it is so clearly flawed.

Medicare Advantage delivers better care at multiple levels for the standard members and it delivers sometimes amazing care the people enrolled in the special needs plans who make up a major portion of that new report.

Those programs for the amputations and blindness for standard Medicare Advantage work extremely well and they deserve recognition and support on their own, but they are far overshadowed by an amazing set of patient specific care processes that have been put in place as the full array of support needs for the special needs patients and for the low-income and high medical-need patients who are enrolled in the Medicare Advantage special needs plans.

You can read about the performance data in this new Dual Eligible report that is giving us a new grounding for our assessment of the plans. They aren’t secret about what they do and why they do it.

The people who accuse Medicare Advantage of exaggerating the health care needs of their patients should be ashamed of themselves for distorting the truth so significantly and badly about those issues. People with some of the highest health care needs in America are in those plans and those patients are getting great care and also giving extremely high levels of satisfaction as members in the annual surveys.

Our problem and concern as a nation is that far too few of the people who should be enrolled in those plans are in them. We need the Medicare Advantage critics who have their politicized, badly distorted, and very inaccurate attacks on the program to stop — because we very much need more people in the special needs plans and the critics make that less likely to happen because they make too many people uncomfortable with the idea.

Only half of the people who could qualify for those programs today are currently in the plans, and that is very bad for the country because the cold truth is that the people who are not in the plans are much more likely to have their leg amputated, and we know from the new and credible mortality rates for the plans that they’re actually significantly more likely to die.

The Medicare fee-for-service care sites that create $8 billion in revenues for amputations are very happy with that cash flow — and those surgeries add those expenses to the $4 trillion that we now spend on care in this country.

So now we have a report that shows the cost of care for each of those programs and it shows the number of people who die going down each of those care trajectories.

They Counted Actual Deaths in Each Program to Get the Mortality Rates

They didn’t just do actuarial approximations or statistical estimates or expert opinion judgement calls to get a general sense of the death rates when they did that report. They actually used direct Medicare data for each program and they counted the actual deaths for each group.

We have better data than we have ever had on major components of the population being served by the Medicare managed care plans and that data collection and reporting extends to showing differences in the mortality rates of each of the four categories of managed care patients.

The chart shows that the mortality rate for the programs ranges from 2.72 at the low end to 11.2 percent at the high end for the specific actual managed care and Medicare Advantage plans that the government currently uses.

The highest number on that mortality chart is the 11.2 percent that happens in the PACE care system and is not a formal Medicare Advantage plan. The PACE funding approach and program of community and neighborhood linked care teams strongly resembles Medicare Advantage at multiple levels and it was included in the report because it is the other way that Medicare pre-pays for care.

Care in the PACE program is an excellent, experienced, historically significant patient-focused systems-based and highly neighborhood-based care delivery approach that was targeted at “Frail” seniors and actually preceded Medicare Advantage as a program. It was set up to avoid hospital care for the people who organized in their communities.

It has some similar patterns of care and it continues to provide neighborhood linked team family- and friend-linked care that is highly superior at every level to the fee-for-service Medicare delivered multiple levels in every PACE setting.

The government included the PACE patients in the study to be inclusive. Because they are a Medicare managed care program it’s good to know how those patients are doing with their patterns of care. The data shows that they are doing some good work on their care and it is interesting to see some of the variations in care that can result when frail in home patients are your original focus.

Continuously Improving Care Happens When the Program is Set Up with that Goal in Mind

The other three programs in the study are the key versions of Medicare Advantage — Regular Medicare Advantage, and two kinds of dual eligible members that have special medical needs and who coordinate care and funding with the Medicaid program for the country and who are set up to having their care patterns continuously improve.

We have been focused in multiple recent polity discussions on the dual eligible population because their future is important to the country and it is good to have data about their care.

Each of the programs saves lives and money and each has its target population and patient focus that we need to understand. The Medicare Advantage Special Needs Plans have their own value that we need to appreciate more completely.

Each of those programs now has years of experience in coordinating the care needs of the members and each has continuously improving levels of performance.

We actually can both assume and know that the performance in those programs today is better than the day that data for the macro report was collected, because Medicare Advantage is the only major component of health care in the country that is on a continuous improvement approach and strategy through the Five-Star quality improvement program — and the outcomes in each of the programs continuously improve as a result of that process.

The quality agenda for Medicare Advantage has actually become an American performance norm, icon, and new achievement expectation for care sites, because plans everywhere use that five-star recognition system for both functional structure and cultural alignment and for triggering staff celebrations and morale enhancement when five-star related achievements happen.

It is now a mark of pride in multiple settings to achieve five-star status as a plan and care system and it’s clearly focusing for both staff and patients to have that status recognized.

As the planners who put the system together had hoped, the plans and care teams have created a sense of identity and pride for achieving high quality and service ratings. The plans have created a culture and a strategy of continuous improvement as an overall approach because care is measured in a number of areas and that process helps create both priorities and activities for care settings.

In many settings, plans and care teams take great pride in achieving higher star ratings and improving care in key areas.

Americans like to be winners. Having multiple stars is clearly a winning thing to do. There is almost nothing else in health care in this country that sets up that opportunity to win and then is also such a legitimate sense of accomplishment that people on care teams can find it reinforcing as team members and as caregivers to get that recognition.

We know that even during Covid, the blood sugar measurements for diabetic patients that is so important for multiple diabetic issues improved in the plans.

It’s important to recognize that nothing else in health care in America today is working on continuously improving care in a systematic way that is changing the culture and the processes of care with that much impact and obvious success, and several studies have shown that care improvements in Medicare Advantage spill over to other patients in a care site.

So, Who Has Not Joined Medicare Advantage from the Medicare Beneficiary Population?

That level of success in providing significantly better care applies only to the people who have joined plans — but that is barely half of the members. Slightly over half of the Medicare Members have not joined plans.

We need to know why that is true. We need to understand who continues to be enrolled in standard fee-for-service Medicare as part of our overall look at the Medicare agenda and our planning for future care delivery.

It’s good for us to understand both who is in the Medicare Advantage plans and to also have a good sense of who is not currently in the plans and what they are likely to do going forward for their care and program choices.

The people who are not in the plans seem to be in two major categories of people. They are clearly different groups.

The people who aren’t currently enrolled in the plans have two major categories of interests, priorities and realities and we need to understand the issues that exist for both groups. We need to understand each of those groups as we think about the future of Medicare and Medicare Advantage and we need to understand what we can do to get the people who we most want to enroll into the plans.

The two groups face very different futures and issues and they will continue to have different interactions with the programs going forward.

One set of people is the traditional Medicare loyalists who tend to have a higher level of personal income and individual wealth who tend to have a long history of receiving care from their current caregivers in their current care sites and who are comfortable with those arrangements.

Those loyalists often have enough money that they purchase Medicare Supplemental plans from Insurance companies that give them benefit sets that resemble the Medicare Advantage benefits and that allow them to stay with their long-standing care linkages.

Very consistently, year to year, 30 percent of the people who are not in the plans buy their supplemental insurance plans, and they tend to report a fairly high level of acceptance and even satisfaction with their Medicare situation. They will not be easy converts to Medicare Advantage, but that’s not a problem because they have the care they want at a price they are willing to pay.

There’s no need for anyone to upset that cart because it works for those people and because the majority of the supplemental Medicap insurers are now also Medicare Advantage plans and many of those patients will benefit from that expertise and skill set tied to the Medicare Advantage program through that back door anyway.

We Need Low-Income People to Enroll

The problem and the challenge we have as a country for our Medicare program is with the other slightly lower-income patients who get their care from an unstructured fee-for-service Medicare and who too often get some of the worst care in the world from that horrible failure of a non-system that exists in too many settings.

We literally have more older people going blind than any country in the western world. We know how to stop every blindness — and we clearly don’t do it for the vast majority of people in that non-structured care setting because the tools to do better care do not exist in their care sites.

The basic steps needed to stop blindness are well known to medical science.

Those processes, tools, and basic steps are an anchor for Medicare Advantage and are a core competency for the Special Needs Plans and for PACE care. But those basic steps simply do not happen far too often in fee-for-service Medicare — and that gap and care failure is almost criminal for us as a country because it damages so many people.

We also have an avalanche and an epidemic of amputations that should not be happening. We have more amputations happening than any other western county and they are currently triggering $80 billion expenses for fee-for-service Medicare care sites.

They add directly to the $4 trillion worth of care that we now have as a country.

That’s just wrong for us to have people damaged in those ways in those settings.

Simply making sure the patients wear clean and dry socks can reduce them by 40 percent. Every single Medicare Advantage plan and every single Medicare Advantage special needs plan does that work well but that level of support is done so badly in other Medicare fee-for-service care sites that we actually lead the world in amputations.

We should be ashamed of ourselves.

Forty percent of the people who get the amputations die.

We know from the study on “Dual Eligible Beneficiaries” from the anchor U.S. Department of Health and Human Services study reflected that success because they mathematically counted much lower levels of those amputation deaths as part of their scorekeeping for showing the success of the plans and that’s why the death rate for the dual eligibles was only 2.72 percent.

The plan success and approaches that to provide better care to these troubled and damaged patients are a major reason why the mortality rate for the D-SNAP Medicare Advantage special needs program was only 2.72 percent in the dual outcomes research.

We are fortunate to have that information. That Dual Outcomes research piece is a wonderful and grounding report. It should give us a new priority and topic as a country on future reporting and it created an unexpected new topic that we will probably want to continue to use.

Mortality levels are very good to know and now that we know them, we should continue to report them.

We should actually ask CMS to include Mortality data on all of their relevant care performance reports from this point forward as a matter of course when the data is available and relevant to the topic and to remind us that we have choices in many of those areas.

We should also learn from that data in this report that we could have saved lives and limbs if we just had those people enrolled in Special Needs Plans.

We should clearly do what we can in every community in America to enroll every dual eligible person in a Medicare Advantage special needs program so that they are much less likely to die from the bad care that exists far too often for fee-for-service Medicare.

We need our news media to have the insight to step up the plate and look at the data and the processes of the Medicare Advantage program both to see for what it really is and to get that information out to people who need it so they don’t lose vision this year because they made the wrong enrollment choices at open enrollment.

Better care clearly saves lives and the four levels of better care available in the Medicare Advantage program and measured by the government in this new study give us four levels of success for how long people live with each of the approaches.

All of the plans work constantly to improve their processes and performance in those areas, so we know that they are all doing better now than they were doing when the government did that report, and we know that we would now save even more lives if we did that repeat of that study.

Three States Were Left Out of the Report Because They Had Too Few Deaths

Maybe the more interesting and most unexpected data point and reporting anomaly that we saw from that national mortality and plan performance report was the fact that care in three states that have a very long record of success with Medicare Advantage programs and with other community supported care improvement programs — California, Oregon, and Utah — actually had their mortality data excluded from the final report because all three of those states had mortality rates for the year that was less than 1 percent.

The people writing the report for the Department of Health and Human Services chose to not include what appears to be extremely successful data from those states that they did not understand and could not explain from those Medicare Advantage programs in their calculations. The authors of the report didn’t want to mislead or confuse anyone with data they could not explain.

That’s an okay and acceptable short-term decision to exclude that data about very few deaths for the purpose of this report — but we now need someone in the process to look at those numbers and to see what’s real and accurate today for all of those performance levels, outcomes and areas because the continuum of care might have some unexpected learnings for us all that would benefit a number of people.

The overall macro report is a very good report to do and to have. It now includes some real data about death that we should probably be considering as a report topic for a number of reports. The mortality rates for that particular HHS report are not the usual estimates, approximations, or formulas of some kind. They are actual deaths. The researchers counted actual deaths from the Federal Medicare Data to come up with those numbers and real people died in each of those settings.

The overall report gives us great context data about the Medicare Advantage plans. We have some significant and hard core Medicare Advantage critics who are continuing to attack Medicare Advantage plans with highly theorized, very politicized, logistically dysfunctional, sometimes non-sensical, often emotional, inconsistent, generally extremely unmeasured and usually clearly unquantified, urban legend based, and almost completely data-free and vaguely historical criticisms of the actual functioning Medicare Advantage program — we know when we look at actual data about what Medicare Advantage actually does for people, that having caregivers assigned to patients who need care is an extremely good thing to do, and it should be encouraged because we have terrible mortality rates for too many seniors when we don’t get the seniors into Medicare Advantage plans.

We now know that the that actual death rate drops along with the number of amputations when we have Medicare Advantage care in place for those people and have the plans delivering the care.

Covid has been a particularly good example of the differences between the two approaches that came up with similar numbers.

The death rate for Medicare Advantage patients hospitalized with Covid was 15 percent, and that contrasted with a 22 percent death rate for the fee-for-service Medicare patients.

The plans all have caregivers who are accountable for the Covid care of their patients, and the plans provided a direct set of caregivers and instant care when patients came in to care for the disease. Fee-for-service Medicare clearly and intentionally had no Covid strategy or organized response to the disease and each patient in fee-for-service Medicare had to figure out their own pathway to care when that disease hit.

What Will It Cost to Have More Survivors?

The new mortality data that we might have for Medicare if we get more people enrolled in plans actually creates its own set of issues at another interesting level.

One interesting challenge that our health economists, our government programs, and our politicians need to think about is, if we do succeed in what our ethical obligation should be, and if we do enroll twice as many people in our Medicare Advantage urgent care plans, and if the mortality rates continue to change in the current directions that the government now acknowledges is happening based on that better Medicare Advantage care: What will the impact be on long-term Medicare trust fund economics and financial projections if we have half as many Medicare enrolled people dying each year?

Medicare today counts on historically projected and long-standing death rate patterns to calculate their future expenses. Having more survivors can significantly change those numbers.

Can the Medicare Trust Fund absorb and support the expenses of all of those additional survivors if we fully succeed in that work? Every survivor creates all of the expenses that each person in the Medicare Trust Fund creates, so it is possible that adding millions more beneficiaries could be a strain on future finances.

We might need to rethink our future strategy for Medicare based on having half as many people dying in the short term.

The best way for us to absorb those additional people into the Medicare cash flow without massive losses would be for us to very strategically and competently use the emerging new tool kit of health care to significantly enhance the delivery and affordability of care, and we will need Medicare Advantage as a well-structured purchasing tool to channel the money down those paths in order to make continuously improving and more affordable care happen for us all.

This is an extremely important time to be doing that work. The overall new tool kit for care has some potentially game changing and high impact components to make care better, more accurate, more effective, and less expensive — but the reality is that we are only likely to achieve those goals and best use those tools if we have someone in the payment process setting up the context and the cash flow for that to happen.

The Medicare Advantage cash flow has an extremely high likelihood of of doing that work well if we set it up do achieve those goals and build the right set of specifications and expectations for the program.

For now, let’s build on current success levels and know what it means to have the mortality rates cut in half or more now and let’s add that expectations to our plans and to our projections because those numbers will happen if we do the right thing and if we help all of those low-income people who need that help so badly now.

Let’s get the word out to our political leaders and to our community leaders from all groups and our key and most relevant news media about the fact that Medicare Advantage saves lives and changes the survival rates significantly for their populations and they should get any of the constituents that they care about into plans this year because saving lives now is the right thing to do, and we have a chance to do that if we make it our goal.

We should factor that migration to better care into our expectations and our agendas for various groups and we should expect that every group who learns that information will do the right thing and will help their people survive and even thrive.

On the largest scale, we just achieved a record national spend of $4 trillion for health care in America. We buy almost all of that care entirely by the piece. The perverse and flawed incentives built into that payment model that has the caregivers able to bill for more pieces when their care fails because failure creates more pieces of care is both obvious and too painful for most people who look at the purchase of care to think about or accept.

We have a record number of amputations in America. Each amputation literally costs $100,000 in billing for caregivers. Every amputation adds that $100,000 to that $4 billion cost for the country.

We need every health care economist in America to understand how that business model and payment model works and why it’s our only chance to get control over the functional cost of care over time.

When a Medicare Advantage plan functionally manages the ulcer levels in the feet of their patients and when a plan eliminates any of those $100,000 procedures, that elimination actually cuts that total $4 trillion expense for the country by that $100,000, because that particular expense does not happen and it isn’t in the total cost for the country when it does not happen.

Medicare Advantage is almost the only thing in the cash flow for American health care that reduces that $4 trillion expense in any way. Some of the ACOs are doing some good work on changing care patterns for some patients that bring down the total cost off care — but there is nothing else in the fee-for-service payment approach that does anything to change care cost.

Fee-for-service payment models make more money when care is bad. Fee-for-service payment models have billions of dollars of care when care goes bad — and they make billions when people have heart conditions, and strokes, and asthma attacks because care was inadequate.

Every Medicare Advantage provider has a financial incentive to prevent asthma attacks and the comparative cost report this December from JAMA shows that fee-for-service Medicare gets to hospitalize 40 percent more of those patients just from inadequate and inept care that happens far too often with fee-for-service Medicare patients.

We need to become a buyer for care and not just a payer for care as a nation. When the government sets the capitation level for buy care for the plans, that actually limits the governments expense for those patients in ways that Medicare can’t even hope to do for other patients.

Capitation is the kind of purchasing model we will need to use if we ever want to have any actual control over our health care spending as a country.

We need to buy care by the package and not by the piece in order to organize both the purchase of care and the structure of care in any meaningful way as a country. That model can work if it is the new normal for the flow of cash in care.

It also changes caregiver performance in what was totally unexpected ways — because there is an extremely high overlap between the Medicare Advantage plans and the self-insurance model that covers most Americans that has been invisible to the policy people and extremely visible to the sites that actually deliver care.

An interesting and important set of relationships we need to understand is that Medicare Advantage now covers half of our Medicare beneficiaries and the caregivers for Medicare Advantage include about 90 percent of the caregivers in America.

We tend to self-insure about 90 percent of our employer-based care, and that is relevant to the discussion because 90 percent of the companies who self-insure hire the same plans and insurers who run Medicare Advantage to run their self-insurance plans.

No companies who self-insure also pay their own claims. They all hire administrators to do that work — and 90 percent of the administrators also run Medicare Advantage plans.

It’s far too logistically difficult for the self-insurance administrators to have their contracted caregivers delivering multiple care protocols for use with the patients, so the plans all use the Medicare Advantage protocols — including the five-star quality program that Medicare Advantage contract insists on and recognizes and rewards — so the Medicare Advantage quality standards and care approaches are now being used with all patients and all payers.

The other major payer for the country right now is Medicaid — with over half the births in most markets now Medicaid births.

The 90 percent reality exists here as well — and the same plans who run Medicare Advantage plans and who administer self-insurance for our employers tend to run the state Medicaid programs.

So we have, by functional default, gotten ourselves to the point where the Medicare Advantage program is steering our care sites down the paths they are on.

No one expected that to happen — but the 90, and 90, and 90 reality is true and we just hit the point where 90 percent of the Medicare Advantage members are enrolled in plans with four- or five-star ratings. The quality expectations of achieving five stars has become the new cultural definition for a major portion of the American care delivery non-system — and it is becoming a system fed by that capitation incentive payment approach.

Most of our health care economist and academicians don’t have a clue. They are still focused on upcoding as an issue because people who hate the plans create urban legends about the coding process that distracts both politicians and academics.

We need everyone to understand the JAMA information.

They get what is happening at JAMA.

Thank you team.

We are on the right track with Medicare Advantage now. The Affordable Care Act gave Medicare those purchasing tools to become a purchaser and not just a payer for care with the Medicare Advantage payment model and those particular Obama Care purchasing tools and are currently getting good use at multiple levels.

Medicare Advantage has better benefits, better care, and far better costs — and that success should be much more visible to the country and to the policy world than it is now.

Each Member Saves Almost $2000 a Year Now with the Current Program

Members save almost $2000 by being in the plans.

It obviously costs less money for both the government and for the members. Every member saves significant amounts of money now. We aren’t asking people to increase expenses to get them into plans.

The savings to each Medicare Advantage member might be the best, most immediate and easiest to use reason to get people to enroll. It is very real and significant and most people don’t know that those cost savings exist.

This year’s savings level per person have just exceeded $1900 per Medicare Advantage member.

Let’s build on that success and ride this horse as far as we can get it to go because it gives us high-impact tool that we should use more intelligently and with a higher level of awareness of what we're doing.

For the past two decades, the annual report from the Medicare Trustees has described the losses that exist in the program from fee-for-service Medicare — and the Trustees have predicted every year that the trust fund would be insolvent in a decade or less. That ultimate insolvency for the Medicare program has been predicted in every report.

The Medicare trust fund has been projected to run out of money in roughly a decade, based on the current spending levels in Medicare, and on the fact that the overall revenue increase for that fund has been projected for the two decades to be roughly 6.7 percent per year over prior year revenue.

When the fee-for-service Medicare expense increases run 8 percent or more each year, that creates a loss for those members and causes the Trustees to predict future insolvency for the program.

For a number of political issues that create complexity in the prediction process, those reports have ignored the fact that the Medicare Advantage cost increases every year for the decade have been 4 percent or less.

The Medicare Advantage critics predict that those lower costs will not continue and should be ignored for Medicare thinking, in favor of a generally accepted belief that they will actually ultimately be much higher than that 4 percent that they are each year and will somehow ultimately bankrupt Medicare.

Some estimates of the future Medicare Advantage costs from critics of the program are that they will exceed 20 percent in the immediate future. That 20 percent cost number is cited and often quoted by both policy people and the news media.

The reality is that the plans bid about 17 percent below the average cost of fee-for-service Medicare each year for their capitation levels and create financial surpluses with those lower bids for the Medicare program.

The plans now are more than half of the enrollees.

Instead of Medicare becoming insolvent as the Trustees have repeatedly predicted, the program now makes money and the actual trust fund level for the 2025 Annual Medicare Trustee Report is a financial surplus of $208.8 billion.

That's the exact opposite of insolvency.

It's a game-changing reality because it means Medicare has been saved by Medicare Advantage.

The revenue for the program will continue to increase at 7 percent or more each year.

With Medicare Advantage current cost increases year-to-year continuously running at roughly 4 percent each year, it appears that if we hold those increases at that 4 percent, the life of the trust fund is indefinitely extended and Medicare is saved.

It also means that the dental, vision, and hearing benefits that are paid for by the capitation (and do not add any expense to the Medicare program) are all protected.

When more than half of our retirees don't have pension plans or retirement savings, it means that Medicare Advantage is the only way that many people will have access to those benefits. They're protected forever as long as that program survives.

Capitation is an almost magical payment model.

The program can lose money in the future if the people who run it decide to pay capitation that exceeds that 7 percent in annual revenue for the entire program — but that wouldn't be a good thing to do, and we should continue to have that 4 percent increase in Medicare Advantage costs protect the program.

It’s a very simple model at the core.

Because the payment model for Medicare Advantage is capitation and that cost number for the Medicare program isn’t driven or created by any other number or factor, we could decide to extend the lifetime of the Medicare trust fund forever, by just deciding not to increase the capitation by more than that 6 percent increased income number during that time,

That seems like it’s probably the right thing to do.

Saving the trust fund by having lower Medicare Advantage capitation increase levels than we have now, that already generate extensive increases in benefits at the current levels, is fairly obviously a good idea.

One key point to remember is that the lower mortality level for Medicare Advantage members will create longer life spans for people, and that will put some pressure on the financial situation for the low-income people with longer lives. That might put some pressure on the vision, hearing, and dental benefits — because people will be using them for more years.

This is game changing for America, and the policy people and health care media don’t seem to be particularly aware of these realities or future consequences. It’s not difficult to understand at one level, because the trust fund is very real and it's now both safe and larger than it was before Medicare Advantage became the majority plan.