MEDPAC ANNUAL REPORT

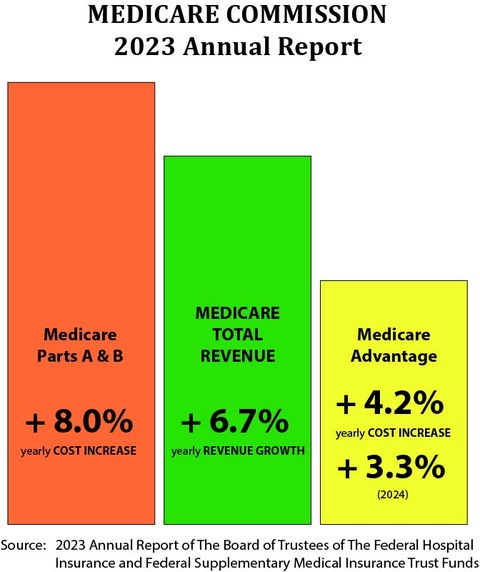

MedPac just published their annual report on Medicare Advantage. They claimed in that report that Medicare Advantage was upcoding information about patients that fed the coding and risk determination system, and they concluded and stated in their official report for 2023 that Medicare Advantage was clearly overpaid by Medicare as the result of that coding approach.

That statement and that conclusion were both very definitively and very provably wrong.

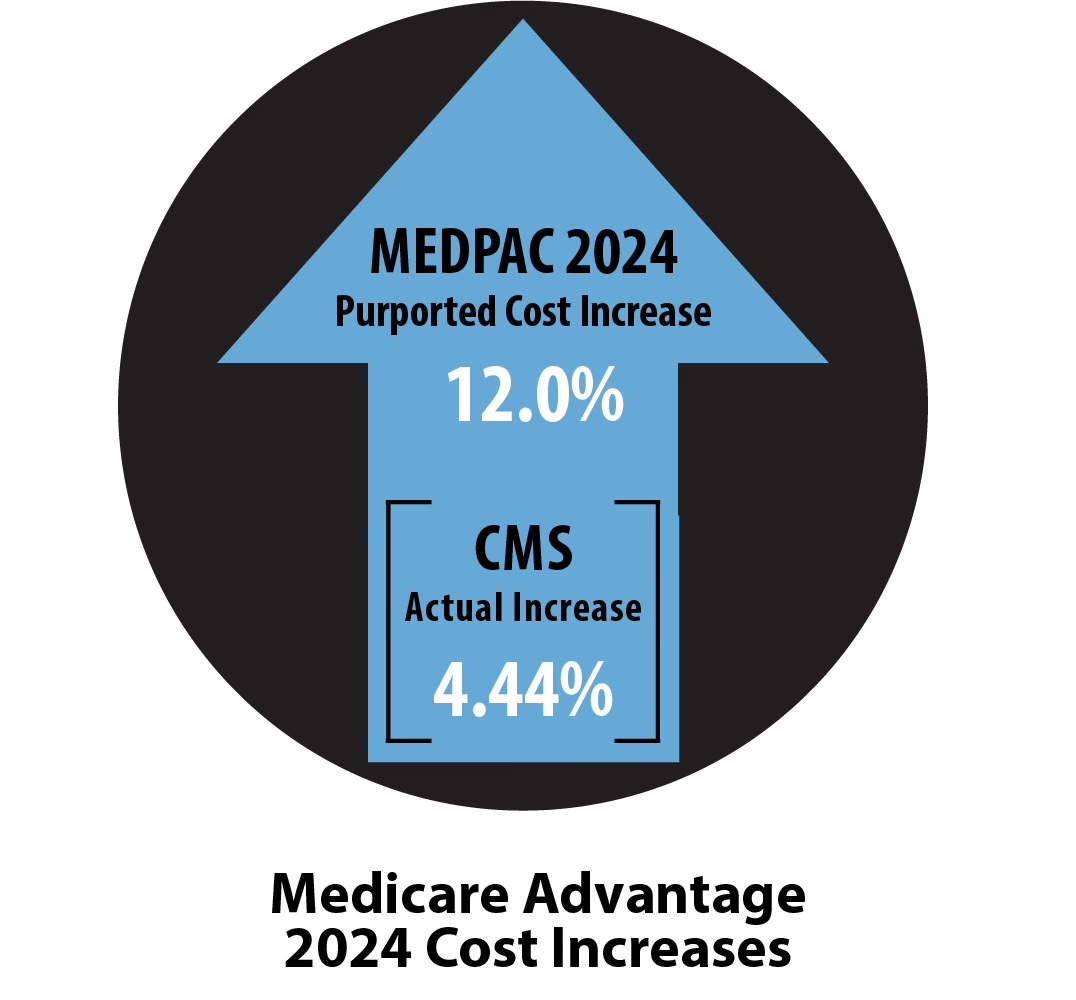

In reaching that conclusion, MedPac completely ignored, avoided, ducked, overlooked and didn’t reference, note, cite, describe, or mention in any way — the actual and official May 31, CMS 2024 Medicare Advantage and Part D Rate Announcement for 2024 that proved their accusations and their numbers to be wrong.

That official and very public announcement about payment levels that was made by CMS on May 31 definitely set the Medicare Advantage actual risk level adjustment for the 2024 year at 4.44 percent. That announcement by CMS made all of the MedPac accusations in their current report about the coding and pricing issues wrong, incorrect, irrelevant, extremely and intentionally misleading and actually, functionally impossible.

CMS said officially, directly, explicitly, openly, and very clearly that the expected revenue increases for the Medicare Advantage plans would be 3.32 percent for 2024 and it would not be the 12 percent payment overage that the MedPac report very inaccurately and incorrectly projected, highlighted, and then explicitly attacked in their report.

Those are important differences in the payment levels for the plans. Medicare would be in trouble if the MedPac numbers were true.

They’re absolutely not true.

We need all relevant people to understand what is actually true and what’s actually happening for Medicare Advantage pricing and costs because people who believe that false information are trying to damage the plans and might be able to do some damage if they succeed. Some people who believe the false data from MedPac are trying to get congress and health policy makers to do negative things to Medicare Advantage and to even reduce benefits for members to make up for what those people believe is both an abusive number now and perpetual overpayments to the plans.

That benefit reduction would be a very bad thing to do. It would hurt people who we should be protecting. More than 60 percent of the lowest income Medicare members have joined plans, and those low-income members very much want and need the much higher benefits that they get from their plans to make their lives better.

That 12 percent increase in payments that’s outlined and attacked in the current MedPac report is just plainly a wrong number. It is a much higher and more abusive and more expensive number than what we now know to be the actual 4.44 percent in risk levels and the actual 3.32 percent increase in revenue for the plans that CMS very publicly decided to pay the plans for that year and that will happen for 2022.

Those numbers that were publicly announced in that CMS payment determination report and decision show and prove that the clear and explicit accusations in the MedPac report about plan upcoding currently creating major overpayments are both wrong and completely irrelevant. They’re completely irrelevant, because even if the plans were running any of the upcoding processes that MedPac very directly accused them of doing in their report, the numbers that would’ve been created by their upcoding efforts would not have been included in the payment process or relevant in any way to the actual process that’s being used to set the actual payment levels for the plans.

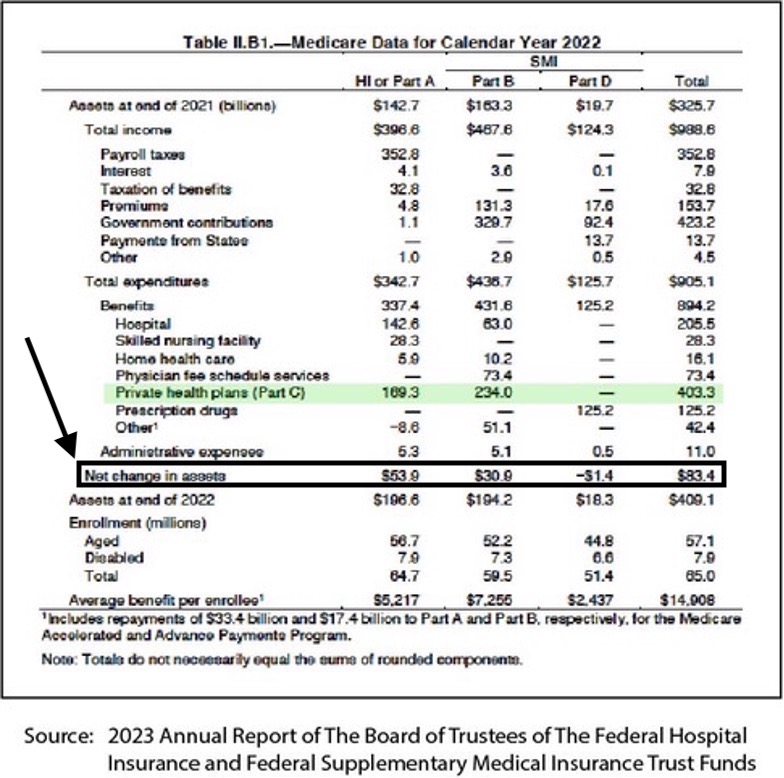

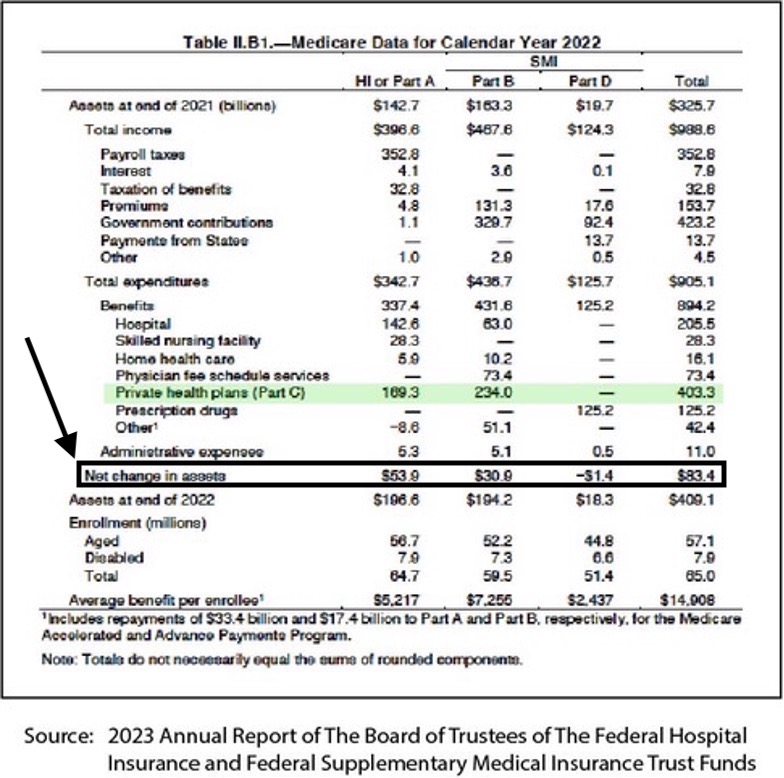

Those numbers are also irrelevant because the Medicare trustees just did their annual report which shows that after two decades of losses for the Medicare trust fund, the combination of 17 percent discounts from the average cost of Medicare that the plans bid every month, and having a majority of the members (and a super majority of low-income members) in the plans has created an $83.4 billion very real surplus for the Medicare program for 2022.

There is no possible combination of upcoding processes that can even put a dent in the current $83.4 billion profit and surplus that now exists for the overall program.

It’s important to have people understand that reality and to strongly support the better benefits, better care, and lower costs created for the people enrolled in the plans.

Unfortunately, many people at many levels are currently opposed to the Medicare Advantage program and they oppose Medicare Advantage because of those wrong numbers and that false information that’s also included in some Health Affairs attack pieces that also use distorted and inaccurate information.

The plan opponents repeatedly and publicly tell everyone very directly and clearly that the plans are overpaid — and too many people believe that’s currently true because they have that wrong information as their data base.

The critics of Medicare Advantage as a program do often acknowledge that the plans have better benefits and that they even often acknowledge that the plans have better care, but too many relevant people still don’t support the Medicare Advantage program in total in many important settings, because of those beliefs about the plans being overpaid that are fed, created and reinforced by MedPac’s false statements.

The people who oppose Medicare Advantage believe that those overpayments happen and they also tend to believe that the overpayments create wrongful and excessive profits for insurance companies that run many plans. A number of policy people and leaders don’t want those supposed overpayments to be part of the Medicare program. So, they don’t support Medicare Advantage as a process or program. They’re critical of Medicare Advantage at almost a generic and automatic knee-jerk response level when it’s mentioned or is relevant to a discussion or process, because they have those beliefs.

That overpayment of the plans is absolutely not true. Medicare just made an $83.4 billion surplus using those payment levels.

And the future payments will continue to be low enough to continue to build that surplus.

CMS has made very sure that the overpayment impact that people are concerned about in those attacks from the upcoding process cannot happen for plan payments today or next year.

CMS changed the reporting process for the plans. They put in place a new coding approach in 2020 that’s based directly on encounter reporting for each care encounter for each patient. That new system is linked to the medical records for each patient, and it is not based on plan risk estimates and plan-based reports that were used to create the risk levels before that change.

The new approach is an accurate, current, credible, and easily available way of getting the diagnosis and activity data for each patient. The new approach gives Medicare extremely accurate data on all of the patients and members.

We can all trust the data that results from that process.

We can also trust the payment level to continue to fund that $83.4 billion surplus for the program that happened for 2022.

Capitation is a very powerful payment model.

Medicare also can, will, and does keep future overpayments from happening by using the capitation process and the capitation system to completely control the actual amount paid to each plan. Everyone should know and understand that CMS has complete and direct control over that number.

Capitation is the most powerful and effective payment model for care and CMS now uses it intentionally and well to buy coverage from Medicare Advantage plans.

CMS directly keeps the overpayment and excessive payment of plans from happening by simply deciding what the plan payment increases will be for each year. They just set the key numbers for 2024 payments, and those numbers now control the functional reality for the program and for the payments that will be made to plans for that year.

MedPac pretended in their very misleading statement that those two decisions by CMS didn’t happen in making their explicit and alarming overpayment accusations for their current report. They wrote their alarming report as though there was some way that plans could do something inappropriate with any of those numbers. Then they warned us that plans would somehow create a 9 or 12 percent excessive payment with fraudulent coding by using those tools and risk-level manipulations.

That was just plain wrong at several levels. MedPac owes us an apology for making those misleading and incorrect accusations and for alarming relevant people who are thinking about Medicare as a program and about future costs and quality for the Medicare program.

The actual numbers that affect the payments for Medicare Advantage have been locked into place by CMS and upcoding was not part of the process and upcoding was not part of the current cash flow for the plans despite the clear and repeated MedPac warnings, accusations, and suppositions about those codes and their negative consequences.

We need everyone to know what the actual numbers will be for 2024 and we need people to know why we can trust them to be the right numbers.

The MedPac report owed the country a clear and accurate description of those actual payment numbers for Medicare Advantage plans because the MedPac writers had them in hand before they wrote their report accusing the plans of being over paid. They should’ve made that information part of their report.

The country and the Congress both deserve to know why MedPac wasted our time and why they felt the need to increase our concern levels about Medicare payments with multiple alarming pages about upcoding issues in their report that are clearly and absolutely incorrect and irrelevant for the program as it exists today.

They should make that statement and announcement now and they should include it as a key agenda topic for the next public meeting of the commission. They do very public meetings on a regular basis and those facts should be a key piece of information they share at the next meeting.

MedPac just held a quarterly meeting of their commissioners. They used it as an opportunity to further mislead the country. Instead of telling the commissioners and the public the truth about how much the plans will actually be paid, MedPac said again (with absolutely no reinforcing data or facts) that they continue to have deep concerns about the possibility of overpayment for the plans. They continue to believe that the upcoding numbers from the plans could somehow be damaging to Medicare, even though CMS has already decided now how much the plans will be paid for that year, and that was a damage-free number.

The CMS decision about the 2024 numbers that Medicare Advantage will be paid in the capitation adjustments was a very public document and everyone can see and understand it for what it is.

There’s no possible way that MedPac didn’t know that their clear, explicit, and direct official warnings from MedPac — telling us about 6 percent risk-level increases for the plans and about even higher functional future 12 percent overpayments from CMS to the plans — were actually possible at any level.

Those MedPac numbers, that they released to the world and then publicized and continue to publicize in their current meetings, were completely wrong, inaccurate, incorrect, misleading, alarmist, and untrue. We know that some of those predictions were even actually functionally impossible for the plans — based on the fact that CMS had already decided on the real numbers in each of those areas and had released the real numbers to everyone on May 31, with no process in place to change those numbers in any way.

MedPac just included another coding intensity discussion in their most recent quarterly meeting.

They haven’t given up on the issue and they haven’t started telling the truth on key points in that process.

They talked about the intensity risk for over an hour as a key part of their most recent quarterly report. They offered a couple of actuarial discussions about coding issues at the meeting. They said very accurately in their report that the plans have much more complete data than fee-for-service Medicare providers. But — they then concluded very inaccurately, for all the world to consider, that Medicare Advantage plans currently have an 11.1 percent coding intensity level in their reports, and they said the coding intensity basically creates wrong payment levels for the plans.

They made that 11.1 percent coding intensity factor a major issue for the meeting, and they said that intensity factor is damaging Medicare.

What is true is that the plans do have much better data than fee-for-service Medicare, because the plans use the data for care enhancement and support. The truth is that the better data in the plans is a major reason why the plans have about 40 percent fewer hospital days for their congestive heart failure patients. It’s a major reason why the plans have 60 percent fewer people with massive diabetic eye difficulties receiving care. It’s also why the plans have less than half as many low-income people having amputations.

That’s true that the plans have better data.

What is absolutely not true is that that 11.1 percent coding intensity factor costs money or does damage to Medicare.

That intensity number doesn’t create a payment problem or error at any level.

The plans are paid a capitation, not a fee.

The capitation is based on the average cost of care for Medicare in every county. Medicare saves money on every member based on those numbers and on that flow of cash to the plans and their caregivers.

MedPac admitted in their most recent report that Medicare Advantage plans bid about 15 percent lower costs than Medicare to set up their payment levels. They also said that Medicare Advantage buys the basic Medicare benefit set for about 17 percent less than fee-for-service Medicare.

They then say not to trust those numbers and that we can’t rely on those fairly obvious and large savings that are reported for the plans every month to actually be savings, because the impact of up coding distorts the picture so badly that after the coding is done, the program actually runs at a 12 percent loss instead of a 15 percent discount from the average cost of Medicare.

They make that claim repeatedly. It’s amazingly arithmetic-free, however, because MedPac never shows any calculations in their presentations that prove that point. They make the claim with vigor and enthusiasm while presenting absolutely no real data showing how it might possibly happen.

The lower cost of care to the plans is why Medicare Advantage makes money every month now for Medicare and has done it for years. Those are important and very real numbers that MedPac ignores. The 17 percent discounts from the cost of care are the reason why the overall Medicare trust fund is actually now growing — not shrinking — as the trust fund has been doing for the past two decades and more. It’s now on a financially secure trajectory for both reserves and program costs.

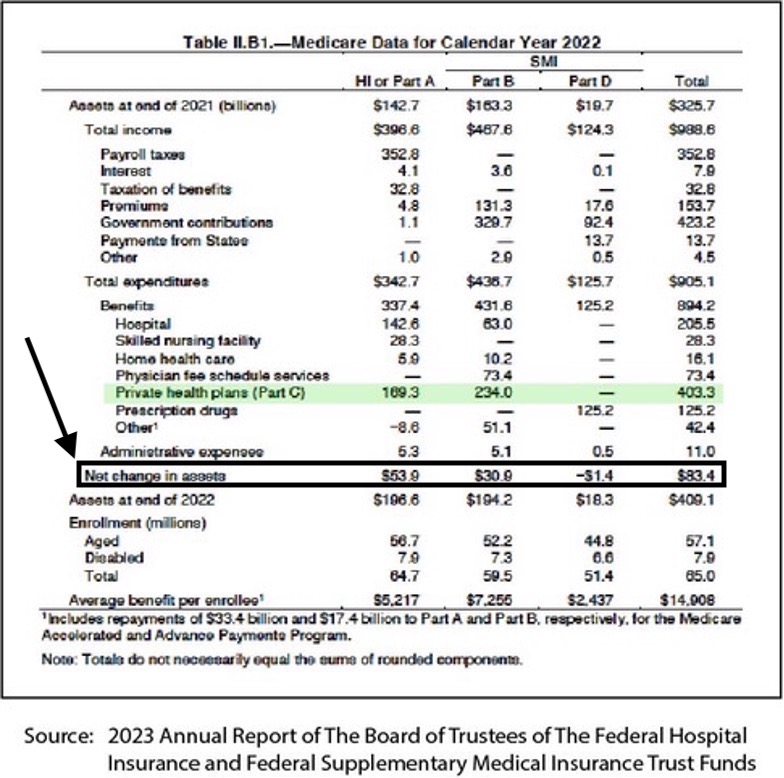

AN $83 BILLION PROFIT FOR MEDICARE IN 2022

The impact of any higher intensity level that might exist on Medicare data from the plans having better data is completely wiped out, offset, and overwhelmed financially by the plans bidding 17 percent lower than the average cost of fee-for-service Medicare for their monthly capitation and then spending significantly less money in real dollars than the fee for service Medicare costs for their members for a majority of Medicare members in 2022 and now for 2023 by providing better care.

Seventeen percent lower costs is massively more money than the 11 percent potentially higher costs for coding intensity that MedPac invented, without the support of arithmetic that could be seen, and then wrote about in their massively flawed current report, as though those were real financial issues for Medicare.

MedPac should be focused now on the fact that Medicare, in total, has become a profit center for the government — not a loss leader as it’s been for a couple of decades.

The profits for 2022 were $83.4 billion for the Medicare program — and that’s real money, not coding machinations of some kind.

The same very important trustee report that shows that Medicare has added that $83.4 billion to the trust fund for 2022, also says that the total Medicare Advantage costs and expenses for the entire Medicare program were $403.3 billion for the year.

That number was created by the fact that the Medicare Advantage bids in all of the counties run 17 percent lower than the average cost of fee-for-service Medicare. The total spent with those lower bids created that $403.3 billion expense, and made it the total expense for the year for the Medicare Advantage program.

If we take that actual expense for running the plans for 2022 and add to it the 17 percent that the plans didn’t need to spend, and didn’t need to pay because of the lower bids, that creates a $68.57 billion reduction in Medicare costs for just the Medicare Advantage enrolled patients.

Medicare Advantage isn’t the only good program that’s saving money for Medicare by creating better care.

The Accountable Care Organization (ACO) programs are also doing a very good job of providing better care at lower costs to the members. Roughly half of the people who aren’t enrolled in Medicare Advantage plans have joined ACOs and have their costs created in those systems and programs.

That has an impact on both care quality and costs.

If we assume that half of the remaining Medicare members are now in ACOs of one kind or another, the average savings for the programs that have been reviewed run from 4–7 percent for those members. We should know that the other growth in the trust fund surplus came from those cost savings.

That creates another reduction in spending for the ACO patients of roughly $12 billion.

Those total savings numbers from expense levels we know about add up to slightly over $80 billion. That is relatively close to the $83.4 billion surplus that we know beyond any doubt that Medicare actually achieved for the trust fund for 2022. That impact and that outcome need to be clearly understood by everyone looking at these issues and these sets of numbers because it’s extremely important information. MedPac should make that set of numbers the single most important thing they’re studying and looking at today.

They haven’t even mentioned the overall profits for the program. They don’t seem to believe that going from 20 years of losses to a couple years of major surplus growth is worth noting or understanding.

The current cost levels for Medicare Advantage and the ACOs are lower than the average revenue increases we see each year for Medicare, and that the trustees predict will hold steady for the next decade. Spending less than that annual total Medicare revenue increase creates a surplus for the plans each month that reached record levels in 2022. It put Medicare on a much better track than it’s been on for a couple of decades.

Those savings from both the plans and the ACOs have been a major reason why we had an $83.3 billion surplus for the overall Medicare program for 2022 — and why we now need to build new sets of strategies for Medicare so that we can get the very best use of that money going forward from here.

That $83.3 billion surplus for the Medicare program is real money. We know from the trustee report that it actually happened for the Medicare program in 2022. It’s game changing for the Medicare Program and should be getting major attention from Congress going forward. Medicare now has a profitable line of business rather than two major loss-linked programs. The profitable line of business should change our concerns and thinking about the future of Medicare.

The misleading and irrelevant MedPac report about upcoding damage should now be followed by a clear report from MedPac about optimal next steps for the program and some of our very best thinking about how to get the very best outcomes from the trajectories we’re now on for both care enhancements and the costs of care.

The Medicare trust fund has been diminished each year for two decades. Now that Medicare Advantage has more than half of the members; and since more than half of the remaining fee-for-service enrollees are in ACOs who also have better care and lower costs, Medicare has a major, game-changing change in financial direction. Medicare actually made money as a total program for 2022.

Medicare is a much different program than it was from the beginning for just the fee-for-service beneficiaries and members.

The health care academic community should completely refocus their attention to look at those surpluses for both the overall program and the individual plans. They should recognize that we’re potentially on the cusp of some major care enhancements and successes.

The business model of Medicare has been significantly changed by having a majority of members in the Medicare Advantage plans. Medicare grows in total revenue as a program each year by 6 percent. The 6 percent revenue increase happens each year for the total program. The 2023 annual Medicare report projected that the 6 percent increase will continue to happen every year for the next decade.

The arithmetic and the business model issues of having two major component programs with their revenue stream and cost impacts for members are fairly basic and easy to see and understand.

When Medicare Part A and Medicare Part B, fee-for-service Medicare, fairly consistently have annual increases in their expense that run 7 percent or more each year. That always creates a loss for Medicare for those members.

That higher cost for those members for the past two decades causes the overall trust fund to deteriorate each year. That deterioration in the fund is exactly what we saw happen every single year when Medicare Advantage was a minority of the total membership and Medicare A and Medicare B were the total program.

That financial loss for the fee-for-service Medicare members has been happening very consistently for a couple of decades. Economists have recorded those numbers and predicted and anticipated that those losses would continue for those members until the trust fund was depleted. The government needed to come up with a scenario to keep coverage in place for those members.

The trustees predict in their report that the basic Medicare fund would be depleted inside of 10 years if, they point out, the only business model for Medicare was Part A and Part B — and if those same losses happened every year for those members.

That is not the path we’re on.

We have Medicare Advantage as Medicare Part C, which has created a very different financial trajectory for the program.

Medicare Advantage taking over a majority of the enrollment alters that overall scenario and trust fund depletion trajectory massively and immediately in a very positive way.

That reality has changed significantly with Medicare Advantage (as Medicare Part C) having annual expense increases that are lower than the 6 percent Medicare increase level every year.

The plans are paid a capitation (not fees). The capitation is under the direct control of CMS as a function of the basic design of the Medicare Advantage program. The goals, strategies, and approaches now are to keep those expenses low enough to have Medicare Advantage function as a profit center for Medicare, and to not only keep the trust fund permanently funded, but also to have the overall program maintained as an asset for the government budget, rather than a financial drain.

It’s actually a guaranteed win if you understand what’s actually happening with that payment flow.

Capitation payment approaches guarantee the success of that approach.

The MedPac people who write their hostile and critical reports on the Medicare Advantage program always fail to mention in their reports that the plans are paid actual dollars as a lump sum, and that they receive a capitation fee for each patient — not a fee for each piece of care that they deliver to members.

The plans actually don’t make their money from coding intensity. The discounts from the average current cost of fee-for-service Medicare in every county far exceed the worst MedPac coding intensity estimates. The plans make money by managing the care well and by reducing the costs for patients in a wide range of ways with better care.

The Medicare economic situation is based on dollars (not codes). The plans are making profits for Medicare with the current payment levels because fee-for-service Medicare is so expensive for so many patients and not spending that money is extremely beneficial to the overall Medicare trust fund.

Medicare Advantage plans bid 17 percent less than the average cost of fee-for-service Medicare in every county in 2022. They still manage to create a surplus each month with that lower flow of cash. The care in the plans is so much better and it costs significantly less to do many things right in the delivery of care.

So, Medicare Advantage turned out to be both a profit center for Medicare and a context for major improvements in both benefits and care in the process.

If you look beyond the major errors about the payment levels in the MedPac report and read their description of the program, the current Medicare Advantage report from MedPac does have some accurate pieces of information that should be known and understood and integrated into the understanding of where we are now with those programs. The significantly lower costs for the plans that result from the bidding process are included in the MedPac report, and they describe accurately that those lower bids create very real surpluses for the plans.

It’s important for everyone to understand how lower bids can create surpluses for plans as the key functional business model for the plans. Far too many people who don’t understand the economics of that situation believe that there are wrong levels of profits going to the plans — and that the data distortions and risk-level inflation create the financial reality for Medicare Advantage plans.

Unfortunately, the history has been that some publications like Health Affairs have run multiple articles making that claim. They’ve been running attack pieces that mention coding issues, which are false and damaging. They predict major financial losses for Medicare, with higher levels of enrollment instead of the $82.2 billion actual 2022 surplus that is currently in place because people joined the plans.

The problem with those highly wrong and inaccurate pieces is that those articles influence thinking for too many influential people. They keep some people who should be working hard to get people enrolled in plans and enrolled in ACOs from doing that work and helping those people get better care.

We need everyone to know, understand, and explain to each other that the plans’ lower costs than the bid amounts are based on much better care.

Better care, in many important areas, costs less than traditional fee-for-service Medicare’s less effective care — particularly for low-income people.

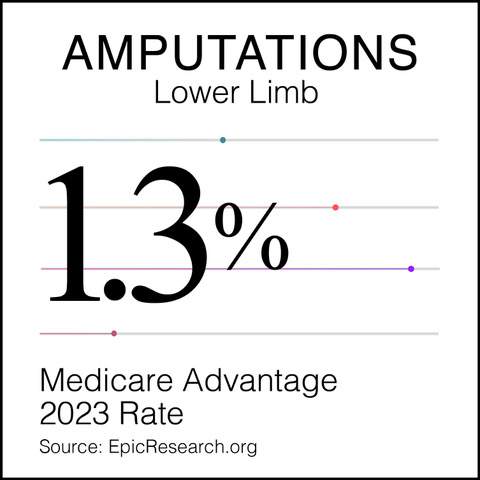

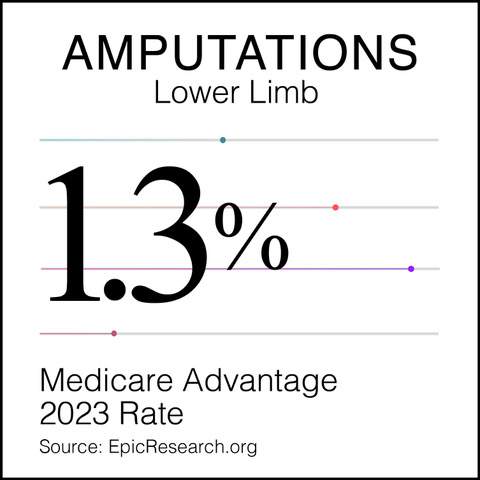

We have shameful and extremely expensive care that gets related to diabetic patients and the amputations that they too often experience in far too many settings for their care.

The average cost of care for fee-for-service Medicare has far too many patients who have lost limbs as the result of the amputations.

The plans all know that 90 percent of the amputations are caused by foot ulcers. They know that you can reduce foot ulcers by more than 60 percent with dry feet and clean socks. So, the Medicare Advantage plans all provide those services to their members.

We know from a massive database for care that only 1.3 percent of the Medicare Advantage diabetics have those amputations.

That’s very different than the Shameful Metric of Inadequate Care we see for other patients in this country, who are in fee-for-service Medicare with no care teams, no quality goals, and no support for the basic functions that chronic care patients need so badly.

People die because they’re not in plans.

The death rate for the patients with amputations tends to be over 40 percent of those patients over a five-year span. Less than 2 percent of the Medicare Advantage patients in a massive study of that care went down that road.

A MUCH BETTER USE OF THE MEDICARE DOLLAR

Those billions of dollars in expenses are in the average cost of fee-for-service Medicare in every county. Those costs don’t exist for Medicare Advantage because the plans deliver much better care. They’re why the Medicare trust fund actually made $83.4 billion in 2022.

Those lower bids by the plans are very visible and very real and created entirely by better care. MedPac mentioned those lower bids in their report, but they then said directly and explicitly that the lower bids result from the plans upcoding their database and not from providing better care.

MedPac owes the country and congress an apology for that accusation as well, and for not supporting the fact that the benefit improvements that exist for the plans now will continue into the future.

What’s true is that the lower bids by the plans are a much better use of the Medicare dollar.

The plans bid that lower amount in every county and then add up the total cost of care delivered to their members to see if there’s a surplus (or a loss) compared to traditional Medicare costs.

If the cost of care for the plans is lower than the capitation level they bid, then that creates a surplus for the plans.

The plans are required to use that surplus to increase benefits or reduce costs — or deliver additional care to the members.

Surpluses happen for the plans in that cash flow. Medicare saves money each month on the initial discounted bids and then there’s a second line of benefit for members and for the country that happens when the plans turn the surpluses that still result from that lower cash flow into additional benefits that are significantly better than the traditional Medicare benefit set.

That cost level for the plans that runs below fee-for-service Medicare costs happens for every plan and MedPac admits that in their report.

The current MedPac report also does describe the surpluses that result from those lower costs. In fact, the report says that the plan surpluses are now at an all-time high level. They currently run at more than $200 every month for every member.

The plans offer vision, hearing, and dental benefits along with a wide range of other support services that traditional Medicare does not offer.

Traditional Medicare has a fairly weak benefit level.

The average fee-for-service enrollee now has out-of-pocket costs each year that exceed $5000, which can create major financial difficulties for many people with that coverage.

The plans take that capitation that is based on the average cost of fee-for-service Medicare in every county, and the plans provide better care that costs less.

Some of the plans take their monthly surplus and actually use that money to buy Medicare Part D drug coverage for their members, instead of the members having to pay that Medicare Part D premium themselves.

Medicare Advantage buys Medicare Part D coverage for some members and almost no one in health policy circles or in the health care news media knows that happens. It’s a major coverage expansion for those members when it does happen and should be seen and appreciated.

The fourth major component part for Medicare is Medicare Part D — drug coverage.

Medicare Part D has been a major asset for our older Americans. It has significant benefits for members. People need to enroll in that program to get coverage. All of the Medicare Advantage plans work closely with part D coverage for their members.

What most people don’t know is that some Medicare Advantage plans discount their expenses from the average cost of fee-for-service Medicare and still have a cash surplus big enough to buy Medicare Part D coverage for their members.

The plans are all active participants in the Medicare Part D program. They all have care plans that include prescription drugs. The plans who provide that benefit actually pay the part D premium for their members who choose that coverage without increasing the total costs of the program.

That link has a very high consumer satisfaction level. It lets people get additional essential coverage in a very affordable way.

It’s a good financial fit when those coverages are linked for the members and the care plans have the right prescription drug tools embedded in the care process as part of the overall package.

That purchase of Part D coverage for those members by the plans doesn’t increase the total cost of the Medicare program because the plans do it from their surpluses. The bids that create their cash flow are actually less than Medicare would’ve spent on each of those enrollees if they hadn’t enrolled in the plans. Those payments are less than the average cost of Medicare in those counties.

THE SURPLUSES ARE FREE MONEY FOR MEDICARE

That much better use of the Medicare dollar by the plans makes those additional benefits that help raise the inferior and inadequate fee-for-service benefit package up to more adequate levels and that benefit increase package is clearly a major asset for the country and for those members in very direct and immediate ways.

The plans bid below fee-for-service Medicare costs and offer discounted bids because they deliver much better care.

The low-income Medicare patients in many of our communities have some of the highest blindness levels in the world. The Medicare Advantage plan quality program knows that diabetic blindness can be reduced by over 60 percent just by managing the blood sugar of the patients.

The very first quality goal that was created for the Medicare Advantage five-star quality plan is to manage blood sugar for diabetic patients. That was done both to improve care and to reduce costs for diabetic patients.

The plans all build their care delivery with those quality goals in mind — and we have now reached the point where almost 90 percent of the plans are doing very well on their basic five-star quality goals and are earning four or five stars for their efforts.

The culture of care at many care sites in America has been improved significantly by having those five-star goals and the processes necessary to achieve them built into the operations of the care sites. Plans and sites who achieve the five-star quality levels make that a point of significant personal pride and recognition. They share the celebrations from those achievements with their communities and teams in mutually reinforcing and supportive ways.

The current quality goals have echoes with the new sets of quality goals for the Medicare programs, and even for the businesses and employers who also have increasingly functional linkages with those programs and their goals.

They also save money.

The vast majority of academic healthcare economists, academic policy people, and a large number of the health care journalists who write about Medicare Advantage completely miss the major economic asset and extremely valuable and highly functional financial impact that is created by better care.

MedPac never mentions that financial benefit and impact. So, the academics in far too many policy settings tend not to know that very direct functional impact exists. The academics don’t know, or even seem to suspect in some settings, that it’s extremely important economically and functionally at multiple levels to continuously improve care.

It’s real money.

The money saved by not having to treat blindness in those diabetic patients creates the surplus and the profit that the plans use to pay for eye glass benefits for their members.

It’s a much better use of the Medicare dollar.

The plans all know that you can reduce the number of congestive heart failure hospitalizations and crisis events by having care plans and care teams for the congestive heart failure patients. Lives are both better and longer for patients who don’t need to go through those terrible, painful, and sometimes-terrifying congestive heart failure crises, and the plans save $40,000 on not having those admissions.

The plans have lower bids for their payment program because of better care.

MedPac is always careful to treat the coding issue in all analytical reporting as if it were a theoretical and purely actuarial science and mathematical issue of some kind, rather than a functional care delivery and operational care improvement issue. They should aspire to more complete and accurate data flow rather than fearing it, as they do in their upcoding report.

MedPac does a massive disservice to the Congress in their reporting by continuing to say that the Medicare Advantage surpluses result from coding deficiencies and not from care delivery, and by not mentioning in any of those pieces that the total costs of Medicare directly and obviously decrease when the plans improve care.

MedPac does some very good work on a number of topics. There are some very solid, competent, and even wise commissioners who participate in their meetings, but the MedPac team tends to miss the boat completely and dangerously on Medicare Advantage functional and financial issues.

On Medicare Advantage, MedPac contends and says (more than once and in more than one setting) that the extent of the upcoding by the plans is so extreme that the coding process takes what appears to be the 17 percent lower cost for the plans in every county every month. Then their report inflates the cost estimate for the plans to the point where MedPac says that the plan overpayments, in total, now actually exceed 6 percent — and the plans are a financial damage point rather than the reason why Medicare made $82 billion in 2022.

They have people in important settings who read what they write and who listen to what they say, and who are opposed to Medicare Advantage as being part of the package because of what they hear from MedPac.

It’s very hard to understand (or believe or explain) with real numbers how it’s possible for MedPac to take a 17 percent lower cost per member bid each month and turn it into a 12 percent overall overpayment for the overall Medicare program by changing some codes for the members in a way that increases profits for the plans as a standalone set of economic issues — without somehow impacting the actual flow of money in some way from Medicare to the plans to make that happen.

They seem to have the courage of their convictions. They make their accusations in what feel like well-considered ways if you don’t look at the actual data.

They never explain how that level of damage can happen with any flow of cash that’s described or discussed in their report. The alleged damage done by the plans seems to be a belief system of some kind, as opposed to a process evaluation or an actual measurement of any kind.

They do tend to say that they strongly believe that overpayment to be true. They actually conclude in their current and historical advice to the country that the obvious savings that exist every month for the plans (in every county) shouldn’t count as savings because there are “upcoding elements” in the overall process that distort some numbers badly, and that distortion somehow causes the plans to be ultimately overpaid.

People in the business of providing care know what the real costs and the actual numbers for the members are.

The people who actually run the plans and the health systems aren’t surprised each year when MedPac assigns their 9 percent overpayment estimate number to the discussion and then uses that completely hypothetical, theoretical, unmeasured, and unsubstantiated inflation estimate equation to offset the real numbers and make gains disappear without actually having real numbers in the loop for the most important calculations that they achieve.

People who are used to the MedPac information distortion process have seen clearly and often how they use those completely invented and data-free inflation estimates to somehow counter, negate, and unbalance the actual monthly discounts that exist for the members and for the plans in the actual payments that are made every month (to the plans) by that offsetting factor.

That hypothetical MedPac adjustment factor that supposedly offset the gains achieved by the plans didn’t happen anywhere in the real world, but MedPac has many people who ignore the actual data and who believe, instead, in using that adjustment equation as a key factor to evaluate and measure Medicare and Medicare Advantage and to conclude that the plans cost more despite actual, available data that shows at multiple levels that the plans cost less.

Why do we care?

We care because the cold and sad truth is that some important people believe MedPac.

Having many people in positions of influence and authority believe in a number that doesn’t exist in the real world wouldn’t be a problem for the country, except for the fact that the annual non-real, but convincing threat of painfully inappropriate Medicare Advantage overpayments trigger a belief, paradigm, data point, and conclusion that keeps MedPac on the fence. It creates negative steerage in the discussions about future payments for the plans.

That distorted thought process and those untrue numbers reinforce a couple of policy journals that don’t look at the real numbers, but that do publish very persuasive thought pieces from people who hate Medicare Advantage and who also use numbers in their attacks that are belief-based and not linked to actual data for the purposes that they’re used.

Those attacks keep too many people from recommending in effective ways to everyone in the world that we should now add enrollment for the plans as a key priority for the country — particularly for our highest-need patients who badly need that care.

People are dying in the real world because those numbers are believed.

People are dying because those numbers create a total context that keeps people who should be encouraging everyone to get people enrolled in Medicare Advantage special-needs plans from having that enrollment.

Far too many people who are eligible for both Medicare and Medicaid don’t enroll in plans now. Those people have much higher rates of blindness, amputations, and the ongoing damage from chronic diseases when they’re not in plans.

We need those people enrolled in plans.

We also need to understand our steerage and optimization opportunities with Medicare Advantage.

EIGHTY BILLION DOLLARS IS A HUGE WIN FOR MEDICARE

In the real world, the combination of the 15–17 percent lower costs every month for Medicare Advantage payments and the addition of some care improvement gains in the 5 percent range made in the ACO world by the owners of the Medicare Advantage plans, who also often run the ACOs, has put Medicare into the best financial shape it’s been in since Medicare was founded.

We should build on that financial platform for the Medicare program. We should celebrate and optimize the opportunities it creates for us for lower costs and better care. We should understand and appreciate what just happened with the 2022 Medicare trust fund results, which are very real successes for the program.

After more than two decades of having Medicare Parts A and B losing money and having the Medicare trust fund shrinking each year — with an impairment endpoint for that fund repeatedly predicted and projected on a rolling basis to happen about a decade from now — we now have had the total impact of Medicare Advantage growing to more than half of the enrollment. In addition, some lower care costs also happening in related areas for another 20 percent of the members who are in ACOs. The truth is that combination of factors has created a major financial win for Medicare, and care is far better for many millions of people.

We should set up creating continuously improving care as an objective, goal, strategy, tactic, skill set, capability, and clear and consistent commitment for the country. That’s entirely possible. The science is getting better and we’re now very well-funded for this segment of care with enough resources to make that strategy and commitment happen.

We’ve just created the biggest single increase in the trust fund reserves since Medicare began. That reality and that major amount of actual cash is giving us the future we need to have Medicare be a long-term success and not a perpetual loser that we need to bail out with other funds at some point in the future.

We have real money available to do that work.

The Medicare trust fund actually grew by $83.4 billion last year.

We’re clearly now on the path to permanently save Medicare as a program by turning it into a profit center for the government, rather than a loss leader for the country.

How did that unexpected, unpredicted, and highly unanticipated, but functionally inevitable, financial result happen?

The 15–17 percent discounts from Medicare Advantage every month have been real. They’ve built significant cash surpluses for Medicare because they happened.

If you look at the Medicare trust fund financial summary report, you can see that $83.4 billion was the actual cash increase and growth factor in the reserves for the program for 2022. That’s real money — not future aspirations or financial directions, wishes, hopes, or goals of any kind.

If you look at that report from the trustees that shows the $83.4 billion surplus, you can also see that the private health plan total and complete expenses for Medicare Advantage ran at $403.3 billion for the year.

That overall Medicare trustee summary financial report deserves to be looked at by every health media person, every health care academic, and by all of the political people who are trying to figure out the future of care for our country; who are concerned about our performance; and who are thinking about our future as a country along the entire Medicare components of our health system and agendas.

The total cost of Medicare Advantage — after every possible level of upcoding and data increases or distortions that any of the plans managed to achieve and work into the process along the paths that MedPac warned us about — was $403.3 billion.

If we look at the bids that the plans did for the year, that showed that the average bid of 17 percent less than fee-for-service Medicare in the counties created $68.5 billion in unspent Medicare cash for people who enrolled in plans and who had that pattern of care and who didn’t spend that money because they were in plans.

That lower cost level for the plans allowed that money (from the Medicare 6 percent annual revenue increase and cash flow) to flow into the trust fund reserves, rather than being spent on care as it would’ve been if the members in the plans had continued to be fee-for-service Medicare enrollees.

This is a good time to take an inventory of where we are on all of those cost-related issues.

We need health care economists and Medicare accountants to dig into those numbers for more detail. We know from very public and reliable data that the bids from the Medicare Advantage plans were significantly lower than the average cost of fee-for-service Medicare in every county. We know that those care cost differences saved money for the trust fund and made it stronger and more successful.

We should address the costs for the people who didn’t enroll in plans. We should reflect on the fact that about half of the people who weren’t in Medicare Advantage plans joined ACOs.

It’s very legitimate to add the ACO lower cost runs for the ACO members to that savings total from the Medicare Advantage plans to understand the total savings amount more thoroughly and to predict future performance for those sets of financial issues.

Those are reasonable and valid estimates to make. We have some good data on those members from a number of sources.

If you look at the fact that Medicare ACOs are currently running about half of the other enrollment for the Medicare program — we see from multiple reports that those plans are generally saving about 5 percent from the costs of Medicare for their ACO patients.

If we take half of the $403 billion private plan expense and use that as the appropriate, approximate expense level for those ACO linked members, that is $200 billion with an unspent care level of 5 percent — or another $10 to $12 billion that had a high likelihood of being money not spent in various fee-for-service care settings because of the enrollment of those people in the ACO programs.

That’s how the surplus was created in the real world of Medicare expenses.

We don’t have perfect numbers at this point, but we have numbers that are legitimate and good enough in those areas to make those assumptions. We have an $83.4 billion very real and very immediate surplus that needs to be explained in reasonable and believable ways.

The trustees ducked the issues and only said in their report that the surplus success and the trust fund increase were due entirely to “money not spent” for Medicare members.

The trustees didn’t expect that gain to happen or that significant improvement in finances to happen. They didn’t predict that lower spending to happen for 2022. They were surprised about that outcome, but they know that it came from money not spent on care that had been spent on care in the past for that volume of members. That’s exactly what happens when we reduce amputations from large numbers to under 2 percent and put the savings in the bank.

They will have a much more detailed explanation for the results this year. The results should be additional growth in those Medicare trust fund reserves. We’re not changing our trajectories in any of those areas. We should see both the same cash flow into the reserves and very close to the same expenses for at least the Medicare Advantage plans.

We don’t know what the trust fund reserve growth will be this year, but we know for an absolute fact that this result is extremely good for Medicare.

We know that there is absolutely no way of us losing ground on the reserves and future successes. The Medicare Advantage plans cost less than the average cost of Medicare and that very powerful and clear capitation payment model means that we will keep, preserve, and save those financial successes for future use of the program.

CMS is in the best position it has ever been in for those programs and expenses.

The MedPac attacks in their current report were embarrassingly, absolutely, and completely (and almost breathtakingly) wrong.

Let’s take advantage of this opportunity.

We should optimize our use of the Medicare Advantage program.

We should make much better benefits a permanent part of the Medicare program for more members. We should continue to create the better benefits by having capitation surpluses rather than spending additional Medicare money on those programs.

We should continue to generate the positive margins for that cash flow that we need for the future of Medicare. We should get continuously better at figuring out the right cash flow for the program without micromanaging key pieces that help create the current levels of success for the members and the plans.

We should protect the much better set of Medicare Benefits against people who believe that the traditional Medicare benefit set is special and a legacy that we should defend and preserve.

Plans are growing and clearly have taken the majority of membership in the Medicare program with much better benefits, but MedPac strangely still believes that it’s a costly mistake to enhance benefits and MedPac currently doesn’t endorse the better benefits approach to making best use of the Medicare dollar. They don’t think that’s fair to traditional Medicare to have better benefits for some members.

They’ve actually said in some earlier reports that they think at a basic level that it isn’t fair to fee-for-service Medicare when the plans have better benefits and when that makes them more attractive to members in the marketplace.

The chair of MedPac writes pieces suggesting that the better benefits are a wrong and expensive path for Medicare to follow. He publishes those pieces as a researcher and not as chair.

The authors of that MedPac report don’t say anywhere in their report that the special-needs plans are delivering far better care to the people who are dually eligible for both Medicaid and Medicare and that we are significantly saving both money and lives with those extremely low-income and high-need members by having them enrolled in the plans.

The Medicare trustees wrote a salute to the Medicare Advantage plans in their report for saving money on the special-needs plans patients and for taking care of those high-risk people. The trustees said that was a significant reason why some Part A Medicare costs for those patients were lower than expected or projected last year.

The Medicare trustee overview report for the trust fund did note in the first section that Medicare saved significant amounts of money when some of the dual eligible people moved from Medicare Parts A and B to Medicare Advantage. MedPac ignored that information from the trustee report, even though they had multiple other pieces of information that confirmed that those cost patterns are happening.

Now that the Medicare trust fund reserves are in far better shape, we need MedPac to revise its priorities on Medicare Advantage and start looking at all of the care opportunities that are created by the plans.

There have been several Medicare Advantage summits held this year. Each of those summits and gatherings for Medicare Advantage programs and plans has a stream of care system improvements being presented that never show up on any MedPac agenda, but that create a rich fabric of care improvement happening across the country in the context of the plans.

THE OVERPAYMENT REPORT IS MISLEADING AND BADLY FLAWED

Before dropping the mention and response to MedPac completely, there is one lingering piece and point that they resurrect and publicize every year and that needs to be killed off to clear the air on Medicare Advantage costs.

The MedPac annual report process has another serious flaw and deficiency that needs to be discussed, exposed, understood, and then rejected to clear the air on the Medicare Advantage cost discussions for the future.

They have created a targeted and misleading report each year that concluded that Medicare Advantage costs more than fee-for-service Medicare for a basic set of enrollees who are currently in plans. They say as a generic conclusion each year that the plans get paid more for a set of members than those same members would’ve cost if they were only covered by Medicare.

They concluded that the plans are overpaid overall because of that measurement. It’s misleading and inaccurate, but it’s reported every year and it’s still quoted. And it can still damage the credibility of the program as a stand-alone piece of data if it isn’t addressed and corrected.

It’s badly flawed, but too often fairly visible as a report.

It’s used every year and it’s cited often when people point out the major discounts in the bids and what appear to be major savings for the plans. They’re told, when they point out those apparent lower costs and savings, that there’s an underlying assessment of the payment process from a different perspective that proves that the savings are not real or accurate for the plans and should be rejected as financial wins.

The MedPac data people say each year that if we take the actual care being delivered to current Medicare Advantage members and if we price that exact care for those members directly against the actual current Medicare fee schedule, then the cost number that results from that process is lower than the capitation level paid to the plans in those settings, and they conclude that difference means that the plans are overpaid for those members.

MedPac files that particular overpayment report every year and MedPac reaches and intentionally publicizes the same badly flawed conclusion about overpayment for the plans each time they run the report even though it’s extremely misleading information.

The truth is, the average cost of care for fee-for-service Medicare that’s used for baseline data set in each county contains the much higher rate of hospital admissions for congestive heart failure patients and for asthma patients, that they had before enrolling in plans. The baseline data also contains the much higher emergency room use and costs that happen for Medicare patients every year.

When you measure the current direct utilization of care for enrolled members against the old average cost of care from fee for service Medicare, that cost level for current care for the current members is always significantly below the actual average cost of care for each county compiled before those patients were enrolled in the plans.

That happens every year. That’s not a problem. It’s a success.

What is a problem is that MedPac calls the difference in those numbers created by that report and by that targeted measurement process an “overpayment.”

They use that “overpayment” number and calculation and conclusion often in their hostile, negative, and critical comments about Medicare Advantage.

They carefully say: “We would pay less for those same exact patients if they were enrolled only in Medicare and if we used only the Medicare fee schedule to pay for their care.”

People who run plans know what’s happening with those numbers, but the news media and many of the health policy people don’t know what those full sets of numbers are and don’t know functionally why they are what they are.

The unknowing listener often accepts that overpayment statement and conclusion at face value and believes that the plans are overpaid and then cites MedPac as the source of that information.

If there’s ever a fake news hall of fame, that particular overpayment report from MedPac should be an anchor example of using data to lead to the wrong conclusion in what feels like a highly credible process of putting numbers together and what is actually deeply, innately, inherently, and irrevocably flawed thinking that leads to the wrong conclusion.

That number of the exact care being delivered today doesn’t include those higher levels of hospital care that those members don’t have on the exact day they measure costs because they’re in plans. And instead of giving credit to the plans for better performance and for much better outcomes, it says the plans are paid too much because those hospital admissions didn’t happen for those enrolled people.

The MedPac approach uses the lower costs of better care as “proof” of overpayment.

Their report makes that claim every single year. The academic community and the health care media very consistently take the bait. They share and repeat that conclusion as if it were a credible fact, even though it’s extremely misleading and flawed.

No one ever points out the huge flaws in the thought process or the data as part of the report to the media or to the policy people.

The truth is, the entire set of negative numbers about Medicare Advantage in the current MedPac report are wrong, deceptive, misleading, and potentially harmful to the process of objective and intellectually grounded comparisons and thinking. That particular report is particularly egregious because it’s so frequently quoted and believed. They very cleverly release it as a stand-alone conclusion that trumps whatever other information you’re hearing about costs at the time.

We’ve shown that that upcoding that they describe so negatively has been made completely irrelevant and completely impossible by CMS in their current set of capitation decisions, and in the current risk levels set for the patients by the current reporting system for care.

It’s entirely a moot point, because the May 31 decisions set the payment levels, and there is no level of upcoding in any setting or any way that can affect those numbers and those decisions.

It can’t be done.

To repeat one more time, the set of facts that tee’d up this discussion about upcoding explained that CMS has decided exactly how much they’ll pay Medicare Advantage plans for the future. The payment levels they set for 2024 are set in stone and can’t be affected by anything that can inflate those numbers.

They told everyone on May 31 of 2023 how much they’ll increase the Medicare Advantage capitation levels for 2024.

Those numbers are on the graphic illustration that leads this piece.

The people who run CMS have been doing extremely good work at multiple levels on data sets, and processes — and care improvement agendas and programs.

The team at CMS now functions very competently and intentionally as buyers — not just as fee-for-service payers.

They’ve been using the various five-star tools with great skill, competence, and with obviously good values, good intent, and solid, functional ethics about the needs of the patients and the various payment approaches we have in front of us.

They’re committed to making sure that every Medicare member is in a setting that provides better care. They’ve set goals for making that happen before the decade is over — and they will probably beat those goals.

The staff at CMS have a very good sense of the leverage they have with their current set of tools to enhance care for both Medicare Advantage patients and for their other versions of better care.

Care in this country should now get continuously better.

We have electronic data for every patient. We have care systems and health plans that benefit from better care. We have the opportunity to link to the next several generations of Artificial Intelligence for care discovery, care improvement, and care delivery in a wide and effective set of ways.

We should use Medicare Advantage to steer us in very intentional ways down that path.

The Medicare Advantage five-star plan might be the most effective government-owned and operated care improvement program currently operational in the world. Other countries don’t have organized care improvement processes and goals. We’re the only country that actually pays more for better care.

Care improvement programs in most countries fall far short of that level of payment for care.

The Medicare Advantage five-star plan is changing and steering the process, outcomes, and culture of care in a range of good ways. It’s affecting care delivery for Medicaid and self-insured employers and benefit plans as well; through the goals it sets and the processes it supports.

MEDICARE ADVANTAGE HAS JUST SAVED THE MEDICARE TRUST FUND

We know from the 2023 Medicare trustee report that the total revenue for the entire Medicare Program for members will increase by about 6 percent for the year. When we look at the entire Medicare benefits plan set of programs, we know the revenue for those members from taxes and other sources will increase, on average, 6 percent each year, for the next decade.

We know from years of Medicare trustee reports that we can expect the Medicare Parts A and B costs to increase by 7–8 percent each year. We also know that the members who enroll in ACOs will have both slightly better costs and far better care than the fee-for-service Medicare enrollees.

Medicare A and Medicare B will probably still create losses for the Medicare program, but after adding $83.46 billion to the trust fund last year from the current set of programs, we’re no longer at risk of those programs putting Medicare into insolvency in the near future. We can now create a long-term trajectory and very intentional and well-structured agenda for Medicare that makes it a high point of performance for everything we do as a country for our people.

We also know that we’re absolutely guaranteed that the members who enroll in the Medicare Advantage plans will cost less than the fee-for-service Medicare members of all types. The overall Medicare trust fund will now survive and even thrive with a majority of enrollment in the Medicare Advantage plans.

Looking at the trustee reports that have been filed each year, it’s clear that the Medicare trustees have not known what to expect or predict from the Medicare Advantage enrollees. That program has been highly politicized by some people, but the trustees, themselves, have almost ignored the issues. The Medicare trustees have been carefully avoiding making comments or commitments in their reports each year on Medicare Advantage. They’ve been waiting to see what happens there before making any comments.

The truth is that the trustees have actually not known (each year when they write their report) what Medicare Advantage might do for the year. The politics of Medicare Advantage have sometimes been heated, so the trustees have been hesitant to engage on those issues and have decided not to weigh in without a need to be a contestant in that particular fight.

That was good judgement on their part because it hasn’t been clear which side of the economic and political argument would win on those most relevant issues. It made much more sense for the trustees to stand back and wait to see what happened on those issues, rather than weigh in prematurely and either choose a side or make a premature prediction before more was known about how successful that program would be.

There have been two very credible and equally well supported schools of thought on that future direction for that program. Neither side required the trustees to weigh in or take sides to guarantee or steer their success, so silence in those reports on that topic was not a shortcoming for the reports.

Both sides assumed that they were going to win. Both believed that the win for their side would be so obvious when it happened that the community would simply recognize the victory rather than having to weigh in on any issue or factor or set of decisions involving the plans.

The opponents often tried to cut the cash flow to the plans, but the process was so clearly defined that they could issue dire warnings. But the likelihood of congress changing any relevant law in a significant way was very low. The membership growth and high satisfaction levels of the members made change politically dangerous for anyone who made members less happy about their situation.

There have been two very different sets of theories that the trustees heard from very credible people about the Medicare Advantage plans and their future. The trustees decided to wait to see which set of theories made the most operational sense for Medicare without weighing in prematurely on those issues for the annual trustee report.

The people who designed Medicare Advantage and who included it in the Affordable Care Act as a central tool and approach believed in the capitation model. They believed in the 95 percent of average Medicare cost goal as the financial future for the program. They believed that the savings would be clear and obvious because the bidding process steered in that direction.

Those advocates who designed that portion of the Affordable Care Act actually expected and intended for Medicare Advantage to save Medicare in the future.

The program was a good and highly functional design. It was appropriately financed and appropriately structured to do that work and to go down that path from day one.

Those advocates believe that a market model based on a capitation payment approach that had to make customers happy in order to get enrollees and grow would be the right approach politically and would also be the right approach from an economic standpoint — and they were right.

The Medicare trustees also heard from some highly partisan people who deeply hate Medicare Advantage and who believe that the plans upcode data and short-change people on various components of care and make too much money — and they heard those particular sets of people say clearly, loudly, and often that that growing enrollment in those programs was going to be very bad for Medicare.

The upcoding people have fabricated some fascinating attack pieces for that part of the agenda. They’ve created some ideological and even emotional reasons why plans should be forced out of existence. They’ve expressed those negative and hostile opinions to the Medicare trustees and to any other relevant people who they thought they could influence.

The critics also wrote some very persuasive pieces that actually didn’t use the most relevant and useful data on those issues, but the pieces they wrote were sufficiently inflammatory and very articulate, so many academics and political types have joined them in their concerns and many of those people worry deeply about plans today.

MedPac, for some reason, has had some people opposed to the plans at multiple levels despite the obviously better care and lower costs. It was probably good for the survival of the program to have MedPac as a constant critic. It kept the plans from relaxing and coasting, and from assuming that better care and lower costs would be sufficient to prevail in the end.

The basic ideological advocates for the plans didn’t enter in public ways into that debate.

The ideological advocates knew and believed that the plans would grow. They knew that the truth and the overall impact of Medicare Advantage would emerge in very visible and credible ways from that growth and the advocates believed that there wouldn’t be a debate in the end, but instead, a clear recognition for a job obviously well done.

The Medicare Advantage advocates are clearly winning today with growth, better benefits, and better costs. Instead of the program crippling or damaging Medicare, it’s been the anchor for an $83.4 billion financial victory for Medicare and very difficult to continue to attack as a threat as the critics have now done for a decade.

The Medicare trustees will now enjoy explaining why they have a major surplus for the trust fund. That is a much better position to be in than explaining how they lost $80 billion that they didn’t expect to lose.

They will probably acknowledge some of those Medicare Advantage achievements in the next report. They’ve started that process with some very positive comments about the money saved by the Medicare Advantage special-needs people, who are eligible for both Medicare and Medicaid, and who really need the plans for their care.

So, what’s the status of the program?

Medicare Advantage has now enrolled more than two-thirds of the lowest income Americans. They’ve enrolled more than 80 percent of our Hispanic Medicare members, because the average net worth of the Hispanic retirees is about $20,000 — and having vision, hearing, and dental benefits that are free to Medicare because they’re created by the plans at no additional cost can be extremely good for both enrollment and support by low-income people.

That will be a slight change for the trustees. It should be an easy addition to make for their report.

The trustees have been officially and very cautiously predicting each year in their annual report that Medicare Part C — Medicare Advantage — would have cost increases for the next couple of years that exactly paralleled and echoed the Parts A and B costs for those years. The prediction from the trustees each year has been that Medicare would lose equally each year from all three parts of the program.

They’ve been wrong every year in that prediction about the next year for Medicare Advantage. But being wrong on that prediction didn’t matter when only 10 percent of the members were in plans. Now we have over half of the members in plans. That growth should continue at the right pace, and it will continue to transform Medicare.

The trustees did predict very accurately that they believed Medicare Advantage costs would increase by 4 percent next year. They reached that number by looking at the current year number and then simply extending it a year.

They should now do a much more complete set of numbers for those issues. That cost will be a key part of their next report.

So, what can we expect now?

We spent $403.3 billion on the plans this year. The plans bid about 17 percent below the average cost of fee-for-service Medicare in every county, and that represented $68.68 billion less than we would’ve spent with Medicare dollars if all of those people were enrolled in traditional fee-for-service Medicare and if they had incurred those expenses through the fee-for-service payment system.

The bid discounts for 2024 look very much like the discounts for 2023.

Those savings should all continue.

The amount we spend per person on the people in the plans will increase by 4 percent this year. That’s what CMS decided for 2024 payment levels. It’s also exactly what the trustees saw happening from the current trend for 2022 and they put in as their cost prediction for the plans.

That might be the only number that everyone is agreed upon today. The graphic at the very top of this piece has that 4.4 percent number in it.

The number in that line of the financial report will increase by the plan enrollment growth number and by that payment inflation number for the plans. It will be a very good number to understand for 2024 to get the entire package on the radar screen. It will be the baseline number for the single most stabile part of the current health care cost reality.

This is a very good place for Medicare to be.

The huge financial success for Medicare last year is game changing and it creates a very solid foundation for next steps for the program.

We need these numbers to be understood by all of the people who write about Medicare and Medicare Advantage so that we can do informed analysis when the next set of numbers is produced.

We don’t know what the impact will be for this year of the surplus, but it clearly won’t be a negative number.

That’s the situation we’re in today.

It’s a good place to be.

Some predictions might be in order.

The current growth puts Medicare on the strongest footing it’s been on since it was created. It sets up future years of slam-dunk absolutely guaranteed financial wins because Medicare Advantage is now more than half of the enrollment. It’s the new normal for Medicare and it is on the right path.

We have significant and absolute control over those costs. Those payments all happen through capitation payments and that payment model guarantees that losses will not happen in future years for those members.

Medicare Advantage will generate a profit and will absolutely have lower costs forever because of the capitation payment model.

Those sections of fee-for-service Medicare that are enrolling in various ACO-like models will also probably cost less than that 6 percent increase number for the overall program. Those sections should also add to the stability and size of the overall trust fund — and they should help achieve continuously improving care for as many care sites as possible.

Our top priority right now should be not to somehow screw up this very good situation and this highly successful program and cash flow.

We could screw this up.

We’re capable of doing things to weaken the best parts of the system we have today, because of political factors that we need to keep from damaging us in some way just because some people are deeply angry that the Medicare Advantage plans have been successful. They might do very tribal thinking in their willingness to damage people to win their political agenda points.

We need to keep and sustain plans in the program by continuing to have the right payment model. We need to keep it on a steady keel for for the next several years for optimal results.

A steady keel is important. We need the people who want care to improve to be able to help make that happen, to achieve those goals and invest in that process because they can rely on that cash and that opportunity.

We know that the current Medicare Advantage payment formula that has evolved over the past decade is sufficient to keep plans in the program. It’s more than sufficient to enable all the plans to have significantly better benefits than the old Medicare program. It’s more than sufficient to have adequate numbers of caregivers doing continuously improving things to make car better.

So should now be on a trajectory for both better care and better benefits that are paid for with better costs if we don’t screw this up.

We should want to create major stability reliability in that overall payment model. We very much do want health care sites in multiple settings to invest in themselves, which will happen most effectively when the care sites can depend on a stable and dependable source of revenue from Medicare Advantage — to fund future care infrastructure and tools and to engineer and deliver optimal care.

If we want optimal care and if we want the lowest costs for that care, we need care sites to be able to invest in themselves by years and even decades — not just by months or years. Having a Medicare Advantage cash flow that has internal stability over multiple years can help make that economic model happen.

The next set of payments are very well designed to fund the next sets of care decisions and to give us better and lower future costs for care.

We now know from the May 31 CMS numbers that the Medicare Advantage member risk levels will increase by 4.44 percent for the year, and we now know that will create a cost level increase for all those members of 3.32 percent for the year.

The difference between a 6 percent increase in overall Medicare revenue and a 3 percent increase in Medicare Advantage costs is an extremely important difference. It gives us a very real and significant growth in the trust fund, rather than the deterioration that people had been projecting. It creates a culture and opportunity for care improvement at multiple levels because it’s enough to fund future care.