We have just achieved a total health care expense for our country of more than $4 trillion for last year, and that number will continue to climb at an unaffordable rate for the foreseeable future unless we do something relevant and useful about it.

We should do that.

We are doing almost nothing as a country to have a positive impact on that trajectory — and that is unfortunate, sad, inadequate, wrong and unnecessary because we actually do have one current purchasing tool that we know can both improve the quality and the effectiveness of care and reduce the costs of care for significant numbers of people at the same time and that tool is in place now doing some heavy lifting for people and processes and settings who deserve and need to be lifted.

Most people do not know that tool exists.

The overwhelming majority of people — including high percentages of our most relevant academics and a very high percentage of our health-related journalists and media people — do not understand today what that tool can do and they do not understand or appreciate both how it does what it does and why we can have confidence in its future success based on current performance and based on understanding layers of structural components that have been carefully, intentionally and competently built into the process over the past decade or so to allow that purchasing process and that care improvement success to succeed.

The Tool is Medicare Advantage

We have overwhelming proof at several levels that we get better, continuously improving and less expensive care for significant numbers of Medicare enrollees and patients through that tool.

Those achievements are a success for the specific purchasing process that is used to buy that care. That better care for millions of patients has happened because the business model of Medicare Advantage is to use a capitation cash flow to pay for the care — rather than buying the care for those members entirely by the piece. Capitation can be set up to both incent and enable better care.

The business model of capitation creates financial gains for care teams when care is more effective and more efficient rather than the purchasing model for care that we usually use for our Medicare patients of having the caregivers rewarded financially and given additional money when their care is inadequate, insufficient, ineffective, underperforms or fails.

That’s the badly flawed payment model and the cash flow reality that we get with the traditional Medicare fee-for-service payment model that we use to buy most care for both Medicare and that we use in almost all care settings for multiple other sets of patients and other care providers in America who are paid only fees for their care.

The results at the care delivery level could not be more different for the Medicare Advantage members than for the fee-for-service Medicare patients — with lower rates of hospitalizations and better care happening for Medicare Advantage patients at an overwhelmingly obvious level.

The costs and outcomes have been very different, but the frustrating reality is that those sets of care differences and those achievements by the Medicare Advantage plans have not been observed or understood by far too many people who should know that those successes exist as we are trying to figure out how to create both lower costs and better care for America.

Too many experts don’t understand what is happening with that care for both Medicare Advantage and fee-for-service Medicare.

Many people looking at health care issues don’t link the fact that the Medicare Advantage plans use 35 percent fewer emergency room visits and more than 40 percent lower inpatient hospital days for several sets of chronic care patients as actual and immediate proof both that the care is better when people don’t need to be hospitalized and that the care is much less expensive for us all when those sets of hospitalizations are not needed.

The $4 trillion we spend on care as a nation actually goes down by a bit as a total cost each time we reduce the length of stay or avoid a hospital admission because each reduction is a care expense that doesn’t happen and that isn’t in the total spend and that will not trigger a bill at any point in time.

The key point is that Medicare Advantage is delivering better care to those patients and doing it for less money and actually bringing down the total cost of care for the entire country by achieving those goals.

We have managed to fail fairly badly in explaining, sharing and linking those results with our most relevant health policy, academic, and health media settings that those results and those successes are far too often neither seen, understood, or appreciated today.

Medicare Advantage has relatively little public policy support today for most of those agendas — even though we have strong proof that it is actually doing that job by delivering better care and it is true that proof of that better care is fairly easy to see at multiple levels once you understand what it is and learn to recognize it as actual proof.

We should be able to earn that support for Medicare Advantage from many more of those people because the approach works so well.

We know that the people who are enrolled in our Medicare Advantage plans are half as likely to go blind, half as likely to have amputations, and less than half as likely to be hospitalized for multiple conditions when they are in the system and when they are using the basic and relatively obvious to see care resources of the plans.

That’s better care — and far too many health care economists and health care policy people don’t understand what it is and why it’s important to our future purchase of care to provide better care to our Medicare population and to do it for less money.

Look at the new and confirming data from multiple sources. Medicare Advantage patients in the groups with serious medical conditions had a 29 percent lower rate of avoidable hospitalizations, and a 41 percent lower level of avoidable acute care condition hospitalizations.

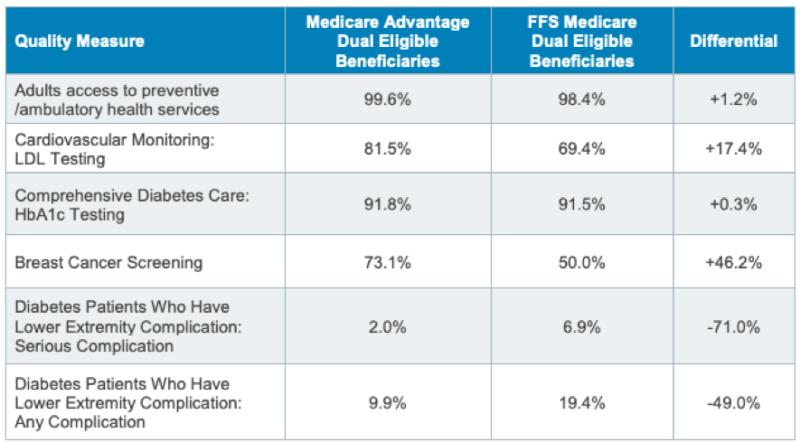

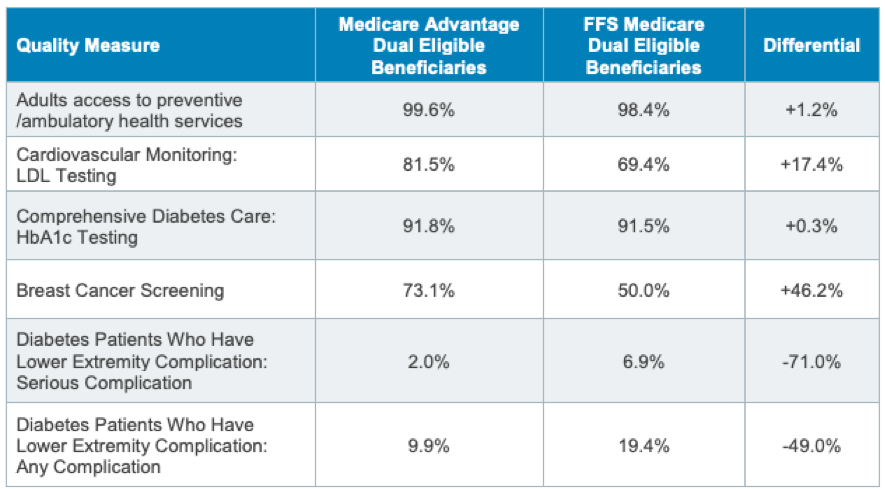

One of the key performance level successes for the Medicare Advantage plans is to have a 71 percent lower rate of diabetes related complications for our lowest income and our highest need dual eligible patients.

Those are very real and important differences in performance between the two approaches. The lives of real people are affected every day in very important and extremely relevant ways based on which Medicare funding track they have chosen to go down — and the people who have chosen Medicare Advantage instead of fee-for-service Medicare are now less than half as likely to have a limb amputated over the next couple of years because their Medicare Advantage plans are doing targeted things with patients to keep that from happening.

Special Needs Members Get Much Better Care

We have much better care for most of the patients who are getting more focused care and we now have extremely good care for many of the 4 million people enrolled in Medicare Advantage special needs plans who create direct and targeted support for each of those patients. People in policy settings do not understand how poor some of the Medicare fee-for-service care is — and the results of that bad care show up in that Shameful Metric care information and the truth is that those horrible care screw ups in that Diabetic Amputations “Shameful Metric” research piece are not happening for the Medicare Advantage patients because every patient has a link to actual organized care and to Medicare Advantage caregivers who are not allowing those care disasters to happen.

The blood sugar successes for the Medicare Advantage plan caregivers tracked by the Medicare Advantage five-star quality plan just improved slightly during Covid and they amputation levels are getting worse in patients who are not included in the care construct created by the plans.

Fee-for-service Medicare has created and sustains that Shameful Metric approach to care by not having any care coordination, no care data sharing, and no systematic approaches to care for those patients who are having amputations and going blind. The capitated Medicare Advantage plans do the exact opposite and it’s the right thing to do because people in the plans have much better lives and fewer lost limbs.

We need people who are thinking about health care policy issues to know that those massive and life changing care differences exist and we need everyone to understand the clear and basic reasons that those huge differences in care patterns and in care outcomes exist between fee-for-service Medicare and the Medicare Advantage plans.

That’s not rhetorical.

We have large scale proof and significant amounts of evidence on each of those points of difference.

The Medicare Advantage patients who are Dual Eligibles are the perfect example of performance in both directions, because we can see easily how bad care is for dual eligibles who have not joined Medicare Advantage plans.

The dual eligible are all of the people in this country who are eligible for both Medicare and Medicaid. They are the highest care needs and the lowest income subset of the patient population in each of their age groups. Medicare Advantage does extremely good work for those patients and standard fee-for-service Medicare underserves many of them so badly that it’s almost criminal behavior for the rest of us to allow that to continue to happen to those dual eligible people without doing something to help them.

It is extremely good for our country that we have enrolled 4 million of our lowest-income and our highest medical-need patients in the Medicare Advantage plans. The data from multiple sources and perspectives shows that their care has often been exceptional in a number of key areas and that lives are better for millions of people who are eligible for both Medicare and Medicaid because the Medicare Advantage plans have taken on those patients and delivered systematic, patient focused care to them on an individual patient specific basis.

The people who look at that reality in functional terms also know that people who understand those related basic care processes for patients can do important things to change the care trajectories for many of the 5 percent of our people who create 50 percent of our total costs if they can just get them into care settings and into care processes that cause and allow that much better care to happen.

The capitated Medicare Advantage plans put patient focused care approaches in place for those high opportunity patients, and those science-based process engineered approaches that are used by the plans actually do work to make care better and less expensive for those patients and that collective success actually gives us a chance to change the cost trajectories for care if we do it for enough people.

That isn’t a hypothetical or theoretical or even an ideologized and politicized basic suggestion for a change of direction. We now have great data for our most vulnerable and high priority sets of patients — the patients who each have personal eligibility for both Medicaid and Medicare — and it’s clear to see when you drill down in to layers of that data that the differences within those dual eligible sets of patients between the ones who have joined plans and the patients who are simply on their own in the world of fee-for-service Medicare are huge.

The approach of patient focused care improvement exists and works now for those members because the plans are paid capitation and that payment model gives the plans very strong and very real incentives to look at how to change future cost trajectories for each patient and then gives the plans the opportunity to use the money made available by the capitation to actually put those differences in place for their actual patients.

We can look with today’s data flow at the clinically complex diabetes cohort of those patients and see obvious and extremely important results. We know that putting in place the right care for patients with diabetes related cellulitis, ulceration, osteomyelitis, gangrene or immediate and current amputations is very important to do because it changes lives and Medicare Advantage does exactly that.

No one debates the fact that Medicare Advantage patients have much lower use of hospitalizations, much lower use of emergency room visits, and much higher levels of care coordination for their care.

People with those same diabetes related cellulitis conditions are enrolled in the plans and because the plans are capitated and because the capitation cash flow has the plans benefit financially when those crisis and those expensive damaging events do not happen and because the plans can use the capitation money to build, hire and then use the care teams needed to reduce those damaging trajectories on a patient specific basis, the plans are currently turning that 17 percent who are at high risk in fee-for-service Medicare into 8.2 percent of those patients at high risk today, and the Medicare Advantage plans have both much lower costs and better care because that has been done.

That isn’t magic. It’s competence. Changing many of those care trajectories for patients is relatively easy to do if you have or create or build any kind of process at all in place to do it and if the caregivers for a set of patients are intentionally and directionally sent down that path and then supported in doing it.

It isn’t good or fortuitous happenstance or even good luck at some level for those patients. It’s basic blocking and tackling for Medicare Advantage Plans for some very obvious opportunities that exist for those patients — and the very sad truth is that Traditional fee-for-service Medicare does not do team care and completely misses those opportunities for almost every patient who needs them and their patients are damaged and often have harder lives as a result.

Fee-for-Service Medicare Providers Can Make More Money with Bad and Failed Care

We need to call that payment reality and that dysfunctional economic situation exactly as what it is and we should be both honest and clear in what we say about it.

Fee-for-service Medicare far too often delivers inadequate and even functionally deficient bad care and often ends up with completely uncoordinated care for those patients and because those fee-for-service Medicare caregivers are literally only paid only by the piece — the unfortunate and almost ironic and very perverse reality is that those care sites with bad care often actually get to make more money from their failure because the fee-for-service care sites get to provide more pieces of care when their care fails and they get to bill those pieces of care for that failure without any questions asked to Medicare and Medicare pays them.

That payment model enables and very unintentionally directly encourages too many of those outcomes — and it makes sense that we get those bad results far too often across our patient population when you think about how the payment process functionally works.

The car industry would probably have different design components if the manufacturers were paid more money when their cars crashed and if they were paid even more money for each car if someone died in the accident. The car companies would never design cars to kill or damage people for core ethical reasons but their current design and productions priorities would probably not focus as obsessively on safety, as they do now, if we were using that payment model and if we had that economic reality of paying more for accidents as the way we buy and pay for our cars.

The pure fee-for-service care sites all have very high ethical standards and the fee-for-service care sites would absolutely never ever do anything to damage or hurt any patient, but it’s also true that they tend to do almost nothing to change many care trajectories to improve performance in those areas.

The fee-for-service Medicare sites do not tend to have very many outreach programs to effectively reduce the number of asthma crisis for their patients or to reduce the number of heart failures in their patients in any effective ways for very many patients in very many settings.

They do almost criminally inept and inadequate work in far too many settings and care sites on not preventing amputations. The number of amputations is increasing in America.

We now have an $80 billion expense for amputations. We have an average of 230 people in America losing a limb every day at this point in our history. The cost of that care is added up and it is included in the average cost of fee-for-service Medicare in every county that we use as a foundation every year to build the new capitation levels for the Medicare Advantage plans.

The plans get to bid each year against the average cost of fee-for-service Medicare in each county to set their annual capitation levels. Those average costs for fee-for-service Medicare in all of those counties include all of those amputations.

That explains some of the Medicare Advantage surpluses that are created in the counties. The plan expense level calculation that occurs each year to see if the plans generate any surplus from their capitation and have to return money both to their members and to the government before taking a profit as a plan obviously has much lower level of amputation costs in it because the plans all deliver better care to those patients and those costs aren’t there for annual expenses for the plans.

That’s why the plans tend to bid capitations that are consistently significantly lower than the average cost of care for Medicare each year — because they have contractually limited profits and they would not be able to keep the surpluses that would occur just from matching their care costs to actual Medicare fee-for-service payment expenses in the counties and then keeping the difference. The bids tend to bid from 10–30 percent below the fee-for-service average costs in each county for their capitation level.

That bid far below fee-for-service average costs is another reason that the annual upcoding accusations have been so off base for so many years — because the plans can’t use all of the available cash flow now and it would be nonsensical, irrelevant and economically pointless to have those numbers coded higher. The plans already have significantly lower use of all of the hospital uses for their chronic care patients, and that’s what creates the surpluses that have to be distributed every year.

Various plans do their own discovery and invention processes in each of those areas and you clearly see those very intentional and well-designed programs in targeted areas — and that entire effort results in care teams doing things to reduce asthma crisis and heart failure crisis for patients in every Medicare Advantage setting.

When those hospital admissions for those conditions and those patients don’t happen, that lack of a bill for that care actually does reduce the $4 trillion total expense for America by the unbilled and the unfilled cost for those pieces of care.

Capitation paid to plans does go into that $4 trillion macro expense — and it’s a much better and more controllable way to buy care because the capitation payment allows for far better care and less expense in total on the care and that supports a slowing of the overall amounts being paid into the $4 trillion expense today.

Capitation is a very good way to pay for care when you understand how to do it and when you get full value for the dollars spent in that approach.

That pattern of better care delivered for those conditions is true in all of those settings because Medicare Advantage plans have a much better, more aligned and more effective payment model — where the plans are all paid by the month for each patient and where the plans are not paid by the piece at any point in the process for any element of care.

Very few health care policy researchers and health care economists ever write about that model or even reflect and mention that it exists — even though it is having a bigger positive impact on health care costs and on several layers of health care quality and processes in its Medicare Advantage model than any other payment approach being used in buying care in this country today

That fact and that process and those incentives have not been part of the community dialogue about Medicare and Medicare Advantage, because the financial and functional thing that almost all academic settings and all policy teams and a very high percentage of journalists who write about Medicare Advantage do not understand or even suspect at any level is that it is much cheaper to provide better care when better care means that you reduce overall costs and payments by reducing the most expensive care expenses — like asthma attacks, intensive care for chronic condition crisis, and issues like amputations and blindness — and the actual business model for Medicare Advantage today is anchored on and financially rewarded by that reality so the plans actually profit when they succeed in those areas and the rest of us benefit from what they do to create their profit.

Most Amputations Should not be Happening — and Fee-for-Service Medicare Rewards Medicare Caregivers Financially When They Happen

It’s actually easy to understand and to believe the link between better care and lower cost when you see what it actually happening for a couple of high volume and important key areas of care where better care reduces costs significantly.

Amputations are on the top of that list.

Amputations are a huge expense for Medicare. The Medicare fee-for-service hospitals and fee-for-service surgeons make significant amounts of money from every amputation. Amputations cost us, on average, $100,000 per patient, and they happen to patients so often that they now cost the nation through Medicare, in total, more than $80 billion a year.

Why is capitation relevant to that expense and to that pattern of care?

The Medicare Advantage plans are pre-paid their monthly capitation as their total revenue stream, so the plans don’t make any additional money by having people’s legs amputated — but the Medicare Advantage plans do all benefit financially when those amputations are not needed for any patient. So they are both incentivized and resourced to do very basic things to keep them from happening and they use the kinds of process engineering that improves products and improves processes in every other industry.

The 20-20 Pattern of Amputations is Important to Medicare Advantage Plans’ Process Thinking Reality and Approaches

What the plans all know about that particular topic is that in our country, 20 percent of Medicare diabetic patients are likely to have leg and foot ulcers as the result of their diabetes. What the plans also know is that 20 percent of those ulcers for those patients in this country currently tend to result in amputations.

That 20-20 is a relatively dependable, predictable and consistent long-standing pattern for relevant sets of patients and the long-standing functional reality for that process is that the plans can plan on that pattern happening for their diabetic patients as they look for opportunities to engineer care and to reduce costs.

When care is purchased by capitation and not by the piece, and when plans routinely do systems engineering and process thinking about care improvement at multiple levels, that particular 20-20 pattern creates a major and immediate opportunity for plans because they can clearly save millions of dollars by first reducing the number of patients who get ulcers and they can save even more millions of dollars by helping the patients who do get their ulcers and by doing what needs to be done on a patient specific basis of keeping the patients who do get those ulcers from needing amputations as the result of the ulcers.

Most of the health care academics and most of the policy people who write about Medicare Advantage today do not know or even suspect that type of cost changing opportunity exists for Medicare patients, because those opportunities are never mentioned in any of the thought pieces, opinion papers or in any of the economic and policy over view pieces in any way, even though they are a functional tragedy and a clear and unnecessary failure for care delivery and also extremely expensive.

The experts writing in those areas sometimes write about the possibility and even the danger of some coding issues for Medicare Advantage plans and a significant number of those writers even mention the specific diabetes diagnosis as a danger area for coding in some of those risk level discussions because MedPac has mentioned it more than once as a credibility threat in the coding process and other critics have followed their trail into that strange set of conclusions.

The people who have criticized and even attacked plans for diagnosing too many diabetics clearly have no clue that you can change a major cost item for Medicare across the board for all patients by billions of dollars just by knowing as early as possible which diabetic patients have feet that are becoming higher risk ulcer territory and by then doing the right thing for each of those patients to keep those ulcers from turning into lost limbs. You can’t do the right thing for each patient if you follow the Medicare Advantage critics strong recommendation that the plans not look for diabetics because their diagnosis codes might increase if that happens.

Everyone who runs a health plan knows with great clarity that those opportunities exist to improve care in all of those areas, because those costs and those opportunities are so important financially to the capitated plans and because doing practical things to reduce those costs can be a key part of the Medicare Advantage plans’ financial success.

It’s pretty basic process improvement done by the plans. The functional reality is that if you put the right processes in place to first know which patients you have are diabetic and if you then put simple and basic processes in place on a patient specific basis to both prevent the occurrence and existence of ulcers and then to detect them when they do happen at the earliest possible point in the ulcer process, and then if you focus on every ulcer that does happen and if you then do the right thing to keep that ulcer in each patient from triggering an amputation, then the plans can do that set of basic lifting on each part of that process as a care system and then the plans can cut the number of amputations by half or more by doing that work and they can save millions of dollars by simply doing those steps for those patients.

That happens. It obviously happens every day for large numbers of people. It’s an $80 billion total expense and it costs $100,000 for each patient. Plans generally want to change that huge amputation expense number and they want to reduce that major cost from both ulcers and amputations, so the plans tend to take advantage of that opportunity and they do it in systematic ways that begin by identifying every diabetic patient as being diabetic.

Plans that manage that care well look carefully at every diabetic patient to see which ones are having something that looks like it might be or become an ulcer in order to intervene with those patients as early as they possibly can in the process to change the ulcer’s status for that patient for the better.

Look at any Medical journal or Medical text book on ulcers and on diabetic amputations. The opportunity to have a major impact on their development and progression is clear if you look at that kind of medical data to find opportunities to improve care and then actually use them.

You can cut the numbers of ulcers that require amputation by more than half relatively easily by helping each of those patients with foot ulcers in direct and individual ways. Medicare Advantage Diabetics have far fewer amputations and the plans save a lot of money and save more than a few lives by doing that simple process and that all reinforces and utilizes and the business model that is funded by the capitation.

The overwhelming majority of economists who write about or study Medicare Advantage plans obviously do not understand the link between care improvement, care quality and the direct costs of care, because they don’t write about those issues, and they should now, as functionally newly enlightened economists, also see and understand why and — if need be — admit that that set of basic science and care approaches been rarely used in fee-for-service Medicare to cut any of those costs or to change those outcomes for very many patients in spite of the obvious needs for those changes to happen for their patients.

That’s why this piece calls failure for those patients a “shameful” metric.

The policy people and the economists looking at those patients should know the full impacts of those procedures. Fee-for-service Medicare providers can collect $100,000 when those amputations happen. Standard Medicare challenges nothing in the care process for any of those care sites creating that sometimes shameful outcome.

The economists and health care policy people who think about Medicare should remember and know, for their own context thinking, that treating foot ulcers more effectively to reduce the number of amputations is absolutely not new science at any level.

That information about those care patterns and the fact that we can reduce amputations in diabetics significantly by doing better work with ulcers in diabetic patients is valuable and visible old science that is finally being used now in a more consistent and more systematic and more beneficial way in larger volumes for the first time only because Medicare Advantage plans are capitated and because the capitated plans getting their cash through that business model have multiple economic and functional reasons to use those powerful and simple care enhancement approaches for their patients.

What is sad — and what should probably be morally unacceptable to us as a nation — is that the amputation problems are getting worse today for older Americans and our community health status is deteriorating in far too many settings because this is true.

The situation for those patients is actually getting worse in many traditional fee-for-service Medicare settings for those most vulnerable patients. Look at what is happening and being done in the country and in fee-for-service Medicare to deal with those ulcers for older patients and you can see from several studies that the care is deteriorating in far too many settings relative to the amputation trajectories and we are being warned clearly by very credible people that more people are going that terrible care situation and we should be doing something about it.

If you are old and if you are low income and if you have many challenges to face in your life today, then we should not collectively be have having your foot cut off added to your burdens and to your wrongful situation.

Amputations are not alone in creating that kind of failure and opportunity for us as a society and as a care system.

We need health care policy people, academics, and media people to recognize how many other care conditions have that same pattern of under delivered care improvement opportunities and we should get people to know how many enrolled people are being helped by Medicare Advantage and are being badly damaged in other settings by what we are not doing for those patients in those settings.

That condition is not alone in being a case where slightly better care done in systematic ways by science reinforced care teams can have a significantly lower cost and high value impact for patients that we are not doing. Diabetes is the most expensive part of the Medicare cost continuum, and several of the other highest impact opportunities are also happening there.

People are Going Blind who Should not be Going Blind

We tend to be public opinion cowards and we tend to suffer from extreme political correctness and from deep seated community positioning timidity, because people in our country do not want to criticize basic Medicare in any way.

Medicare might be the most popular program in the country by many measures, and it deserves that recognition and respect because it covers all of us as we grow older.

The truth is, however, it is not perfect. Looks at the data. We know that people are going blind because traditional Medicare is not doing what it should be doing for all of the relevant people and the fate of each of the people who go blind is to be blind forever because too many of us were cowards on raising those realities for the public discussion in a way that improved their care before going blind.

Medicare is doing some very good things that we should encourage with some of the ACO programs that do look at those issues, but the majority of the people who are at risk of going blind in fee-for-service Medicare are still losing their sight and we probably owe those patients some kind of apology for letting them be so damaged in that way for the rest of their lives.

Many of the people with amputations are owed that same apology.

Blindness should be a target and opportunity for us to make care better — and we are not doing it outside of Medicare Advantage. We all need to look at the fact that far too many people are literally going blind and those numbers aren’t shrinking.

Diabetes is currently the number one cause of blindness in the US. We have some of the world’s worst blindness rates for our older patients today and the cold truth is that the high blindness rates in America are overwhelmingly linked to diabetes and not getting care that should have happened for those patients.

This is another area where absolutely sold and useful old science hasn’t been used for far too many patients by fee-for-service Medicare in any structured or effective way. Managing blood sugar for diabetics is one of those areas where we have known what to do on a very important issue for a very long time and we have done it right for far too few patients, and we have the highest rate of blindness for the world for our older patients because of that failure.

Managing blood sugar levels for patients is an anchor to the process-related opportunity that exists to reduce or prevent blindness. Multiple studies have shown everyone for a very long time that you can cut the blindness rate in half or more just by managing the blood sugar levels of diabetics.

Blindness is expensive, devastating and damaging for many life issues and situations, and it is just plain wrong as a health outcome for us and for our people that we have growing blindness rates in our country because it is clear that we actually can prevent it for so many people.

The Medicare Advantage five-star plan for quality makes diabetes a focus condition, but that focus on better care would have happened for those patient enrolled in Medicare Advantage plans just based on those many opportunities that exist to help diabetics and to simultaneously reduce the cost of diabetic care.

Medicare Advantage plans know the science and the opportunity and they also know how much money they can save by getting people down the right path that does involve the levels of care that people need as they go blind. Because the plans are capitated, they have the money in their flow of cash to put in place the levels of systematic care for diabetic patients that create much lower long term and immediate cost levels for those diabetic patients and save vision in the process.

For the Special Needs patients with co morbidities, the plans develop patient focused care plans and they make sure that they get the right care to every patient every day as needed and have extremely good patient centered processes in place for everyone.

None of that care is happening for the traditional fee-for-service Medicare patients in any systematic or organized way.

The cold truth and the sad reality is that Fee-for-service Medicare far too often hugely fails diabetics at multiple levels and the patients suffer the consequences of that inadequate care.

That isn’t even up for debate as an assessment of relative performance levels between the two funding approaches that pay for most care for America. Fee-for-service Medicare does not do what needs to be done in most settings to cut the blindness levels for diabetics. The tools and processes aren’t even there in too many of in those settings and too many of our fee-for-service care sites don’t even have any combined medical records for our patients that identify who would benefit from that care.

Fee-for-service Medicare care sites also often have weak, inadequate and unlinked medical records — and the unfortunate reality is that those many of those care sites far too often don’t even know which patients they have who actually have that disease.

They inherently do the exact opposite of upcoding — and one of the interesting aspects of the attacks from some of the Medicare Advantage critics is that they refer to that information deficiency in those sites with approval as the norm for patient record keeping and some of the Medicare Advantage critics even seem to both defend and prefer and even protect that completely inadequate record keeping approach it as an acceptable approach to care information collection.

By huge contrast, Medicare Advantage plans immediately look for diabetes in every patient because that information is so useful at so many levels. The Medicare Advantage plans all know which patients are diabetic and the plans consistently have patient specific plans in place to both manage blood sugar and to look for early levels of foot ulcers to keep them from turning into amputations and also to help manage their other co morbidities in intentional ways to reduce the rates of mortality for those patients.

Deaths are prevented at significant levels by the Medicare Advantage co morbidity work for patients with multiple conditions and the care coordination that exists in the plans for those patients.

We Need to Get People to Plans Where Everyone is Above Average

The plans are not all perfect in all of that work but they are all so much better and they are all so much more consistent and more effective than fee-for-service Medicare in most settings in helping diabetic patients that we need to start thinking and discussing as a country that it might be an ethical issue and a moral failure for us as a country not to more intentionally steer relevant people away from those settings where they lose their feet and where they go blind and we need to get them before it is too late to Medicare Advantage plans where everyone is above average.

MedPac has said clearly and often that they oppose steering patients in any direction. They explicitly say and they clearly think steerage from MedPac is wrong.

MedPac staff and writers are very careful not to point out or mention or even notice the obvious and clear quality failures of fee-for-service Medicare that give us more blind seniors than any western country because the MedPac staff does think sharing that information in any direction is not fair to the fee-for-service Medicare program and they make fairness to that program a goal.

That is bad policy. MedPac should change their approach about steerage because we do have more amputations than any other western country and they are happening for real fee-for-service Medicare patients who have no one looking at their foot ulcer treatment and processes and steering them to care settings that will support them in having better lives.

As a nation, we should be looking at all the things we can do to get that information about relative care outcomes to patients. The news media too often also has had no clue on most of those quality and performance gap issues, and we should encourage a new level of medical enlightenment for the media that includes care improvement as part of their agenda.

The Media are missing a plethora of very legitimate stories about what is happening in health care quality efforts. They could write stories and do reports every year celebrating which local plans have achieved five-star status on the Medicare Advantage rating system to tee up those reports and they should ask the care sites with four- and five-star ratings to celebrate their internal local successes in those quality and service areas and to explain some of the solid things being done in those settings to make care better and more accessible to their patients. The public would love to know that some plans are doing some very positive things to make care better and that is legitimate news to cover.

The patients will benefit from those stories and those hero stories will encourage other care sites to do similar programs and stories.

When the plans achieve those ratings, the local media should describe those successes because they are real wins and because they can create public expectations for care improvement by the other plans and patients.

The news media and the health care publication and services should also be looking at those sets of failures of care, and the media should be informing the public about those issues and about those dangers rather than taking the fake bait of MedPac and their staff who are still writing about risk coding levels for health plans as though the business model of plans actually is to refine their actuarial and coding skills and not to improve their care.

Real people’s lives with Medicare coverage are being damaged because they are not in the best patterns and in the best approaches for their care. People’s lives are damaged and sometimes even ruined by those kinds of health outcomes in so many settings.

The Medicare Advantage critics who actually wrote recently in a couple of critical documents that ran in credible policy settings that the Medicare Advantage plans literally only collected diagnosis information about diabetics so the plans could “upcode” their risk levels for payment purposes for those patients should now apologize.

They said it more than once.

It is not true.

They owe an apology to the world for misleading people so badly on such an important point of fact about why plans collect information to discover who is diabetic. That accusation in credible settings has caused some relevant people to have less faith in plans. One very critical piece also said that the plans who sent the nurses into homes did it purely and only so the nurses could “harvest diagnosis” and not to deliver care. That story was also clearly extremely wrong at multiple levels — and it has been repeated in multiple settings.

The plans, in the real world, obviously very quickly gather the information about which patients are diabetic because that is extremely important and useful information for providing care to diabetic patients.

That entire array of processes to improve care and to reduce future hospitalizations for people with all of those chronic diseases were designed, were built and exist now in all of those settings only because the Medicare Advantage plans are capitated and because the business model of capitation thrives on volume and on getting rid of reams of unnecessary costs in all of those areas.

The current data shows us that the plans can and do very intentional patient focused work that can cut the very worst care outcomes for many categories of patients and those approaches exist for each plan in significant part because the plans spend less money when they succeed.

Cutting Congestive Heart Failure Crisis by Almost Half also Keeps Patients Alive Longer

Congestive heart failure is a particularly good example of how that cash flow and financial flow works extremely differently for fee-for-service Medicare and for Medicare Advantage and what happens to those patients directly reflects how each way of paying for care changes how the care is delivered.

Congestive heart failure kills a significant number of people, sometimes far too quickly. It’s painful, life threatening, often frightening, and it can make a major negative difference at many levels in many people’s lives for a very long time once it begins to change a person’s life.

Medicare Advantage plans do the right things for those patients using their capitation payment cash flow to fund each right thing.

Medicare Advantage plans very intentionally discern and detect who is at high risk of having those kinds of Congestive Heart Failure crisis events and the plans very consistently intervene on a patient specific basis with each patient to manage the risk and to avoid the damage for those patients.

That tends to be a profitable condition for fee-for-service care sites.

The fee-for-service Medicare care sites make significant amounts of money from each congestive heart failure crisis. The hospitals get paid $20,000 to more than $40,000 with no questions each time one of those crisis happen for a patient, and that is often very profitable care delivery for those sites.

Their marketing teams at those fee-for-service Medicare care sites work hard to get as many referrals as they can for those patients from other fee-for-service doctors in their area. The care sites don’t do things to reduce future patient damages and current risk levels.

Very few of those fee-for-service programs who make $20,000 to $40,000 from each damaged patient do very much to prevent them from happening in the future. Those care sites very consistently do deliver great care to the patients when the crisis actually happens, but they don’t do much to avoid them or to keep them from happening.

Capitated Medicare Advantage plans reduce those admissions by over 40 percent in most settings. They set up very specific care plans for each patient, and they assign care team members to those efforts to help the plans succeed.

That’s the genius and the beauty of capitation. The plans take their capitation cash flow and they use part of it with no challenges from Medicare to invest in in those processes that can help to keep the future crisis for each patient from happening. Nurses and other support caregivers are often part of the process and they often help get the patients out of risk and coach them into less damaging approaches.

Some plans have put very accurate scales into patients’ homes and some of the scales in the homes of the patients have an actual telephone link and that link can be set up to call the care team when the patients have unexpectedly significant and alarming weight gain that says they are in potential trouble.

Many emergency room admissions have been avoided when the care team detected weight gain of a patient triggers the right care and steers patients to safe places and better outcomes.

Traditional fee-for-service Medicare not only does not do many of those kinds of patient support activities that Medicare Advantage plans do, the reality has been that the traditional Medicare program has explicitly been very opposed to having those nurses in those in-home settings — and they can file legal action against any care site for what they call Medicare billing fraud if a nurse in that home for that patient bills fee-for-service Medicare for that care.

That’s another example of the differences in approach that often makes Medicare Advantage hugely better and safer care and those levels of flexibility in use of that cash flow to put the right people in place is why the capitation model is so useful in getting care outcomes to better places and to higher levels when you know how to use the process engineering tool kit for each condition well.

“Medicare for All” Should Insist on Using the Best Care

We need the people who are advocating for Medicare For All as a universal coverage program for the entire country to realize that the idea of universal coverage for everyone is a solid and good goal and it deserves support — but doing universal coverage with a payment approach that creates the highest level of older patient blindness and the highest volume of foot amputations in the western world is a bit suboptimal as a destination for everyone in the country that we should all want everyone to have.

Let’s raise our expectations for Medicare For All.

We should want Medicare for All to be patient focused and to use the very best levels of care and we should want the care approaches that are used for universal Medicare to be continuously improving as a strategy and a commitment and a goal, and a competency and a skill set because the American People deserve Continuously Improving Best Care and because we can clearly afford it because it will cost less than having too many hospital admissions for bad care.

We have more than enough money to pay a capitation that can make that happen and rationing anything in that process to save money to make universal coverage affordable for the country is both unnecessary and wrong.

The Affordable Care Act does not get the credit it deserves for transforming Medicare Advantage into a much better purchase for the country. The Affordable Care Act carefully designed and built the best features of the Medicare Advantage program as a care improvement and cost containment tool for the country and not as just another way to pay Medical fees for people with Medicare coverage.

The Affordable Care Act built several of the best care and delivery structuring features into the Medicare Advantage portfolio. Far too many people in our country did not see, understand or appreciate what they were doing when they did that because they didn’t explain what they were doing and the political and public discussions at that time were focused on other parts of the law.

The Affordable Care Act Redirected, Rechanneled and Refined Medicare Advantage.

The Affordable Care Act significantly refined, improved and enhanced Medicare Advantage. They rebooted the program, took it away from the sway of some of the early players and redefined it to be a purchasing model for care and not just a payment model for pieces of care.

They took the old program and immediately reduced some key costs that had some prior levels of over payment and rebased the cost levels. They also created intentional and important purchasing power through the contract for CMS over creating performance expectations in a number of key areas and their use of those enhancements have been responsible for many of the Medicare Advantage program success today.

The tools that CMS is using today to steer performance were intentionally built into the model by the Affordable Care Act and those improvements have the same kinds of long-term staying power as the somewhat parallel pieces and somewhat parallel requirements created for the Exchanges in every state that also very intentionally give people choices of health plans for their core coverage and their care and keeps them affordable for people who need them.

That very intentional and clear design role for Medicare Advantage from the Affordable Care Act is increasingly visible and it is increasingly appreciated over time because it has so many effective moving parts and it actually creates better care for less money as they intended to happen when they wrote that law.

Possibly the most important unexpected thing that Medicare Advantage has done for us as a country has been to provide a badly needed safety net for 5 million of our hard-working retirees who had spent their lives with employer based and union-based retiree health care benefits as their expectation for their care when they retired.

The challenging truth was that many of the trust funds and many of the retiree related health plans faced major challenges and some were seriously underfunded. Had they continued entirely under their own funding stream, up to 5 million Americans who thought they had assurances for their retiree health care could have been in serious difficulty. Having all of those people who had worked hard and who thought they had retiree coverage for their health care scrambling for enough money to pay their health care claims was potentially damaging to those people and to the country.

The Affordable Care Act created a safety net by setting up an employment-based set of trust fund coverage options — and we now have 5 million people with absolutely solid and guaranteed retiree coverage through Medicare Advantage. We actually now have Medicare For All with extremely good benefits for more than 4 million retired union members because of vision and the design of the Affordable Care Act.

That program is funded and runs at a pace with seriously contented members because their retirement expectations are being met.

The MedPac people who continue to attack Medicare Advantage are careful to leave that entire set of people out of their communications every year because they know how popular that program is with the retirees, former employers with health obligations and with labor unions with those programs in place.

We should continue to channel people into each of those pipelines for coverage and care.

We should also recognize that we have already begun to use it as the working foundation for Medicare For All if the Congress ever gets to the point of moving in that direction.

We also need everyone thinking about the care area to know and understand that those differences between fee-for-service Medicare and Medicare Advantage are very directly created by the flow of cash into each program and we need to understand that flow of money will continue to create those differences in each direction because that’s what happens in any industry when cash flows.

This approach being used for Medicare Advantage plans to change that trajectory for those patients isn’t rocket science. It also isn’t actuarial data manipulation or any level of economist formulae academic fine tuning. It’s simple functionality and process engineering and we now know that we can cut Medicare patient blindness by more than half by functionally managing processes and approaches that can steer the blood sugar level of each diabetic in the program to get them to the right levels.

We should obviously do it for every relevant person on Medicare because we know what it is and we know how to do it.

In fact, not doing some of that care improvement work now for those actual people who are in the fee based Medicare program is so wrong that its almost an ethical issue for us as a community because real people are going blind when we don’t make sure the basic care is being done for them and we should think of it as a huge and even shameful ethical failure for us to allow that many people to go blind today and to accept that as a macro purchasing failure for Medicare fee-for-service care cash flow and not look at the ethical consequences inside that package for people’s lives.

We have massive opportunities for diabetic patients, because they are almost half of the Medicare cost burden and because we now know so many functional things that can make their lives better.

The Medicare Advantage five-star quality agenda includes diabetic care as a target area for obvious and highly valuable reasons. Even during Covid, the blood sugar levels for those Medicare Advantage patients improved by almost 2 percent.

Health care academics and health care policy people need to expand their paradigms to recognize and understand that bad care is very expensive and it also functionally hurts and damages people in what should be unacceptable ways to us as the purchaser and payer for that care.

We Americans need to raise our expectations — and then we need to intentionally pay for what we expect to happen in ways that actually cause that to happen. Medicare Advantage does exactly that by setting clear and continuously evolving expectations and using their leverage to improve care.

The specifications on care and service that are built into the Medicare Advantage program are good and solid, and they get better every year. As intended by the Affordable Care Act, CMS functions today in very real ways as a buyer — not a payer — with that system and you can read what they are actually now demanding and mandating now in exchange for their capitation payments for 2023 operations below:

The 2023 Expectations for Medicare Advantage from CMS have Several Excellent and Powerful enhancements

Please read this:CY 2023Medicare Advantage and Part D Proposed Rule (CMS-4192-P)

Everyone wondering where Medicare Advantage is going now should read those very specific and explicit requirements from CMS that they have created as a demanding buyer for the plans for next year. The leaders at CMS go through a similar process every year and you can learn a lot about the program and what it does from the expectations they set for it in that annual document. The old sets of those documents are worth reading for context and direction and a sense of their mission.

The current expectations are both very real and important, and they are creating the kind of care for their beneficiaries that we all should want delivered to the people we care for, respect, and love.

That program has been fiercely attacked by people who generally don’t know what it does or what it actually is but who oppose it and resist it for their own set of ideological, political and. sometimes, financial gain, or economic advantage issues and reasons.

Misinformation about Medicare Advantage is created far too often by those critics and opponents with great enthusiasm and energy and an almost total absence of actual functional data or understanding of what is actually happening.

That set of attacks on those agendas is bad for the country because it is so inaccurate. This is the wrong time for us to have inaccurate information about care because we should be building great care starting now.

Our Goal Should be to Build on the Golden Opportunity We Have for Great Care

There is far more at stake than just getting the prices right for Medicare.

We could and should be on the cusp of a golden age for care that uses a combination of care connectivity processes, best science, artificial intelligence, patient focus and continuously improving disease detection and anticipation tools that will make care much less expensive and far better at multiple levels.

The core process of Traditional fee-for-service Medicare has always resisted that set of tools and they resist them with conviction because when you only buy care by the piece, you need to worry about adding more pieces to the mix without knowing what they might do to the cost mixture for those patients.

Medicare Advantage will obviously use the new tool kit and plans will compete to be there for their customers and patients with those tools — both to attract additional customers and to bring down the costs of each piece of care for the patients they have.

When Medicare Advantage does electronic patient visits, that is much better and more interactive care and it has the potential to be the new normal for all care. During Covid, some Medicare Advantage care sites got up to 80 percent of their visits with electronic connectivity that the patients often prefer. Fee-for-service Medicare initially banned it, and is reluctantly now trying to figure out how to meet patient’s expectation in that area and still kill those connections because patients love it and many caregivers find that they can deliver better care for many patients when they are electronically connected.

We should set up a context for great care — and it should be great care that very directly meets the needs of our lowest income beneficiaries.

Two out of Three Low-Income Medicare Members are in Plans Today

Enrollment in Medicare Advantage is growing nicely and it is relatively stable over time. Roughly half of our Medicare beneficiaries are now in plans and that total number of enrollees grows slightly every year.

It covers about half of the Medicare people now.

We need to know and understand who has chosen what as we go forward with the program.

The people who have stayed with traditional Medicare through multiple opportunities to enroll in plans tend to be higher income people who have longer term relationships with the own personal long-time care sites. Their net worth is more than $100,000 over the groups of patients who are actually joining the plans and many have been getting care from care sites for higher income people in the past.

Most people hate to change doctors. It can be very hard to change doctors when you are happy with your doctor now. Many higher income Medicare Beneficiaries have those good longer-term relationships with their physicians and many of those more satisfied patients will probably be loyal to traditional Medicare for a very long time for those reasons.

That is not our most diverse set of Medicare members. Only 16 percent of the traditional Medicare enrollees are minority members today.

By contrast, our lowest income members and our largest groups of minority members have overwhelmingly become members of plans.

Two out of three of the lowest income Medicare members have now joined the plans.

Many of our current lower income Medicare beneficiaries don’t have those long-standing and positive linkages with care sites and many of our lowest income Medicare beneficiaries do not have any of those kinds of relationships at any level with their local doctors or local care systems. Many of our lowest income beneficiaries live in settings where those sets of doctor availabilities and relationships do not exist at high levels, so the Medicare Advantage plans are their easiest, fastest, and, for many, possibly their only possible access to an actual direct relationship as a patient with a care site or a care team.

Over half of the African American members and more than two-thirds of the Hispanic members have now joined the plans, and they have had very high satisfaction levels with that choice.

Many of those patients from those groups and settings now have a personal doctor and a patient focused care team for the very time in their lives. That is much better and more personalized care, and patients tend to appreciate getting it.

The satisfaction numbers for the new and current members is currently very high.

We have extremely solid support among the members at all income levels for their plan links and we also have very strong support with Members of Congress for Medicare Advantage right now because the members of Congress hear from their constituents, and they can see that their voters like the plans and they can see that their voters have better benefits for less money.

The Medicare Advantage program costs significantly less than fee-for-service Medicare in most counties. Critics of the program try hard to pretend that isn’t true, but the plans all have lower costs than the average costs of fee-for-service Medicare in every county, and those lower costs are permanent savings for the Medicare trust fund because the capitation cost is the only money the government will ever have to spend for the plans and it is being paid every year at capitation levels that are lower than the average cost of fee-for-service Medicare in each county.

The plans have expenses for their members that have to be paid for from the capitation. The plan expenses are totaled annually to see how well each plans did financially each year.

If the expenses from the plans are higher than the capitation, the plans eat and absorb the losses. There is no way for the plans to be ever be paid any money from the Medicare trust fund beyond the capitation payment.

If the plans expenses are lower than the number created by average cost of Medicare in those areas, that creates an internal cash surplus for the plans that is used in the ways that the program set up to benefit both members and plans.

The plans have both legally limited profits and a clear path for sharing the surpluses they create with their members. The surpluses must be shared with the members and that sharing with the members allows the plans to have much better benefits than fee-for-service Medicare in all of the counties and to have lower costs for many areas of care.

Those surpluses in each of the counties that shared with plan members are everywhere — and those surpluses might higher this year because CMS has looked at how much the plans could be paid based on their current enrollment and relative risk levels from the encounter reports, and they have raised the potential payment level from CMS by more than 8 percent for next year.

The plans clearly will not be able to use that additional money to increase their profits because their surpluses are at top levels now. It will be interesting to see what the plans decide to do their year on pricing and capitation and benefit expansion to respond to that additional money.

Major critics of Medicare Advantage plans have been arguing that the old cash flow was based on plans doing clever and sometimes unethical things to increase their risk levels that triggered their cash flow. “Upcoding” has been a major accusation for the plans for many years.

The people who have been complaining in a number of settings that Medicare Advantage was badly over paid and that the cost levels of fee-for-service Medicare in the counties that triggered the first round of data for the capitation process in recent years was wrong and being wrong was caused in some unclear way by Medicare Advantage plans doing upcoding of some kind are completely wrong and their accusations are now even non sensical because the coding system is actually gone.

The higher capitation availability levels that the critics and opponents have said were somehow created by plans doing serious and inappropriate upcoding were actually based entirely on the fact that the average cost of fee-for-service Medicare in our counties today is so high because it is bad care and bad care is very expensive.

The plans did not inflate their risk scores because they did not need to create wrong risk numbers to justify higher costs when the average cost of fee-for-service Medicare coverage in each county was so expensive because so much of the care has been clearly bad.

The much higher rate of hospital admission for congestive heart failure with the fee-for-service Medicare payment approach is in the county totals and that expense creates a cash flow that it is extremely easy for the Medicare Advantage plans to beat.

The amputation expense of $80 billion is included in the average county per capita costs that created the first cost levels each year from the Medicare fee-for-service expenses. None of the plans are doing amputations at that $80 billion level, so the amount that is the expenses that they use to see if they have a surplus is based on whatever their current amputation level is.

That’s better care. Not upcoding.

The upcoding accusation was highly flawed and it is now completely impossible because CMS actually eliminated coding for the plans two year ago. No one can upcode now because no plans today can code at all.

CMS now collects information from each and every patient encounter — so they now know what the diagnosis was for each piece of care and they know what the procedures were for each piece of care. That is extremely accurate and very current information — and there’s no place like the old plan coding profile for plans to even suggest codes.

This would be a good time for us to move away from that old and disruptive set of debates about risk coding and move on the a far more productive discussion of how we can create great care for all Americans and do it with less money than we spend now.

We Should be Building an Incredible Array of Continuously Improving Care Tools

Care can be hugely better and that should be expanding and improving Now.

Great tools are being built. We need to use the full possible tool kit being created today to deliver what should be continuously improving care with better outcomes, better processes, and better cost levels because that happens in most industries when you engineer the products well. Care is obviously on a trajectory that could and should get to that result.

Artificial Intelligence is exploding as a powerful and game changing care support tool and it will continue to explode.

Very amazing new tools are coming into existence — and they will be used by Medicare Advantage plans early and well because the plans have a major financial reward associated with that can be linked to reducing the crisis level of those events.

Medicare Advantage plans lead in several of those technology areas now and they will enhance their leads in all of the new high-tech care support because the tools are better and the capitated plans have major financial reasons to make care better because the new tools will enhance care and most will do it for less money that they spend now.

It will be much cheaper for care delivery and for the Plans to actually know with more than 80 percent accuracy which patients are likely to have a heart event next year — and the plans will use that data to change the trajectory and the reduce the costs for that event while creating better outcomes.

The organizations developing those very real new tools will be competing to make them available — and the plans will be competing to get access to them and to use them.

Fee-for-service Medicare will fail completely in using those tools.

Traditional fee-for-service Medicare isn’t even in the technology improvement game at any level. That has been their clear choice. Traditional fee-for-service Medicare has never been supportive of those sets of tools and they are not going to be changing their approach to innovation now.

The reality is that traditional fee-for-service Medicare won’t even pay for any of those new tools for a very long time — if ever — so their patients will get inferior care in all of those areas and their patients will continue to be more expensive than Medicare Advantage because the reality is that stage four cancer is much more expensive than stage one cancer that is detected much earlier for most patients by the new cancer detections tools. Far too many fee-for-service Medicare cancer patients with be diagnosed at stage four while the Medicare Advantage plans will all use the early cancer discernment and the early detection tools (just like they manage blood sugar to prevent blindness) and their cancer care will cost a lot less and will have much better survival rates.

Some of the new heart crisis detection tools can predict with more than 60 percent accuracy now from in home devices that an adverse health event will happen for a patient within the next 12 months. Plans will save a lot of money with that information because they will be able to intervene and respond extremely quickly in ways that are rewarded by the plans being capitated. Plans will be current on every one of those new technologies and many plans will probably compete in the market with their comparative access to those sets of diagnostic and intervention tools.

If a patient is trying to decide whether or not to join and plans and if one of the plans say they have a new blood test that will identify with better than 60 percent certainty that any of 50 cancers will or will not happen within the next year for them as a patient, that could be a good market tool for that plan and people will be likely to join the plan to have that advantage in their life and care.

The plans will have care teams attached to that flow of data. That’s far superior to having an application on the internet that creates a flow of information to patients that leaves the patients on their own in trying to figure out how to respond to whatever the information from that test or process reveals.

That isn’t speculation.

Many of those tools exist now and are being perfected. Medicare Advantage plans can get them to their members — and fee-for-service Medicare won’t have any vehicle for their use and will probably not pay for almost all of them.

Some People Still Say that Plans Have Inflated Profits Triggered by Inflated Risk Codes and That’s Very Wrong

The plan profits are limited by contract and the profits limited by law and the actual profits for Medicare Advantage plans currently average about 4.5 percent per member. The critics often lie in some documents, speeches and settings about the profit levels of the insurers and try to make it appear as those numbers are higher.

The 4 percent levels are not abusive profits, even though some of the most aggressive critics say they are. That’s less than half of the normal and average profit levels for American businesses, and it is very far from the excessive and exorbitant profit levels that some of the most negative Medicare Advantage critics claim repeatedly that the plans receive.

There are some critics who simply oppose having health insurance companies functioning as health plans and who say that any health insurance company who gets money from Medicare Advantage is simply getting a wrongful flow of cash.

It’s a combination of ideological, political, emotional and economic opposition, and it is hard to address if it’s actually ideological as a core component for the belief. The actual profit levels for Medicare Advantage plans are under 5 percent and that’s less than half of the average profit levels of American businesses and less than the profit levels of just about every other element of health care in America.

The drug companies all make more than 5 percent and even hospices are currently granted 9 percent profits by Medicare.

You can hate and oppose the use of insurance companies for whatever reason, but we can’t blame them for abusive profits in that space. The Affordable Care Act did an extremely good thing by limiting the profit levels and the administrative costs of all health insurance companies to 15 percent, and the plans can’t ever charge 20 percent profits in Medicare Advantage or in the insurance exchanges because there is no way around that very well-conceived and designed 15 percent limitation.

The insurance companies deliver high quality Medicare Advantage plans and many obviously do good work. The first two health plans in America to get tests to their Covid Patients were Kaiser Permanente and Optum, and they both did it weeks and months before anyone else was doing that work in any systematic way.

One is extremely not for profit, and the other has the biggest for profit cash flow in the business, and they both achieved that goal of getting Covid tests to all of their care sites for similar reasons.

So Plan structure and the role of insurance companies needs to be recognized as an issue that concerns some people, but it clearly does drive much that says this agenda isn’t the best for Medicare patients or is creating any damage to the process.

They are all motivated to create the same kinds of better care outcomes, and the bids for all are below the average cost of fee-for-service Medicare in all of the counties — and that means the Medicare Trust fund got a good deal with those bids.

The core strategies look alike in the plans regardless of their for-profit status as businesses.

Anyone who has managed to get to a senior leadership job in a capitated care system understands the basic business model and we know from decades of experience that the leadership of all plans is continuously looking for a growing number of ways to make those kinds of care improvement successes happen to create lower costs and better care for their members.

It isn’t rocket science. It’s actually remarkably simple work. We can all see exactly what happens and we all know the reasons for doing it.

It’s almost too simple as a strategy to be as effective as it is.

Care teams at plans learned long ago that quick weight gain is often a high value warning of congestive heart failure — so many plans have been known to put extremely accurate scales into some patients’ homes that have telephone connections. Those scales and phones are used to notify the Medicare Advantage care team if a patient weight gain seems to indicate they might be at increasing risk of a failure and crisis.

Many very successful interventions have happened from just that information.

Every other industry uses process engineering to improve their products and reduce their expenses. Fee-for-service Medicare engineers absolutely nothing and Medicare Advantage plans engineer wide ranges of things because they have the resources to do it and they are rewarded financially — in an optimal win-win total context — when they succeed.

Medicare Advantage is almost the only place in American health care where that set of interactions is the goal of the purchasing model and it actually happens.

There really is a lot of low hanging fruit because so much of fee-for-service Medicare is so consistently bad care. We should not collectively criticize or even condemn that set of fee-for-service Medicare caregivers that service so many of our patients. There are many great and wonderful and even underpaid caregivers in Medicare care settings and when you look at heroic care delivery and when you look crisis response performance for patients, the fee-for-service care infrastructure always steps up to the plate and they very often even deliver great care.

But the best care sites there have to step up to the plate far too often — and we owe it to ourselves to think about what directions we should be going as a country if those millions of patients are in crisis modes in hospitals 30–60 percent of the time more often than those crisis should be happening.

Medicare Advantage has Serious Critics and Opponents

There are serious long-standing Medicare Advantage critics who continue to attack the plans — with what are obviously angry and inaccurate and sometimes non sensical attack points. We need to respond with facts to every attack point and we need to work past those attacks by looking at what the plans are actually doing and convince credible people that the critics are wrong and Medicare Advantage is a very right part of the solution set.

The reality is very different than the attack points of the critics. The costs of Medicare Advantage are lower at multiple levels and that’s easy to prove because they happen in plain sight.